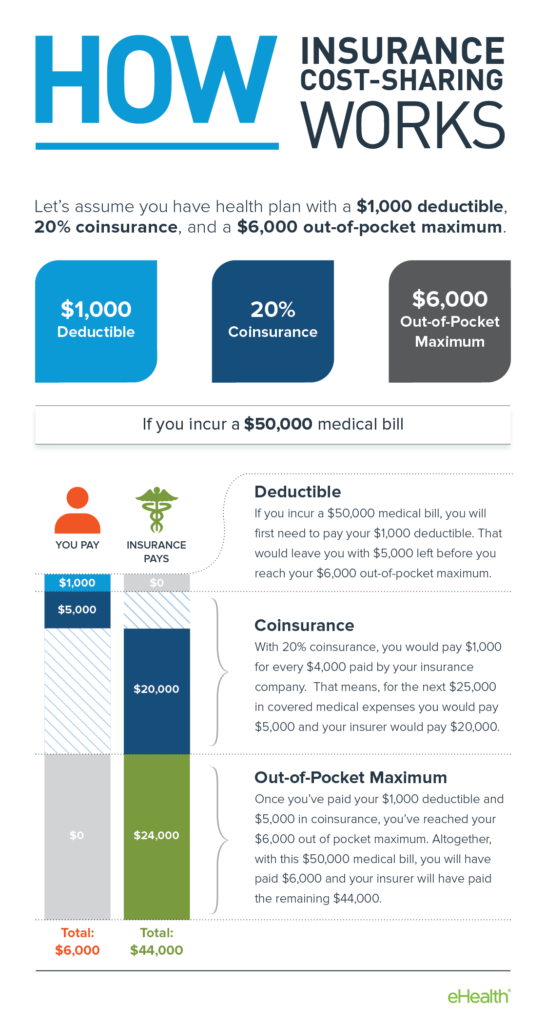

For instance with 10 percent coinsurance and a 2000 deductible you would owe 2800 on a 10000 operation 2000 for the deductible and then 800 for the coinsurance. As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year.

What Happens After I Meet My Deductible Ehealth Insurance

What Happens After I Meet My Deductible Ehealth Insurance

You pay 20 coinsurance of 14000 which is 2800 and your insurance company pays 80 of 14000 which is 11200.

20 coinsurance after deductible. For example you could have 35 coinsurance for hospitalization but only 20 coinsurance for surgery at an outpatient surgery center. After deductible and copay the ER charges total 3200. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

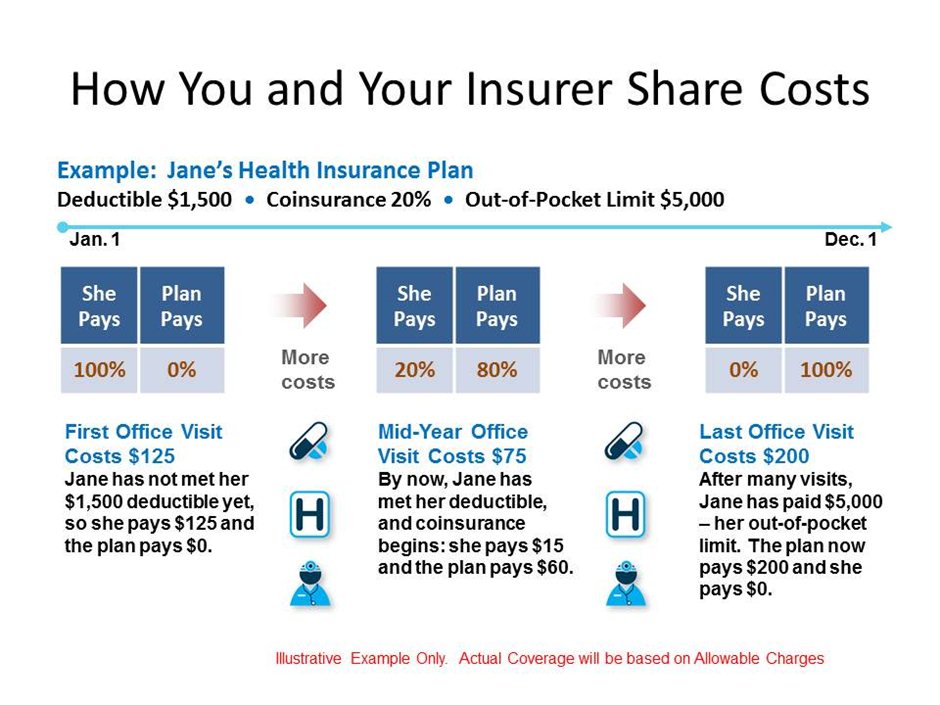

You pay 20 of 100 or 20. It is your share of the medical costs which get paid after you have paid the deductible for your plan. Youve paid 1500 in health care expenses and met your deductible.

You start paying coinsurance after youve paid your plans deductible. The other 150 gets written off by the MRI provider and doesnt figure into the amount you owe or the amount you still have left to pay towards your out-of-pocket maximum. Coinsurance is the percentage that you and the plan pay for the covered medical expenses until you reach your out-of-pocket maximum.

When you look at your policy youll see your coinsurance shown as a fractionsomething like 8020 or 7030. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would. Coinsurance Most Tier 1 services are covered at 90 coinsurance after deductible while Tier 2 services are 75 after deductible and Tier 3 are 60 after deductible.

If youve paid your deductible. What Is Your Coinsurance After Deductible. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met.

If you meet your annual deductible in June and need an MRI in July it is covered by coinsurance. A 20 coinsurance means your insurance coverage firm can pay for 80 of the full value of the service and you might be answerable for paying the remaining 20. The remaining balance to pay for the surgery is 14000.

Her health plan will pay 80 or 2560 leaving Prudence with a 20 coinsurance of 640. If you purchase coverage through the marketplace youll choose from tiered metal levels. Lets use 20 coinsurance as an example.

If youve met your deductible already but owe a coinsurance of 20 you owe 70 thats 20 of the 350 discount rate. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance.

For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. Coinsurance is usually 10 30 or 20. With a 20 coinsurance you pay 20 of each medical bill and your health insurance will cover 80 after your deductible is met.

100 for the ER copay. Coinsurance is a portion of the medical cost you pay after your deductible has been met. For services covered by coinsurance after deductible the amount you pay in co-insurance continues to count towards meeting your next Tier deductible.

For example if you have an 8020 plan it means your. For example if your deductible is 2000 you must pay 100 of your medical bills af. And its very common for prescription drug coverage to be structured with copayments for drugs that are in lower-cost tiers but coinsurance for higher tier or specialty drugs.

They are Bronze Silver Gold and sometimes Platinum. First you pay 1000 deductible and your OOPM drops to 920 1920 1000. The amount of money you pay after the deductible that you pay is based on the type of insurance you purchase.

Coinsurance Most Tier 1 providers are coated at 90 coinsurance after deductible whereas Tier 2 providers are 75 after deductible and Tier 3 are 60 after deductible Instance. Your health insurance plan will pay the other 80 percent. You typically pay coinsurance after meeting your annual deductible.

The insurance company pays the rest. Each level of insurance dictates how much your coinsurance. A 20 coinsurance means your insurance company will pay for 80 of the total cost of the service and you are responsible for paying the remaining 20.

Coinsurance is the percentage of covered medical expenses you pay after youve met your deductible. You can think of it as cost sharing between you and the health insurance plan. For example your plan pays 70 percent.

The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. Lets say your health plan has 20 coinsurance. Your health insurance plan pays the rest.

Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20. Your deductible if you werent aware is the amount you have to pay. Coinsurance is often 10 30 or 20 percent.

Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met. What Does 20 Coinsurance Mean. Once you reach your deductible the health plan pays a portion of health care services.

When you go to the doctor instead of paying all costs you and your plan share the cost.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Coinsurance And Medical Claims

Coinsurance And Medical Claims

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Difference Between Coinsurance And Deductible Difference Between

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

![]() Deductible And Coinsurance Useful Tips To Lower Health Insurance Costs

Deductible And Coinsurance Useful Tips To Lower Health Insurance Costs

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

Coinsurance And Medical Claims

Coinsurance And Medical Claims

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.