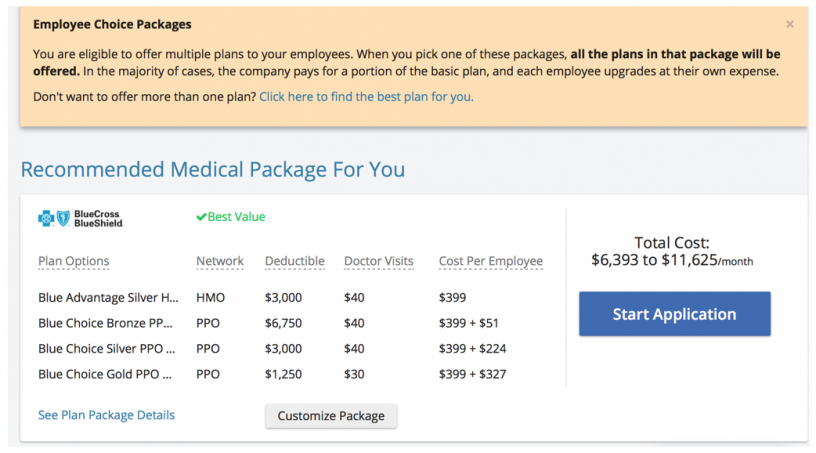

Like all of our Kaiser Permanente plans this plan gives you access to high-quality care and resources. Non-grandfathered HDHPHRA plans are required to have out-of-pocket maximums of no more than 7900 for single coverage and 15800 for family coverage in 2019.

An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses.

Hdhp kaiser plan. The Summary of Benefits and Coverage SBC document will help you choose a health plan. With this plan youll need to pay the full cost for. Plan HDHP HMO 1121123121 Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO is a health benefit plan that meets the requirements of Section 223c2 of the Internal Revenue Code.

Preventative is covered on all plans. You must use Kaiser Permanentes network of providers. Advantages of Your Health Plan HSA-Qualified High Deductible Health Plan HDHP HMO Plan With this Kaiser Permanente health plan you get a wide range of care and support to help you stay healthy and get the most out of life.

To help you feel your best. BRONZE 60 HDHP HMO 70000 CHILD DENTAL INFERTILITY HSA-qualified High Deductible Health Plan HSA can be administered through Kaiser Permanente FEATURES MEMBER PAYS PLAN DEDUCTIBLE Embedded Individual 70001 Family 140001 OUT-OF-POCKET MAXIMUM Embedded Individual 700012. 25 Virtually all HDHPHRA plans.

Kaiser Permanente health plans around the country. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. The 2020 deductible for an HDHP will be between 1400 for an individual 2800 for a family and an out-of-pocket maximum 6900 for an individual 13800 for a family.

Jefferson St Rockville MD 20852 Kaiser. You can also set up a health savings account HSA and put money in it1 You wont pay taxes on. 16 January 1 2020 through December 31 2020.

What is the HSA-Qualified HDHP. Accumulation Period The Accumulation Period for this plan is January 1 through December 31. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E.

The HDHP deductible is 1600 greater than my employers HSA contribution which means Id have to put a lot more money into it to cover my worst case scenario. For 2019 it is 1350 for individuals and 2700 for families and it. The High Deductible Health Plan HDHP with a Health Savings Account HSA is a unique medical plan that puts you in control of your health care spending.

Northern California Region A nonprofit corporation EOC 16 - Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO Evidence of Coverage for LAWRENCE LIVERMORE NATIONAL SECURITY LLC Group ID. Summary of Benefits and Coverage. HDHPSOs are treated as a distinct plan type even if the plan would otherwise be considered a PPO HMO POS plan or indemnity plan.

For a complete explanation please refer to the EOC. Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO Plan Embedded Questions and answers Set up a health savings account HSA to help pay for care 2018 or when your Kaiser Permanente plan renews in 2018 97331 National Committee for Quality Assurance NCQAs Private Health Insurance Plan. Preventative care is free even if you havent met your deductible and you wont ever be charged a copay.

Plus it offers flexibility in how you can pay for care. My last employer charged 1000 for annual premiums and this one only charges 280 with 0 deductible. Beginning on or after 01012019Kaiser Permanente.

The Kaiser HMO plan is unbelieavably sweet. Members will pay 100 of the doctor office visits radiology services lab tests. Jefferson St Rockville MD 20852 Kaiser.

Kaiser Foundation Health Plan Inc. An HDHP usually has a higher annual deductible than a typical health plan and its minimum deductible varies by year. This plan requires a member to meet the calendar year deductible FIRST before ANY plan benefits will be paid except covered preventive services.

Kaiser Permanente health plans around the country. Bronze 60 HDHP HMOCoverage for. This network is the same network used with the Kaiser Permanente HMO.

The Deductible First HDHP plan provides a 21 savings compared to the current Kaiser Permanente 10 Copay Plan. The SBC shows you how you and the. What this plan covers and What You Pay For Covered ServicesCoverage Period.