This doesnt only mean risking a gap in coverage but by having to reapply your monthly premiums may increase. Often enrollment into group life insurance is automatic.

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

Even then the amount you pay for life insurance.

Life insurance policy through work. For example most employer life insurance policies fall far short of the amount of coverage that you actually need. Basic life insurance through work is often automatic and free but the amount of coverage could be much less than what you may actually. Because youre part of a group plan you pay less than what youd otherwise shell out for an individual policy.

And the benefits of relevant life insurance can save you huge amounts on tax. The paperwork is often part of your hiring documents. Here are three main advantages of getting group life insurance through your employer.

Essentially in exchange for your premium payments the insurance company will pay a. While basic employer-provided life insurance is usually low-cost or free and you may be able to buy additional coverage at low rates your policys face value still. Some employers may pay the entire cost of the group policy so you get life insurance at no charge.

Life insurance is a contract between you and an insurance company. This can be useful in some cases as these supplemental policies are usually. Unless youre single without dependents most life insurance policies acquired through a job wont be enough.

The third-party buyer then takes over any premium payments and becomes the beneficiary of the death benefit. Your employer shoulders a considerable part of the premium payments. This risk skyrockets if youve.

By running a life insurance policy through the business you can save money. Life insurance is by its very nature a deeply personal financial decision. Basic coverage through work is usually free for.

In some cases a life insurance policy obtained through your employer will not be enough to cover everything and it should be considered a supplemental policy to another larger policy. But that will be totally inadequate if you have a young family and actually need something closer to 500000 or more. Heres why that matters.

Other important workplace life insurance downsides. And everyone who can get life insurance at work should definitely take it as there are many advantages to company-funded life insurance also known as group life insurance. Group Term Life Insurance Group term life insurance carries no cash value and is intended solely as a supplement to personal savings individual life insurance or social security death benefits.

Its Tied to Your Employer. Additionally as your salary and living expenses increase your. The life insurance your employer offers is part of a group life insurance plan which means the employer purchases a single policy that covers all employees.

Once you leave your job say goodbye to your life insurance. Advantages of getting insurance through work The big advantage of getting life or disability insurance through work is that its easy to do. Selling a life insurance policy is when the policyholder sells the policy and associated death benefit to a third party in exchange for agreed-upon funds.

When you rely exclusively on group coverage through work you miss the opportunity to personalize your coverage based on your specific needs. Getting coverage through work can be relatively easy. Other employers ask you to pay a portion of the cost.

How Does Selling a Life Insurance Policy Work. Advantages of life insurance through your employer. Key man insurance can help you save on corporation tax or tax on the payout depending on how the money is used.

If your employer offers the coverage its usually as simple as checking the yes box during open enrollment and youre signed up. If you do so your premium payments will be deducted from your payroll. Your group life insurance policy through work may give you the option to buy a supplemental policy.

Determining Adequateness of Life Insurance Through Work Lets say your employee benefits include a 100000-value life insurance policy. Your employer will have a type of life insurance chart that may offer you a 50000 or 100000 policy at no cost.

How Does A Life Insurance Policy Work Life Insurance Policy Term Life Insurance Quotes

How Does A Life Insurance Policy Work Life Insurance Policy Term Life Insurance Quotes

Life Insurance Myths Can Lead To Protection Gaps

Life Insurance Myths Can Lead To Protection Gaps

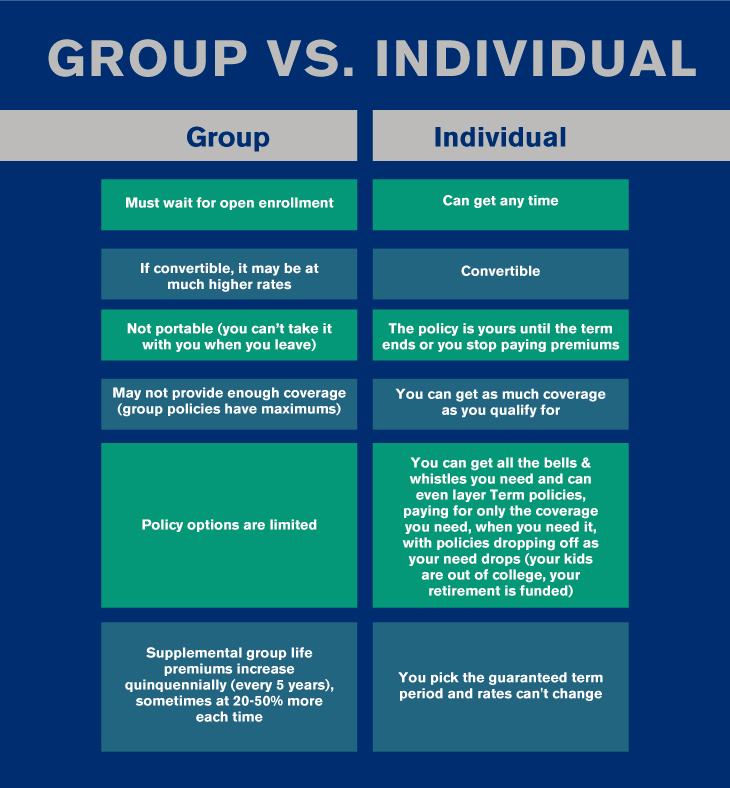

What S The Difference Between Life Insurance Through Work Vs Private Insurance Control Cost Coverage And Duration Of Coverage Plus A Free Calculator To

What S The Difference Between Life Insurance Through Work Vs Private Insurance Control Cost Coverage And Duration Of Coverage Plus A Free Calculator To

What You Need To Know About Buying Your Life Insurance Through Work Contractors Resource Center

What You Need To Know About Buying Your Life Insurance Through Work Contractors Resource Center

![]() Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Is Life Insurance Through Work Enough Especially Today Llis

Is Life Insurance Through Work Enough Especially Today Llis

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security 04 05 21 Finanzen Ch

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security 04 05 21 Finanzen Ch

Is My Life Insurance Policy From Work Enough Laptrinhx News

Is My Life Insurance Policy From Work Enough Laptrinhx News

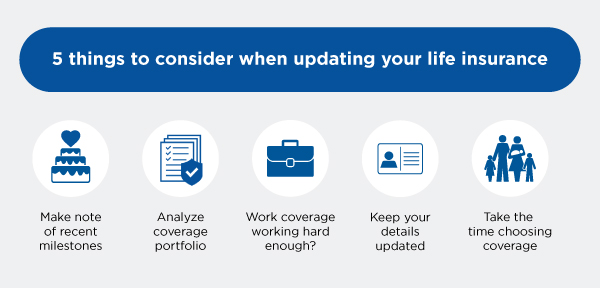

5 Life Insurance Boxes To Check During Open Enrollment

5 Life Insurance Boxes To Check During Open Enrollment

Is Life Insurance Really Necessary For You

Is Life Insurance Really Necessary For You

Life Insurance Through Your Employer Is A Great Benefit But Usually Isn T Enough To Cover All The Important Expenses Con Life Happens Life Personal Marketing

Life Insurance Through Your Employer Is A Great Benefit But Usually Isn T Enough To Cover All The Important Expenses Con Life Happens Life Personal Marketing

Is It Enough To Have Life Insurance Through Work Good Financial Cents

Is It Enough To Have Life Insurance Through Work Good Financial Cents

Is My Life Insurance Through Work Enough Coverage Colorado Life Quotes Term Life Insurance Colorado Insurance Broker

Is My Life Insurance Through Work Enough Coverage Colorado Life Quotes Term Life Insurance Colorado Insurance Broker

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.