Medicare Supplement Plan F Rates. Your options if Medicare Supplement Plan F rates increase beyond your budget.

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Supplement Plans Comparison Chart 2021 What S New

The Difference Between Plan F Extra and Medicare Advantage Ancillary Benefits.

Medicare supplement plan f rates. You may also contact the NH Insurance Departments Consumer Services Division at 1-8008523416 option 2 to obtain updated plan and rate information. This rate isnt guaranteed to match the Medicare Supplement Plan F rate that you will receive in your state but it should provide you with a rough idea of how much you could be. Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away.

Aetna Medicare Supplement Plan F is a great option for Medicare beneficiaries to consider if they want to reduce their health care expenses. The real concern is that Medicare supplement Plan F rates will increase faster than they normally would if new insured were buying the plan. Medigap plan rates vary by individual.

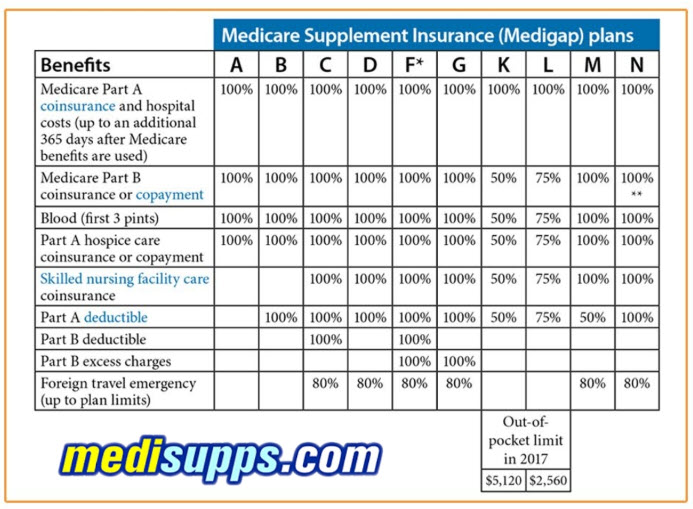

As the risk pool ages it stands to reason that claims will increase causing Plan F premiums to increase. Rates for Medicare Supplement Plan F While the benefits of Medicare Supplement Plan F remain the same regardless of your insurance company as mandated by the government in some states the premium you pay may vary according to a number of factors including age location gender and. Innovative Plan F is equal in comparison.

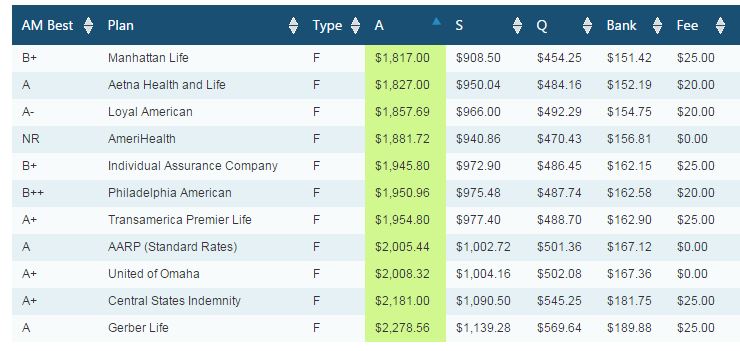

View the Lowest Rates for Medicare Supplement Plan f in 2019 Easily Online. Plan F vs Plan G. The average cost of Innovative Plan F is around 130-230 per month.

Plan F options have always been the most expensive Medigap plan with the most coverage. Aetna Medicare Supplement Plan F Benefits Rates. Enter your ZIP Code below.

Theres no doubt that it can be difficult to know which Medicare plan is most suitable for your medical needs particularly when its a question of coverage. Factors that influence the Medicare Supplement Plan F rates include the current residential address the sex and general physical health of the beneficiary at the time of enrollment and the age of the beneficiary. This dashboard will be updated periodically as additional company plans and rates are approved.

Medicare Part A and Medicare Part B which is often just known as Original Medicare provides a lot of coverage for its beneficiaries. The average cost of Medigap Plan F is around 130-230 per month. There are many factors that impact the premium price.

Medicare Supplement coverage and benefits rarely change from year to year. Very little change from year to year. Get Quotes in Minutes from Mutual of Omaha Cigna Aetna BCBS AARP United Healthcare and more.

If you choose the high-deductible Plan F option you have to pay for up to 2300 in Medicare-covered costs before the plan starts covering any expenses. Get An Instant Quote For Medicare Supplemental Rates Start Saving Now. Medicare Supplement Plan F Rates.

16 Zeilen Medicare Supplement Rate Look-Up. Mutual of Omaha Medicare Supplement Plan F Rates. 12 Zeilen The average premium for Medicare Supplement Insurance Plan F in 2018 was 16914 per month.

This brochure only represents insurance companies with approved plans and rates as of the date above. Fill Out The Form Below Or Call Now To Speak To A Licensed Agent To Get A Free Quote Instantly. Visit our DFS Portal and enter a zip.

Most Medicare Supplements provide very comprehensive coverage. The effect of the age of the beneficiary on the Medigap Plan F rates varies depending on what method the insurance company uses to calculate their Medicare Supplement Plan F rates. Compare Medicare Supplemental Rates and Plans Across Carriers Find Savings Today.

Beneficiaries who want additional benefits should consider Aetna Medicare Supplement Plan F. How Much Does Medicare Plan F Cost in 2021. However you can easily determine the plan that better supplements your existing coverage by comparing Plan F and Plan.

Visit our additional Medicare Supplement. High-Deductible Plan F on the other hand offers lower monthly premiums but requires you to pay an annual deductible set at 2370 for 2021 before it will pay toward out-of-pocket costs. Plan F is 100 Plan G is 100 after a small 198 deductible and Plan N has the 203 deductible and 20 copay.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement Plan F Plan G Empower Medicare Supplements

Medicare Supplement Plan F Plan G Empower Medicare Supplements

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplemental Insurance True Cost Of Healthcare

Medicare Supplemental Insurance True Cost Of Healthcare

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

Medicare Supplement Plans Comparison Chart 2021

Medicare Supplement Plans San Diego Compare Plans

Medicare Supplement Plans San Diego Compare Plans

Cheapest Nj Medicare Supplement Plan F

Cheapest Nj Medicare Supplement Plan F

Is Plan F Worth The Price Ensurem Life Optimized

Is Plan F Worth The Price Ensurem Life Optimized

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.