How to find your 1095-A on Covered California Step 1. Covered CA will send you Form 1095 A I nstructions HTML Cover Letter Covered CA Video so that you can fill out Form 896 2 to reconcile Premium Tax Credit Subsidy.

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

How do I get my 1095 A from Kaiser.

Covered ca 1095 a. In addition this form will give you proof of coverage so that you dont have to pay the California m andate penalty of 25 of income. The Form 1095-A also tells you how much premium assistance tax credits or APTC your health plan got on your behalf during 2014. Medicare and Covered California Fact Sheet.

I have spent 8 hours on and off on the phone with Covered Ca agents none were able to help me to get the 1095A form. Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895. The FTB 3895 will report any California premium assistance paid to the households health insurance plan and will also verify enrollment in Minimum Essential Coverage to avoid the new California individual mandate penalty.

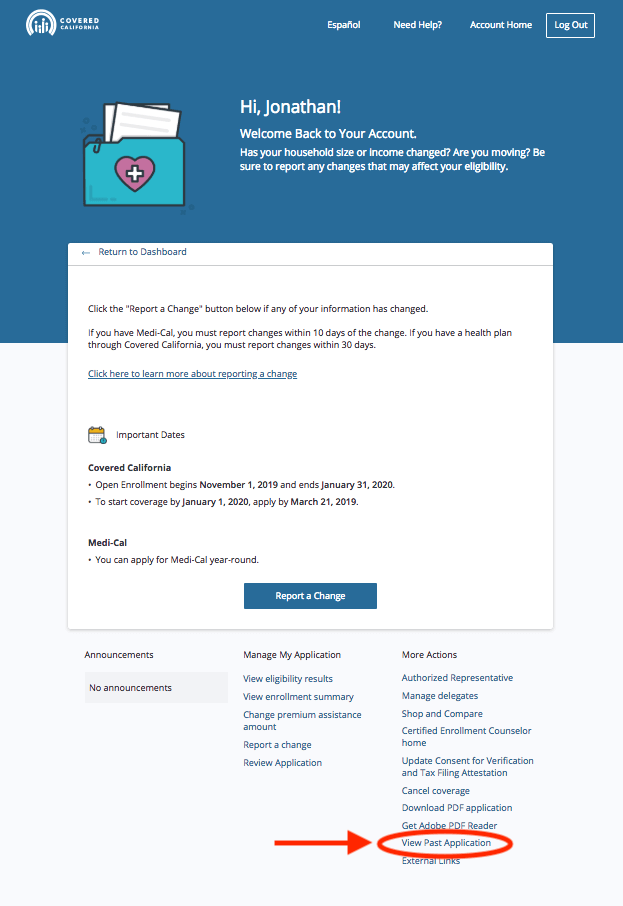

Click Case Summary in the upper left. Find the link called View Past Application in the bottom right-hand column and click on it. You will have to login to your Covered California online account.

Information in the Covered CA notice includes. The California Form FTB 3895 California Health Insurance Marketplace Statement. Read About IRS Form 1095-A.

Since Im not an active member they have closed my account and then tried to get a new account the Agent found 3 accounts under my name and was not able to help me at all. Instead he told me to contact the agent that enrolled me in the plan after I did that my Agent stated he could not access my acct either. I have a Client that has Covered Ca.

1095-As from Covered California and 1095-Bs for Medi-Cal enrollments should be sent by January 31 2016. Use the California Franchise Tax Board forms finder to view this form. Medicare and Covered California Fact Sheet Spanish Rights and Protection Brochure.

The Form 1095-As have already been posted online. If you have not received a 1095-A from Covered California in the mail or through your Covered California account you can either call 1-800-300-1506 or file an online dispute form at Covered California 1095-A Dispute Form. Federal COBRA Election Form for Group Health Coverage.

She also had her 23 year old son on the policy for the entire 2018 year. Then called for the 5th time to cover. If you enrolled in a health plan through Covered California but did not receive premium assistance you will still receive a Form 1095-A from Covered.

Near the end of February Covered California sent out notices to members receiving tax credits as reminders that they should have received an important tax document their IRS Form 1095-A. You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page. Insurance bought through Covered California.

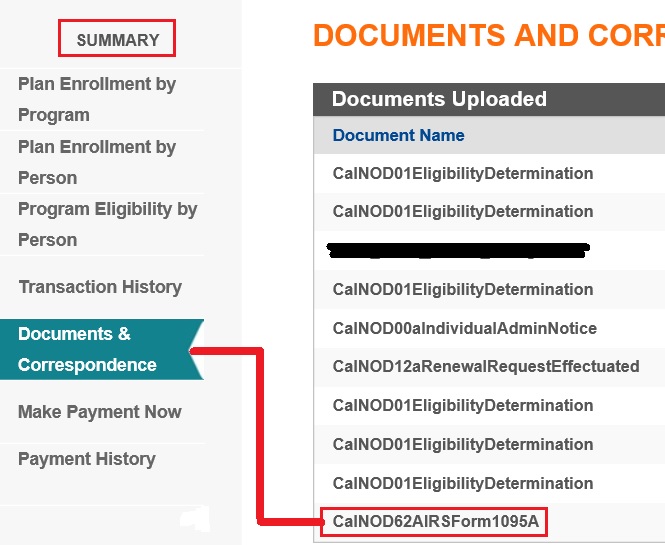

Covered California consumers will receive not only a 1095A statement for 2020 they will also receive the new Franchise Tax Board FTB 3895 statement. I did the 1095-A and 8962 for her. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016.

The federal IRS Form 1095-A Health Insurance Marketplace Statement. These forms are used when you file your federal and state tax. If you were a customer of Covered Ca you can not correctly file your taxes without a 1095A.

During tax season Covered California sends two forms to members. You were enrolled in a minimum coverage plan also known as catastrophic plan. You will find the 1095-A form in your Documents and Correspondence folder.

You were enrolled in the Medi-Cal program. You were enrolled in employer health coverage through Covered California for Small Business CCSB. Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members.

Without it you can not properly complete IRS Form 8962 which is now required of all tax filers. Where to call if you did not receive your 1095-A 1-800-989-2199 Why you need your 1095-A form. It is your proof that you had health insurance in place so that you wont be subject to a tax penalty.

It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return. It shows how many months you had health insurance and how much Advanced Premium Tax Credit APTC you received. The 1095A is a tax document that lets the IRS know how much Covered Ca tax subsidy you were eligible for and how much tax subsidy you received.

Login to your Covered California online account. Access to your online account 1095-A tax form and the Shop and Compare Tool will be unavailable from 1201 am. If You Didnt Receive Your Tax Forms.

The 1095-A Form is a Covered California statement that is needed to file your Federal Income Tax Return. On May 8 to 6 am. She did not claim her son as he made 4000000.

FPL Federal Poverty Level Chart.

Covered California Forgot To Add Pediatric Dental To 1095 As

Covered California Forgot To Add Pediatric Dental To 1095 As

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

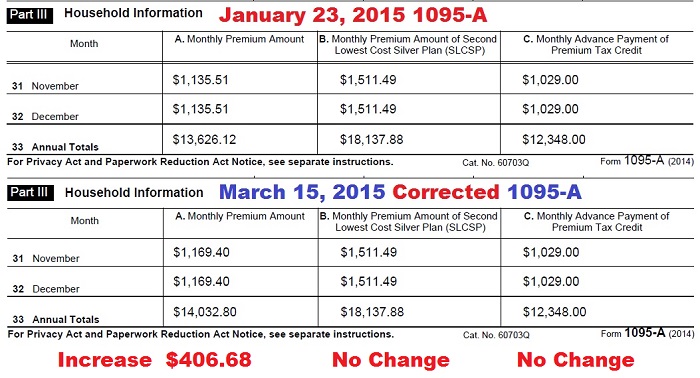

1095 A Tax Credits Subsidies For Form 8962 Attaches To 1040 Covered Ca

1095 A Tax Credits Subsidies For Form 8962 Attaches To 1040 Covered Ca

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Where Is The Covered California 1095 A

Where Is The Covered California 1095 A

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

Covered California Ftb 3895 And 1095a Statements 2020

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.