Group Life Insurance Plan 3 MC Life anuary 2019 MC Life and Accidental Death and Dismemberment Coverage for Eligible Employees of New York State at a Glance This book describes the MC Life Insurance Plan. Interested in pricing for our life benefits.

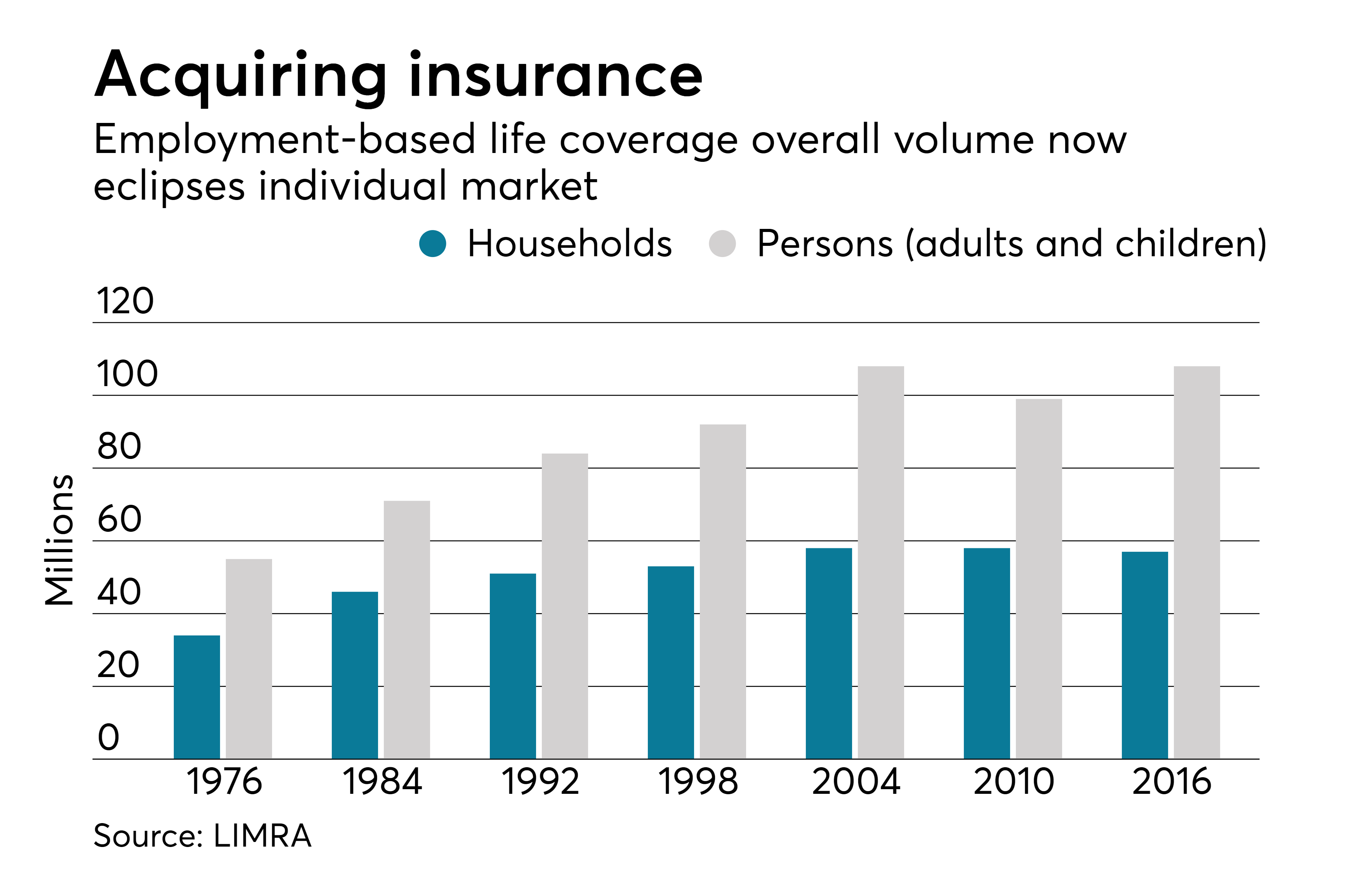

Group Life Insurance Policies Surpass Individual Market Sales Eba Employee Benefit News

Group Life Insurance Policies Surpass Individual Market Sales Eba Employee Benefit News

Best Life Insurance Offers For You.

Group life insurance plans. Group term life insurance is a type of term insurance in which one contract is issued to cover multiple people. NLG is one of the most trusted group life insurance companies in the UAE. If you wish to buy additional.

Group Gratuity PolicyLeave Encashment Plans. How Group Term Life Insurance Works Coverage Amounts. Combines life insurance protection with tax-advantaged investment options enabling employees to grow their savings.

These are available for organizations and groups to provide effective life insurance benefits to their employees or members of different groups. Supplemental group life insurance Many people opt to buy more insurance known as supplemental life insurance through their workplace plans. National Life Groups variable universal life insurance policy is for those who need life insurance but want to choose how the cash value account is invested.

The coverage offered through a group plan varies among employers. The return for the cash component of the policy is tied to mutual funds or another investment option. It is meant to offer a financial guarantee to the survivor affected by the community life insurance scheme in the insureds death.

The group life insurance plans we provide are truly designed to serve the changing need of employers. Group life insurance is fairly inexpensive and. The amount of coverage available to.

VGLI application deadline extended due to the coronavirus pandemic. Group Insurance Plans When people are brought together camaraderie and loyalty keeps them bound to each other. Our Group Plans ensure that this loyalty is rewarded by the promise of taking care of your employees family in case of death or permanent disability of the employee.

This Plan is available to. Group life insurance plans Our life insurance plans can help your business protect its greatest assetyour employees. Your employer may provide a certain amount of coverage free of charge.

Life other than GUL accident critical illness hospital indemnity and disability plans are insured or administered by Life Insurance Company of North America except in NY where insured plans are offered by Cigna Life Insurance Company of New York New York NY. Group life insurance is offered by an employer or another large-scale entity such as an association or labor organization to its workers or members. Offers life insurance protection along with a tax-advantaged saving option that allows employees to save for their future.

Flat Schedule - Coverage from 10000 to 50000. Group Variable Universal Life GVUL. Group life insurance is a benefit offered by groups to their members -- most commonly by employers to their workers.

Group Insurance Plans help to deliver multiple insurance benefits to a standard group of individuals in one go. The amount of coverage available varies among. Find out if you qualify for VGLI and how to manage your coverage.

ABCs Group Life Plans let you design a plan that is best for your situation. Group life insurance policies have been a central component of the compensation programmes. Veterans Group Life Insurance VGLI With Veterans Group Life Insurance VGLI you may be able to keep your life insurance coverage after you leave the military for as long as you continue to pay the premiums.

The employer or an entity such as a labor union is the policyholder and the employees or members of the group are the ones covered by the group policy. With group life insurance a single contract master plan policy covers an entire group of people. A group benefits plan helps employees cover the cost of things that provincial health care plansmay notpay for includingcertainprescription drugs dental hospital vision paramedical and ambulance services.

Group Universal Life GUL. Choose the level of coverage you want to offer your employees from among three programs. Group Universal Life GUL insurance plans are insured by CGLIC.

The most common group is a company where the contract is. Group life insurance plans provide financial independence to the families of the employee involved in the case of demise. Many provisions like the removal of ex-employees and the addition of new employees can be easily undertaken during the term of the policy.

ManagementConfidential employees of the Executive Branch of the State of New York and Participating Employers. With a group life insurance policy the insurance contract is between the group and the insurance company and the participating group members receive certificates of coverage.