Also known simply as group coverage small business group health insurance is a single policy issued to a group of 50 or fewer people. Health Savings Accounts HSAs A Health Savings Account HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur.

How To Set Up An Hsa For Your Employees

How To Set Up An Hsa For Your Employees

Silver PPO 2000206000 wHSA RxC.

Group hsa plans. A Health Savings Account HSA is a tax-favored savings account that when paired with a high-deductible health plan HDHP can be used to help your employees pay for qualifying medical expenses. HMO POS PPO or traditional indemnity plan. And our doctors are in the plan.

Must have a minimum deductible of 1400 for individuals and 2800 for families. HSA-Qualified High Deductible Health Plans. Can use any plan design.

Your employees can contribute funds into an HSA on a pre-tax basis to save for current and future medical expenses putting them in charge of how they manage their health care dollars. In most cases this is a business although group coverage is also available for trade organizations and nonprofits. Group HSA plans for Colorado employees provide flexibility and security in meeting medical payment obligations.

Contact RMHP today for more information. Receive complete coverage with UnitedHealthcares group health insurance plans. A high-deductible health plan HDHP offers you and your employees a Health Savings Account HSA a tax-favored personal health savings account that your employees own and control.

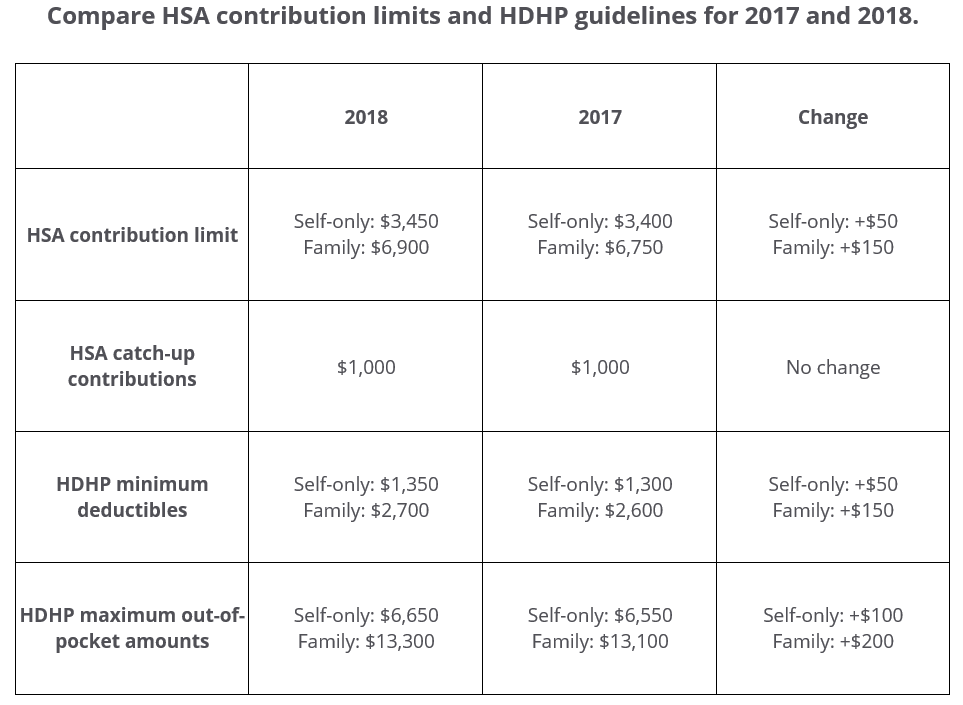

800-843-0719 Text Size A A A MyRMHP. According to the IRS high deductible health plans or HDHPs. For 2020 the maximum contribution amounts are.

Bronze Select PPO 4500356550 wHSA. The people at HSA have been very helpful. Bronze PPO 5000356550 wHSA.

Employees take responsibility for most initial. If you are at least 55 years old you can contribute an additional 1000 in 2016. An HSA-compatible HDHP typically has lower monthly premiums than lower-deductible health insurance plans and contributions to an HSA may be made on a pre-tax basis up to annual IRS limits.

The tax-free money put into an HSA can be used to pay for qualified medical expenses and save for future medical needs. You must be an eligible individual to qualify for an HSA. Explore Consumer Driven HSA Group Coverage by UnitedHealthcare.

HSA health plans consist of tax-exempt savings accounts that are used for medical expenses. Group Dental and Vision Plans Insurance through your employer Humana group dental plans are offered by Humana Insurance Company HumanaDental Insurance Company Humana Insurance Company of New York The Dental Concern Inc Humana Medical Plan of Utah Humana Health Benefit Plan of Louisiana Inc CompBenefits Company CompBenefits Insurance Company CompBenefits. Silver Select PPO 2000206000 wHSA RxC.

This easy-to-use program accommodates members by allowing them to control their personal health savings account HSA and receive low monthly premiums while you benefit through potential tax savings. The Harrison Group is a leading national administrator of tax-advantaged reimbursement plans including Health Reimbursement Arrangements HRA Health Savings Accounts HSA and Flexible Spending Accounts FSA. Small group coverage is sometimes more affordable than plans purchased on the individual market.

They have been helpful and understanding of my needs and service has been solid and dependable. It is a Health Savings Account that allows you and your employees to save money on their group health insurance. There is no federal income tax imposed on deposits and employers are also allowed to deposit funds similar to a 401K plan.

Once you enroll in Medicare its. Require a member to meet the deductible before the health plan benefits apply all covered medical and prescription costs count toward the deductible. I have been very happy with the choices of insurance and when I have had to speak with someone there they have been.

Bronze PPO 650006500 wHSA. HSA Plans Health Net has created EZ Access HSA plans for groups. Since Medicare is not considered an HDHP enrolling makes you ineligible to contribute to an HSA.

HSA options are available for both HMO and POS plans. The annual contribution limit to an HSA in 2016 is 3350 for an individual and 6750 for a family. Bronze Select PPO 5000356550 wHSA.

Our individual HDHPs include convenient access to Aspirus Health Plans Signature Network plus many health care professionals and hospitals in your area. Anthem Blue Cross of California. HSA is only for those enrolled in a high-deductible plan.

A Health Savings Account HSA is a tax-advantaged personal health care account that works with an HSA-qualified health plan. You can only open and contribute to a HSA if you have a qualifying high-deductible health plan. Bronze Select PPO 650006500 wHSA.

Bronze PPO 4500356550 wHSA. First Health functions as a wrap network to help lower out-of-pocket costs for emergency services in the 49 states outside of Wisconsin. In addition we also perform direct bill compliance services including Wrap Documents and Summary Plan Descriptions Non-Discrimination Testing Form 720 Preparation ACA Reporting.

Very professional customer service and user friendly site.

Health Savings Accounts How Hsas Work And The Tax Advantages

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

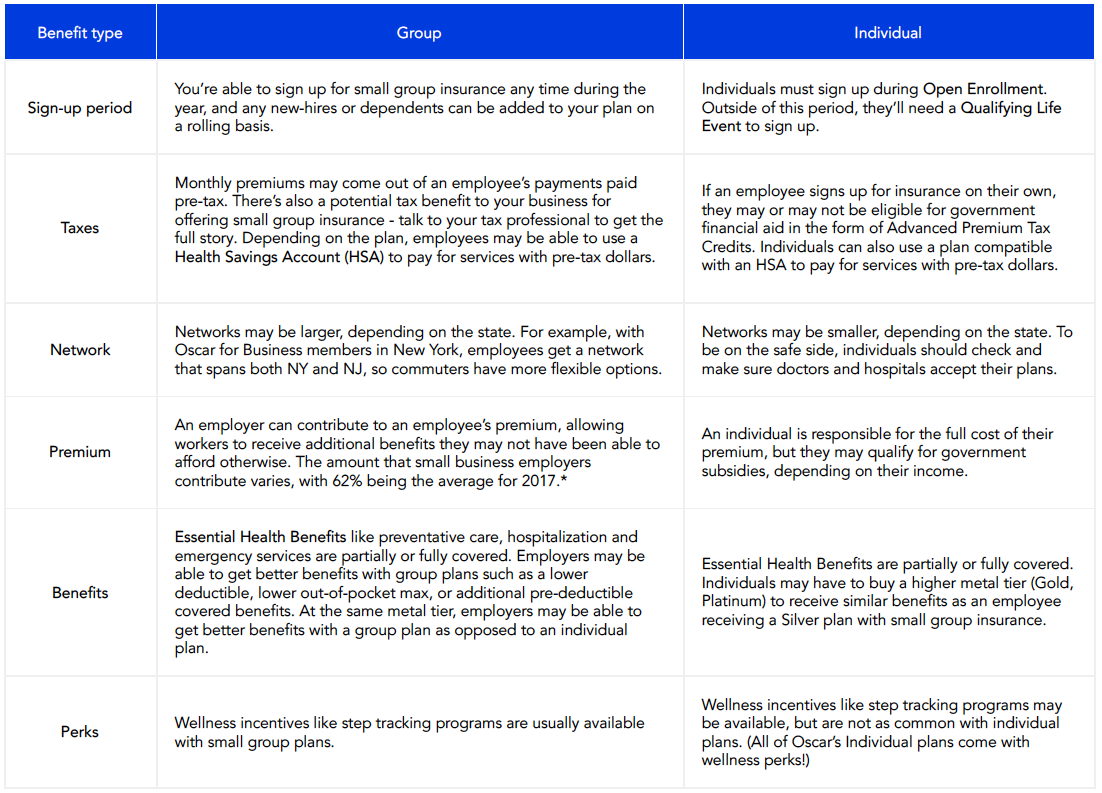

What Benefits Are Included In A Small Group Health Insurance Plan

What Benefits Are Included In A Small Group Health Insurance Plan

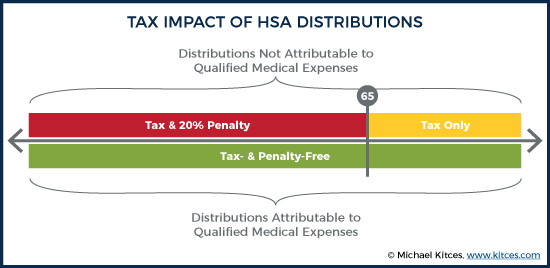

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

Guide For Third Party Administrators Seeking Growth In Health Savings Accounts Aite Group

Guide For Third Party Administrators Seeking Growth In Health Savings Accounts Aite Group

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

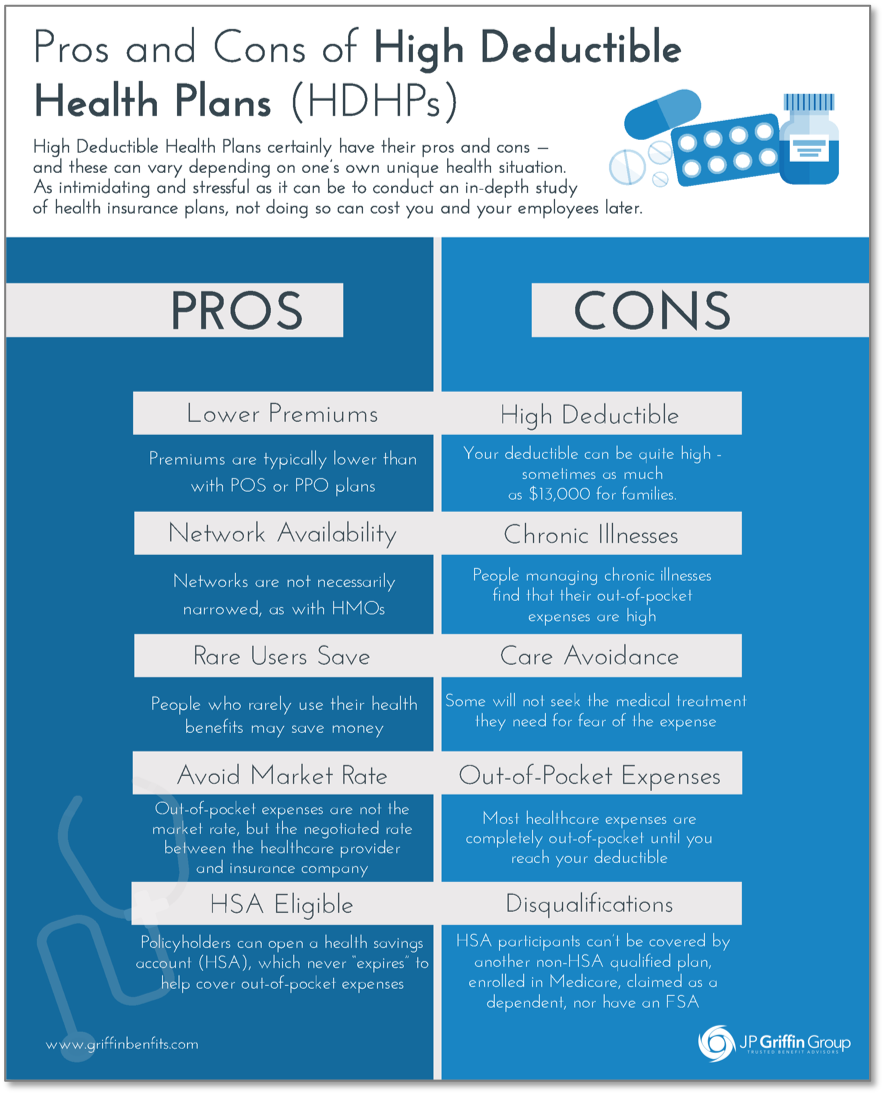

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Open An Hsa Or Fsa Healthcare Savings Visa

Open An Hsa Or Fsa Healthcare Savings Visa

Health Savings Accounts Minot Bismarck Nd Pinnacle Employee Benefits

Health Savings Accounts Minot Bismarck Nd Pinnacle Employee Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.