An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network. An Exclusive Provider Organization EPO is a type of health plan that offers a local network of doctors and hospitals for you to choose from.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png) How Does Health Insurance Work

How Does Health Insurance Work

But like an HMO you are responsible for paying out-of-pocket if you seek care from a doctor outside your plans network.

How does epo insurance work. Basically an EPO is a much smaller PPO. The only exception is that emergency care is usually covered. Other types of managed care plans including POS point of service and EPO exclusive provider organization.

More importantly how does EPO insurance work. Also like an HMO you cannot receive care outside of your plans network if you wish to receive coverage. Like a PPO you do not need a referral to get care from a specialist.

The biggest difference is that this health plan will not cover care outside of your network unless it is an absolute emergency. You must stick to providers on that list or the EPO wont pay. With EPO insurance you are required to use hospitals doctors and other healthcare providers within your network similar to an HMO.

An exclusive provider organization EPO health insurance plan offers the cost savings of an HMO with the flexibility of a PPO. EPO health insurance got this name because you have to get your health care exclusively from healthcare providers the EPO contracts with or the EPO wont pay for the care. EPO or Exclusive Provider Organization describes the network of healthcare providers doctors hospitals imaging services that the health insurance plan is contracted to work with and is willing to compensate for your care.

Exclusive Provider Organization EPO EPOs got that name because they have a network of providers they use exclusively. This managed care health plan comprises a network of health care providers that the EPO contracts with at negotiated rates. An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribers.

How Managed Health Care Plans Keep Costs Down. An EPO is basically a kind of health plan that uses a network of local hospitals and doctors. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

One of the biggest advantages of choosing an EPO is that the costs are less. In general an EPO is a little cheaper than a PPO plan. 1 As is the case with other health plans that require you to stay within their provider networks EPOs will pay for out-of-network care in emergency situations.

One exception when it comes to provider restrictions is. An EPO can have lower monthly premiums but require you to pay a higher deductible when you need health care. Your insurance will not cover any costs you get from going to someone outside of that network.

PPOs are a type of managed care health insurance plan like their distant cousins health maintenance organizations or HMOs. An EPO is usually more budget-friendly than a PPO plan.

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

How Does Epo Insurance Work Business Benefits Group

How Does Epo Insurance Work Business Benefits Group

Frequently Asked Questions About Health Net Health Net

Frequently Asked Questions About Health Net Health Net

What Does Epo Mean In Health Insurance Business Benefits Group

What Does Epo Mean In Health Insurance Business Benefits Group

The Insurance Basics Cf Foundation

The Insurance Basics Cf Foundation

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

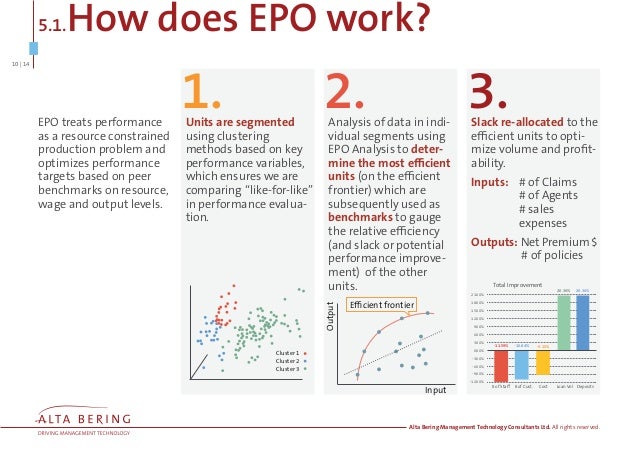

Alta Bering Insurance Solutions

Alta Bering Insurance Solutions

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

Ppo Epo Hmo Which Is The Best Safe Policies Insurance

The Top 4 Benefits Of Epo Insurance

The Top 4 Benefits Of Epo Insurance

How Does Epo Insurance Work Business Benefits Group

How Does Epo Insurance Work Business Benefits Group

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

How Does Epo Insurance Work Business Benefits Group

How Does Epo Insurance Work Business Benefits Group

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.