Deciding for a copay vs. A percentage of covered benefits that the patient is responsible for paying.

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

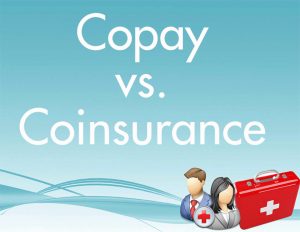

We discuss in detail how coinsurance is a valuable insurance option to some than to others.

Coinsurance vs copay. Copays für verschreibungspflichtige Medikamente liegen zwischen 5 und 20 US-Dollar pro Rezept während Copays für Generika vs. Coinsurance is a portion of the medical cost you pay after your deductible has been met. Where a copay is a fixed amount that you pay in addition to your monthly dividend coinsurance is the percentage of the amount that is divided between the policyholder and the insurance agency and each party has to contribute to paying.

Der Leistungserbringer holt das Copay zum Zeitpunkt der Leistungserbringung vom Patienten ab und stellt der Versicherungsgesellschaft eine Rechnung. These health insurance terms very often get mixed up. The definitions presented above make it all clearer.

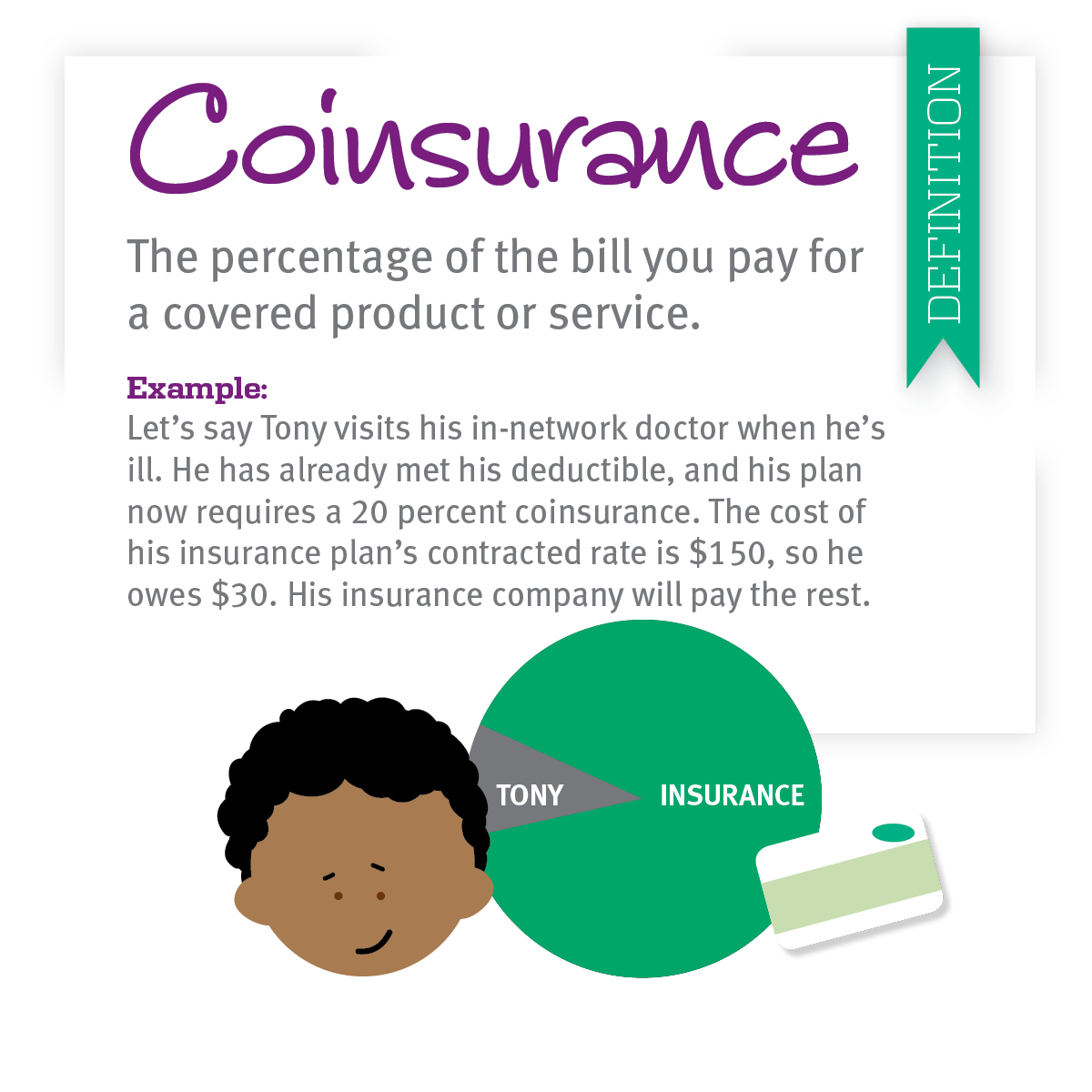

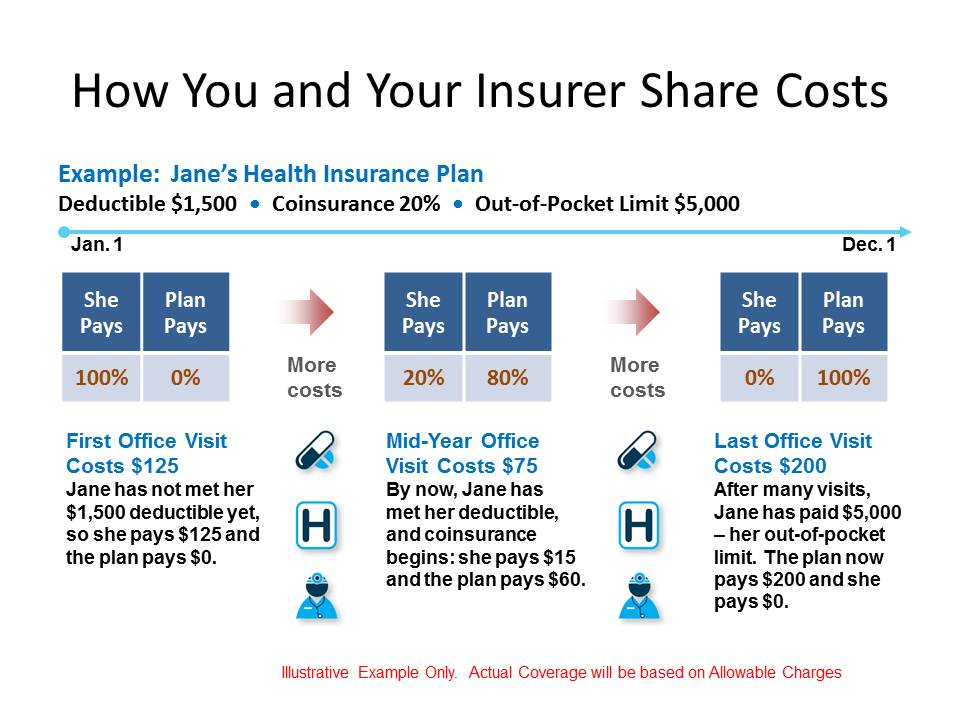

Her health plan will pay 80 or 2560 leaving Prudence with a 20 coinsurance of 640. A copay is a set rate you pay for prescriptions doctor visits and other types of care. Coinsurance is a way.

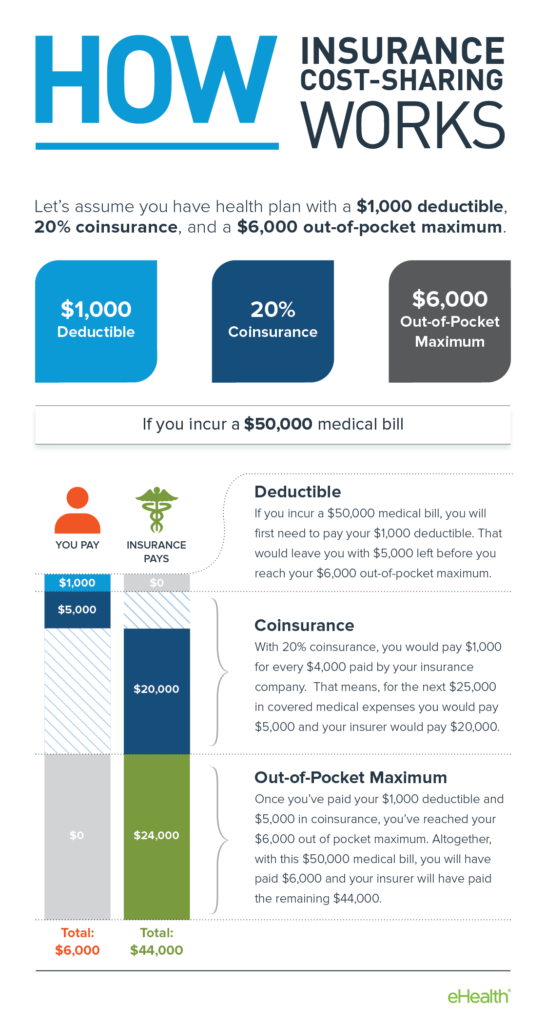

Das Copay ist in der Regel zu gering um alle Gebühren des Anbieters zu decken. In that case youd pay the 1000 for the deductible portion and youd also be on the hook for the remaining 20 with the health plan picking up the other 80. As you can see copays and coinsurance both reduce the amount of money you pay out of pocket for health care.

Copay Now that we have fully rounded up the process of covering medical expenses from start to finish there is only one thing left to do understand the difference between copay and coinsurance. What is the Difference Between a Copay vs Coinsurance. In this case youd pay 1200 for the MRI on top of the 30 copay.

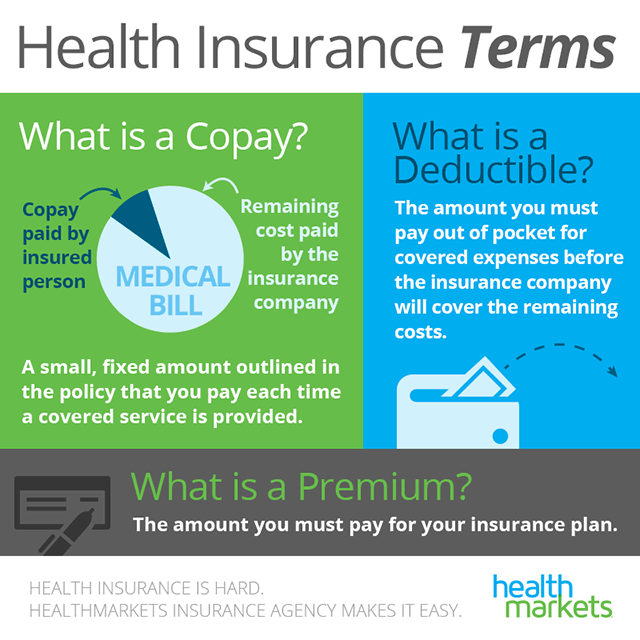

Dies bietet einen Anreiz die Kosten durch die. A deductible is the set amount you pay for medical services and prescriptions before your coinsurance kicks in. Both copays and coinsurance are forms of cost-sharing meaning you are splitting.

100 for the ER copay. After deductible and copay the ER charges total 3200. A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met.

What are the differences. The fact that both terms carry the same prefix may give you some initial idea. If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example.

A flat amount that the patient pays a healthcare provider or pharmacy at every visit. Coinsurance medical plan can seem tricky. Coinsurance is the percentage of costs you pay after youve met your deductible.

Die Kosten für Facharztbesuche sind in der Regel höher als für Allgemeinärzte. Coinsurance What is coinsurance. Wenn der Anbieter im Netzwerk ist senkt die Versicherungsgesellschaft zuerst den zulässigen Betrag auf den vorab ausgehandelten Tarif.

10-40 of the healthcare providers contracted rate with the insurer. Coinsurance versus Copay comparison chart. For example a prescription medicine.

Maxwell Academy to the rescue. They also are both used for all healthcare services. Ideally your goal should be to pick the option that results in the lowest overall costs to.

Also a copay and coinsurance come out of your pocket not your insurance company. The between both coinsurance and copay lies in how the cost is split between the policyholder and the insurance company. Depending on how your plan works what you pay in copays may count toward meeting your deductible.

What is the difference between coinsurance and copay. What do they mean. Whereas coinsurance is the percentage you pay for medical costs after your deductible your copay is a set amount you have to pay for other covered expenses.

For more visit our website. Your deductible is 1000 and your coinsurance responsibility is 20.

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Copay Vs Coinsurance The Differences And Why They Matter Preventive Care Health Insurance Plans Health Plan

Copay Vs Coinsurance The Differences And Why They Matter Preventive Care Health Insurance Plans Health Plan

The Single Strategy To Use For The Role Of Insurance Service Providers Thong Tinbe Nh Daday

The Single Strategy To Use For The Role Of Insurance Service Providers Thong Tinbe Nh Daday

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Vs Copay Difference And Comparison Diffen

Coinsurance Vs Copay Difference And Comparison Diffen

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Copays Vs Coinsurance For Health Insurance

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.