Even an individual earning close to 75000 may qualify for financial help. The California Premium Subsidy Estimator Calculator tool is targeted at households who earn between 401 and 600 of the federal poverty level and qualify for no federal ACA premium tax credit.

Covered California Premium Health Insurance Subsidy Estimator Link

Covered California Premium Health Insurance Subsidy Estimator Link

Premium subsidies in the health insurance exchange are only available if your MAGI doesnt exceed 400 of the poverty level.

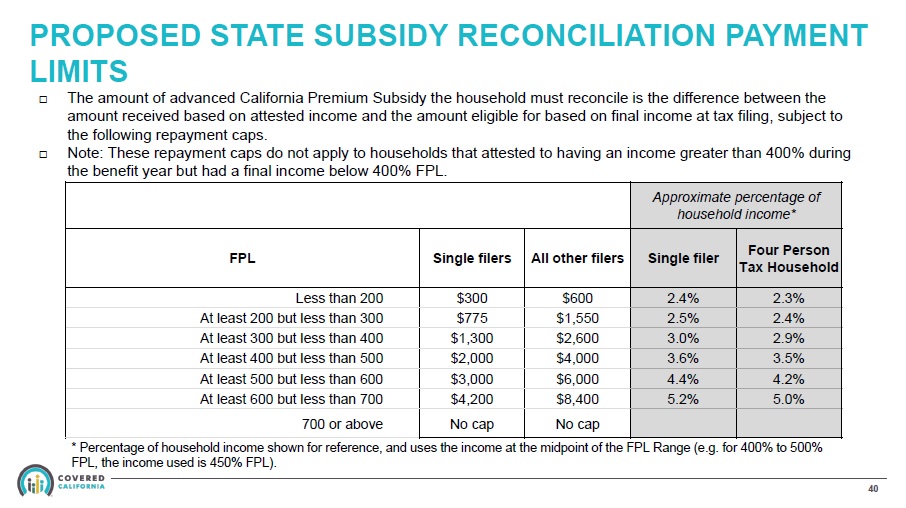

California health insurance subsidy calculator. For a married couple with 70000 AGI their California state income tax is about 1400. For more information about the new state subsidies please review the design documents which have more details about the program. If you qualify you can re-enroll in a Blue Shield plan sold through Covered California to obtain your subsidy.

The calculator also indicates income-eligibility for Medicaid. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. If you purchased a plan direct through Blue Shield and you didnt qualify for a subsidy at that time use our subsidy calculator to check again you may qualify now.

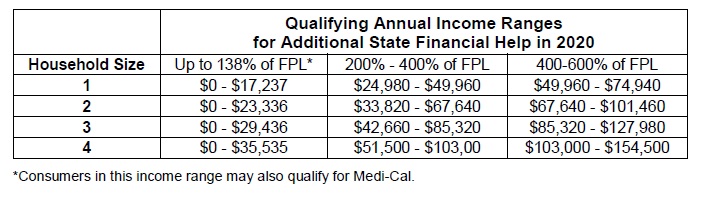

For a family of four its 104800 these limits are for the continental US. 200 400 Federal and State Subsidies Available. They are higher in Alaska and Hawaii where the federal poverty level amounts are.

Visit our individual and family health insurance page enter your zip code complete a quick questionnaire and click See if I Qualify. With this calculator you can enter your income age and family size to estimate your eligibility for subsidies and how much you could spend on health insurance. Beginning January 1 2020 all California residents must either.

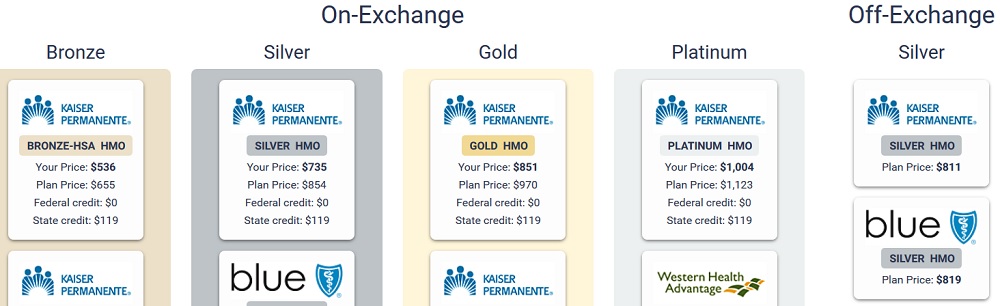

The calculator also indicates income-eligibility. You can run your Covered California plan quote to view rates and plans side by side from the major carriersFree. Some families get a thousand dollars a month in savings even those making up to 154500 a year.

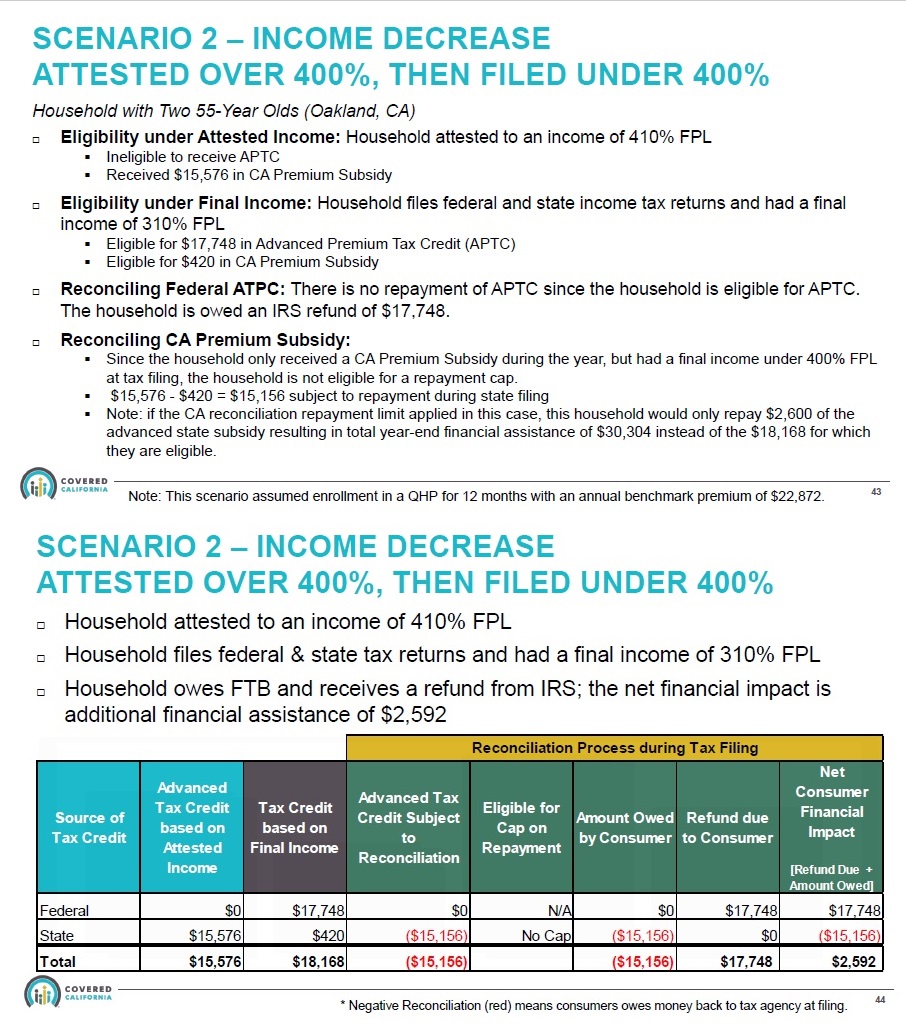

If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies. The 9000 health insurance subsidy from the state is over six times the California state income tax they pay. If you are in a Silver 70 off-exchange plan which cost less than the Covered California Silver 70 plans any California Premium Subsidy you.

138 200 Federal Subsidies Available. And the subsidies covered an average of 85 of their premium costs. The calculator is designed to estimate eligibility for individuals under age 65.

It will show the cost of the off-exchange Silver 70 plan. Then because California has determined that that household should only spend 738 on health insurance Covered California determines the household is eligible for a larger subsidy of 1796. California health insurance - California Health Reform - Health Reform California Rebates Tax Subsidy Calculator.

With this calculator you can enter your income age and family size to estimate your eligibility for subsidies and how much you could spend on health insurance. To find out if you qualify for subsidies under the new California subsidy program you can use eHealths subsidy calculator while shopping for health insurance. This interactive calculator estimates how much eligible individuals and families will spend on premiums for a Covered California health plan under the law.

Federal premium assistance subsidy is only available for medical plans purchased through Covered California. For a single person in 2021 thats 51040. How Saving Money Might Make You Eligible for Subsidies.

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. Peter Lee stressed in a webinar on Monday that state subsidies are only available to those who enroll through Covered California. You can now quickly run your Covered California with the tax credit calculated at the link below.

You need to know your annual modified adjusted gross income from your 1040 tax form. This interactive calculator estimates how much eligible individuals and families will spend on premiums for a Covered California health plan under the law. To see if you qualify for the Federal Subsidy to pay a portion of your health insurance premium for 2020 use this helpful tool.

Obtain an exemption from the requirement to have coverage. When their net premium is reduced from 12000 to 3140 thats nearly 9000 in subsidy from the state of California. California allocated 295 million in state funds to provide premium subsidies to people earning between 400 and 600 percent of the poverty level ie people who arent eligible for federal premium subsidies as well as supplemental subsidies for enrollees with income between 200 and 400 percent of.

400 600 State Subsidies Available. Pay a penalty when they file their state tax return. The price is based on your estimated income for the coverage year your ZIP code your household size and your age.

The best way to get a quick estimate of the price you would pay is to use the Shop and Compare Tool. The system might determine that for this household size income and region they are eligible for 1782 per month from the ACA Premium Tax Credit. Have qualifying health insurance coverage.

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Covered California Premium Health Insurance Subsidy Estimator Link

Covered California Premium Health Insurance Subsidy Estimator Link

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Covered California Premium Health Insurance Subsidy Estimator Link

Covered California Premium Health Insurance Subsidy Estimator Link

2019 Health Insurance Marketplace Calculator Kff

2019 Health Insurance Marketplace Calculator Kff

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.