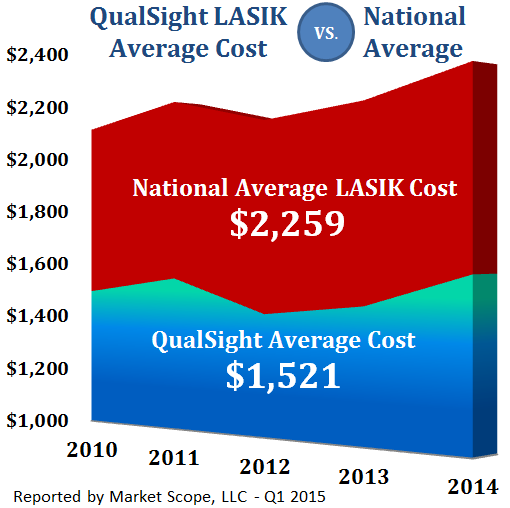

The cost of custom orthotics typically ranges between 300 and 600. Most if not all insurance policies cover the custom orthotics you can obtain at Care-Med as long as some details are completed.

Custom Orthotics Specialist Falls Church Va Arlington Va Orthopaedic Foot Ankle Center Foot And Ankle Specialist

Custom Orthotics Specialist Falls Church Va Arlington Va Orthopaedic Foot Ankle Center Foot And Ankle Specialist

Only logged in customers who have purchased this product may leave a review.

Custom orthotics insurance. However more often than not insurance doesnt cover them. The cost of custom orthotics typically ranges between 300 and 600. A diagnosis and determination of the best materials and level of rigidityflexibility of the orthotics is made followed by an impression mold of your feet.

Before you consider having custom orthotics made youll want to check to see how much your insurance will cover and what your out-of-pocket expenses are. We wish we could give you a simple yes or no answer however the answer varies greatly among insurance companies and there are several determining factors within those companies. You have heard custom orthotics can help but arent sure if insurance covers medical devices like these.

This can vary clinic to clinic and patient to patient as it is dependent on many factors such as how much a particular clinic may charge for your clinicians time as well as the cost and complexity of the orthotic. In some cases they are more expensive than some minor surgeries so getting insurance companies to cover them would probably be a good thing. This includes unlimited top cover exchanges as well as any fix to a compromised hard-shell.

Upon ordering an impression kit will be mailed to you. Depending on your policy if you are covered for podiatry and orthotic services you may be eligible for a rebate on your orthotics. Your doctor felt you may benefit from custom made orthotics shoe inserts cost 35000.

Order from the website or give us a call 800-500-2909. Custom Orthotics are expensive ranging anywhere from 300-600. Are custom orthotics covered by insurance.

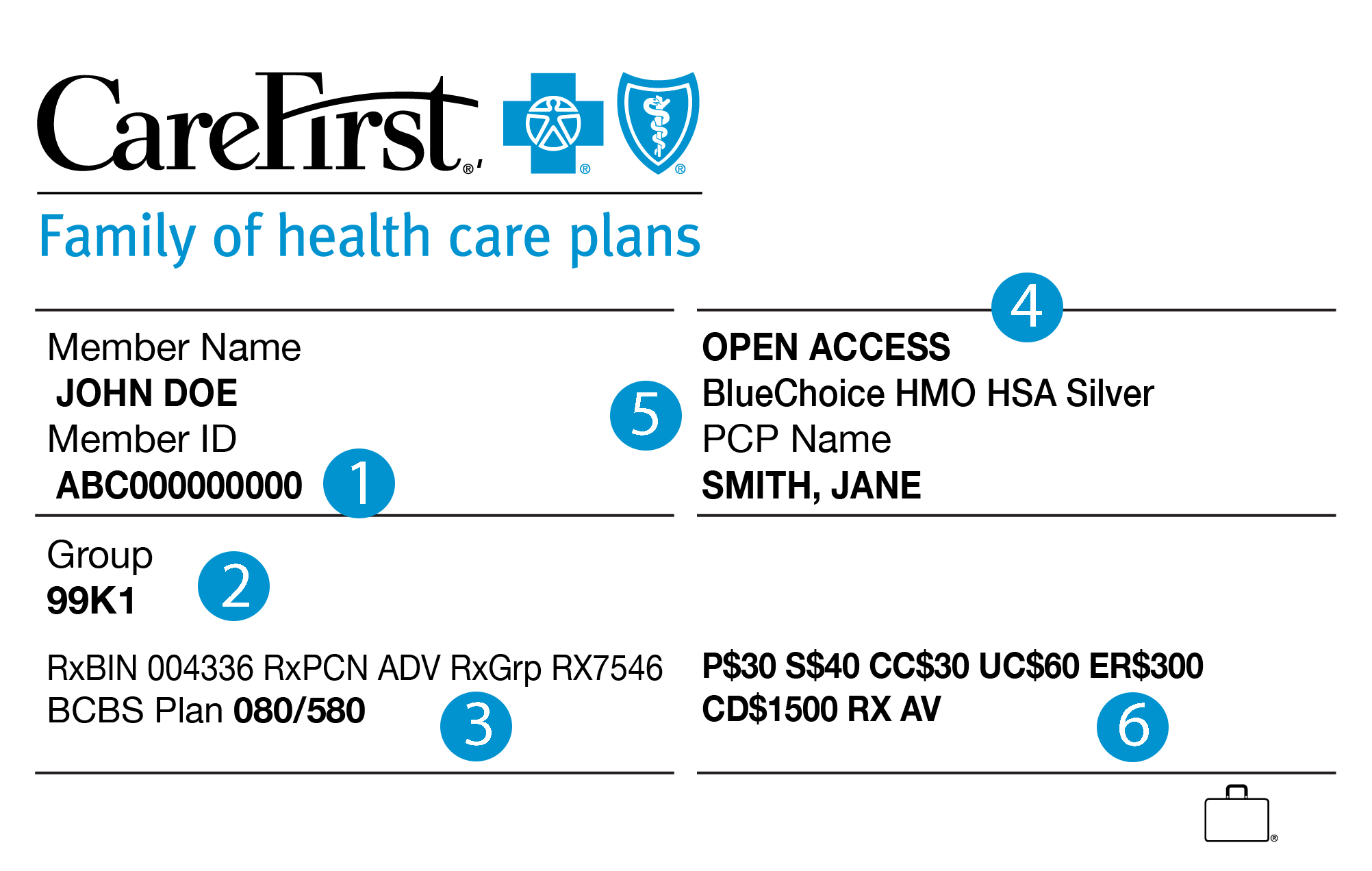

Always check if foot orthotics are a covered benefit under the patients insurance policy insurance Verification for Custom Foot Orthotics L3000 or L3030. Off-the-shelf orthotics require minimal self-adjustment. An orthotic is considered prefabricated even if it is assembled from prefabricated pieces.

How much do orthotics cost with insurance. Medicare will cover diabetic shoes and inserts annually but only if the patient meets strict requirements. Before investing in an expensive pair of custom-made orthotics consider trying good-quality nonprescription orthotics.

CUSTOM MOLDED ORTHOTICS Date. Many insurance carriers cover the cost of one or more pair of custom foot orthotics as they can be an effective treatment for many foot and ankle conditions along with some leg knee hip and back conditions. Custom-made orthotics are available by prescription.

They can usually be found at drugstores supermarkets and sporting goods stores. 24900 Add to cart. 13010 L3020 or 143030 Custom Molded Orthotics Diagnosis Codes.

Insurance companies differ in how much of the cost they cover. Return your impressions using the pre-paid label. We provide a Doctors Prescription free of charge for custom orthotics saving you money and an extra trip to the clinic.

Check with your medical insurance provider to see how much if any coverage they provide for custom orthotics. Also ask yourself if you really need them. Does Insurance Cover Custom Orthotics.

Custom-fit orthotics require expert fitting which can include trimming bending and molding. How To Order Your Custom Orthotics. We offer a two year umbrella insurance policy for 90.

Make sure you check with your insurer before you get fitted. Often the use of orthotics can eliminate the need for long term drug therapy physical therapy or surgical correction. For custom prescription orthotics a health professional performs a thorough health history including an assessment of your height weight level of activity and any medical conditions.

There are no reviews yet. Orthotic coverage can be complex but our staff would be glad to help you understand your coverage. Depending on your insurance company and benefits these may be covered.

It reduces cost to the patient and allows the doctor to collect a decent profit. This can be a touchy subject for some as custom-made Orthotics can be quite expensive costing typically between 45000 and 65000. INSURANCE COVERAGE FOR CUSTOM FOOT ORTHOTICS Insurance coverage for Custom foot orthotics will vary by insurance company and individual policy.

How much do orthotics cost with insurance. To get an insurance company to sign-off for custom orthotics the patient needs to have a foot assessment performed by a certified chiropodistpodiatrist. Currently Medicare interprets custom orthotics as a preventive service and therefore does not cover the custom item unless it is an integral part of a brace.

How Custom Orthotics Insurance process works. Take your impressions following the video instructions. For example one plan may cover custom orthotics at 500 per calendar year and another plan for employees in the same company may only cover 80 of costs up to 300 every 2 years.

If your health insurance covers the cost of custom orthotics youll usually only have to pay 10-50 of the total price. No matter what insurance company you are with Pro Balance g uarantees approval for every orthotic claim or your orthotics are free. Check with your medical insurance provider to see how much if any coverage they provide for custom orthotics.

All insurance providers accept paperwork from a Certified Pedorthist. Custom-fit documentation must clearly indicate what was modified why and why the modifications. For example Medicare does not cover orthotics at all.

In a couple of weeks receive your orthotics made from the molds of your feet.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)