If you make 601 of the FPL you will be ineligible for any subsidies. If you dont have a login and password call 800-300-1506.

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

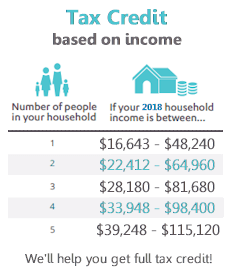

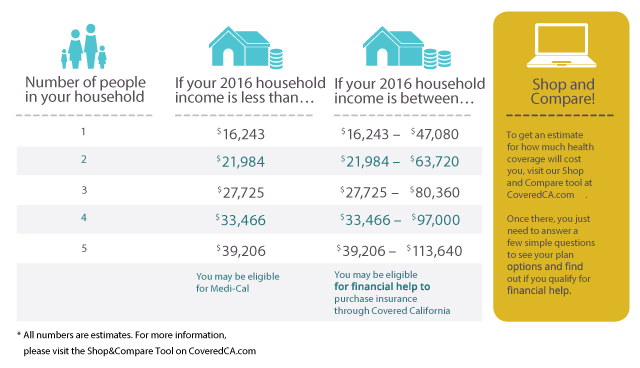

In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Covered california tax information. You were enrolled in a minimum coverage plan also known as catastrophic plan. If you do not find an answer to your question please contact your local county office from our County Listings page or email us at. Use the California Franchise Tax Board forms finder to view this form.

Unable to live on 17900 I had to withdraw 15000 from an IRA. During tax season Covered California sends two forms to members. Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

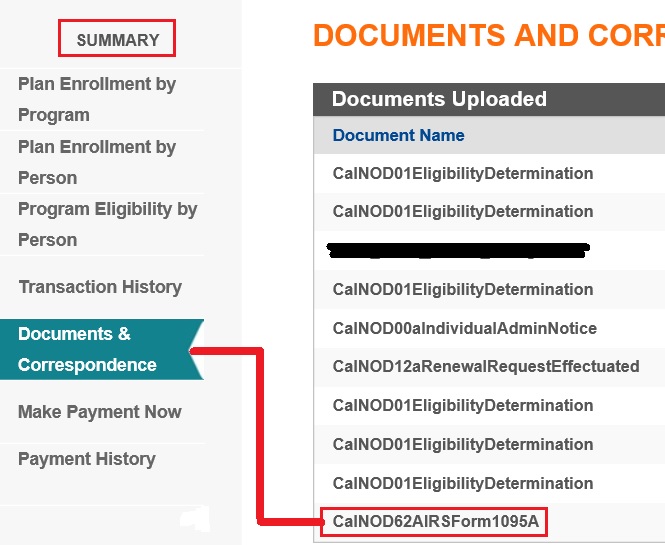

Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage. After logging in youll be on the Consumer Home Screen. It shows how many months you had health insurance and how much Advanced Premium Tax Credit APTC you received.

The web address for the Covered California Account Login is. Many of these materials include editable text fields that you can use to customize the piece to include your contact information. The California Form FTB 3895 California Health Insurance Marketplace Statement.

Keep in mind that Tax deductions can. You could get multiple federal and state forms if members of your household were enrolled in different. Look for the list of links in the bottom-center of the page.

My income for the 2014 year was 32700. Bilingual Services Complaint Form. Covered California Complaint Form.

Request for a State Fair Hearing to Appeal a Covered California Eligibility Determination. Again as certified Covered California agents there is no cost for our services. Can anyone get Covered California.

This question is in regards to Covered CA vs. Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895. If you chose email as your communication preference you will receive an email that your tax forms are available to access through your Covered California secured mailbox.

The 1095-A Form is a Covered California statement that is needed to file your Federal Income Tax Return. In order to be eligible for assistance through Covered California you must meet an income requirement. The Covered California CalHEERS program reaches out to the federal Hub to confirm citizenship immigration status Medicare and Medicaid enrollment incarceration Native American status veteran status and income information from the latest IRS tax return.

The Covered California application compares the estimated income of the applicant to the Adjusted Gross Income figure for the last filed federal tax. The designs living on this page are available to you free of charge and are print-ready. If You Didnt Receive Your Tax Forms.

Click on Eligibility Results. Also if you or someone in your household receives a premium tax credit through Covered California or through healthcaregov or another state marketplace if you lived outside of California for any part of the tax year you are required to file taxes. Now I must pay Covered CA Federal 2500 due to the withdrawal.

Please feel free to download print and. Back to Medi-Cal Eligibility. When someone receives a premium tax credit and does not file taxes Covered California will not continue to provide financial assistance in paying for their coverage.

Thank you for visiting Covered Californias official home for FREE downloadable PDFs of our collateral materials. Covered California will let you know which categories they need documentation. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

46 Zeilen Generally the projected annual income on your Covered California. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

You will need to sign in to your account to download and print your forms. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Privacy Complaint Form by a Parent Guardian or Authorized Representative.

Its the only place where you can get financial help when you buy health insurance. It is your proof that you had health insurance in place so that you wont be subject to a tax penalty. This left me with 17900 to live on for the year.

One notewhen enrolling in Covered California you essentially confirm that you will file taxes as required by law and on time if you are required to. Request to Correct or Dispute Tax Forms. You were enrolled in the Medi-Cal program.

My medical out of pocket was 14800. These forms are used when you file your federal and state tax. On paper it looks like I made a lot of.

Some people do not need to file taxes since their income is below the threshold. You were enrolled in employer health coverage through Covered California for Small Business CCSB.

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered California Ftb 3895 And 1095a Statements 2020

Where Is The Covered California 1095 A

Where Is The Covered California 1095 A

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Updated Countable Sources Of Income Covered California 2020

Covered California Steps Up Messaging That Tax Penalties Are Going Up In 2015 For Uninsured Californians

Covered California Steps Up Messaging That Tax Penalties Are Going Up In 2015 For Uninsured Californians

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.