Generally for each member of your household who is required to. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

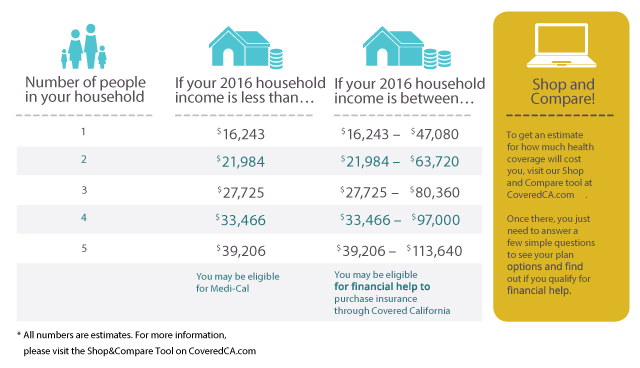

Maximum Annual Household Income to Qualify for Financial Help You may be eligible for low or no-cost Medi-Cal.

Covered california household income definition. The state of California is making new financial help available to almost a million Californians many for the first time. You could even qualify for low-cost or. Covered California is the new marketplace where people can get free or low cost health insurance through Medi-Cal or get help paying for private health insurance available through Covered California.

The penalty estimator uses an income number called modified adjusted gross income MAGI. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. To be eligible for assistance through Covered California you must meet an income requirement.

Our goal is to make it simple and affordable for Californians to get health insurance. Back to Medi-Cal Eligibility. Covered California determines whether you get financial help by how much your household earns not just the ones applying for health coverage.

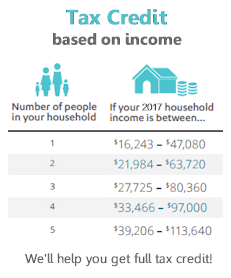

Dont include anyone you arent claiming as a dependent on your taxes. For families or individuals with a household income below 400 percent of the FPL Covered California may qualify them to receive subsidies that will lower their premiums. What counts as annual household income.

Based on your income you may qualify for tax credits when you enroll in health insurance in the state of California. For most individuals who apply for health coverage. If you do not find an answer to your question please contact your local county office from our County Listings page or email us.

MAGI is not a line on your tax return. Your spouse or registered domestic partner RDP Your dependents. Can anyone get Covered California.

A household includes the tax filer and any spouse or tax dependents. 16394 22107 27820 33534 39247 44960 1 2 3 4 5 6. Marketplace savings are based on total household income not the income of only household members who need insurance.

Your household for the penalty includes. Under the Affordable Care Act eligibility for income-based Medicaid 1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI. All Covered California health insurance plans have an actuarial value assigned to them.

What is Covered California. Covered California is a partnership of the California. Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

Our goal is to make it simple and affordable for Californians to get health insurance. You may be eligible for financial help through Covered California. This means the Platinum plans cover the.

As the metal category increases in value so does the percent of medical expenses that a health plan covers. 16 rows You must include the income of any dependent required to file a federal income tax return. Covered California Households That Are Eligible for Tax Credits Receive an Average of 5300 per Year in Assistance or 3500 for an Individual to Help Them Pay Their Health Insurance Premiums In 2016 Covered California enrollees received on average 299 per enrollee per month or 442 per household.

Your spouse and tax dependents should be included even if they arent applying for health insurance. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. Ninety percent of people who have signed up with Covered California get financial help and you could be one of them.

You can start by using your adjusted gross income AGI from your most recent federal income tax return located on. Bronze Silver Gold or Platinum. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance.

If anyone in your household has coverage through a job-based plan a plan they bought themselves a public program like Medicaid CHIP or Medicare or another source include them and their income on your application. The Affordable Care Act definition of MAGI under the Internal Revenue Code 2 and federal Medicaid regulations 3 is shown below. Also if their income falls between 138 and 250 percent of the FPL Covered California may also qualify them to receive extra discounts that reduce their medical costs.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

What Type Of Income Is Counted For Covered California Aca Plans

Signing Up For Covered California Or Medi Cal Here S What You Need To Know Orange County Register

Signing Up For Covered California Or Medi Cal Here S What You Need To Know Orange County Register

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

What Type Of Income Is Counted For Covered California Aca Plans

Step By Step Income Calculation For Obamacare In California

Step By Step Income Calculation For Obamacare In California

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Enrolls Tens Of Thousands As Impacts Of Covid 19 Pandemic Hits California Households

Covered California Enrolls Tens Of Thousands As Impacts Of Covid 19 Pandemic Hits California Households

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

What Type Of Income Is Counted For Covered California Aca Plans

What Type Of Income Does Covered California Consider

What Type Of Income Does Covered California Consider

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

/what-is-disposable-income-4156858_color3-628c03933fb6493db51f94cf9d0df4da.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.