The California health insurance mandate is in effect requiring Californians to have health insurance The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty. California imposes individual health insurance mandate for 2020 bumps Covered California subsidy eligibility to 600 of poverty level We said it was only a question of time.

How To Get Low Cost Or Free Health Insurance In California Cost U Less Insurance

How To Get Low Cost Or Free Health Insurance In California Cost U Less Insurance

The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020.

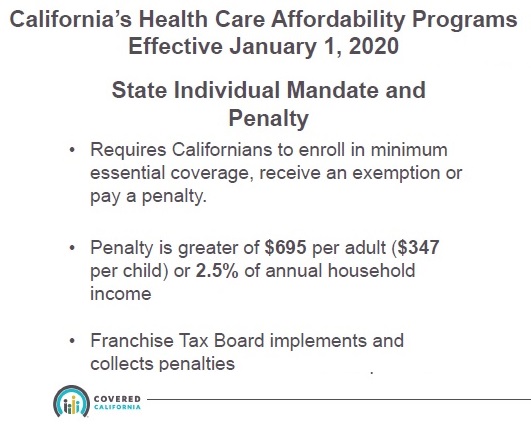

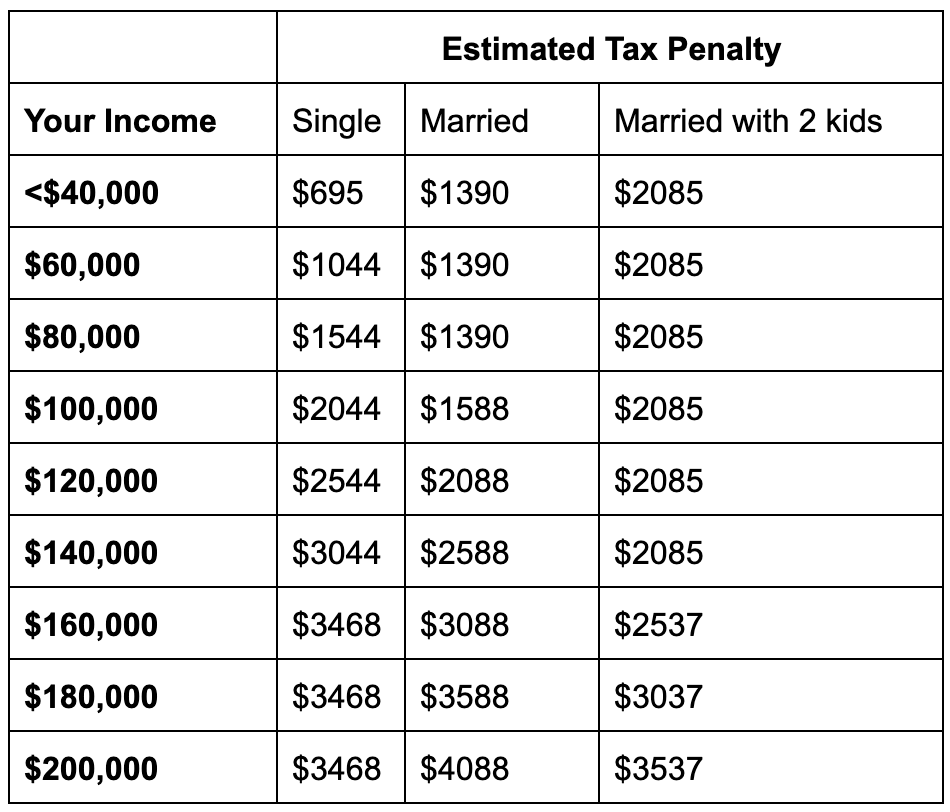

California required health insurance 2020. Beginning January 1 2020 California residents must either. 1 requires Californians to have health insurance in 2020 or face a penalty on their state taxes. California Health Insurance Penalty-If you are a resident of the state of California and dont have health insurance in 2020 you can expect a tax penalty of 695 per adult and 34750 per child or 25 of your annual income.

The federal law was repealed and coverage was not mandatory in the state of California in 2019. Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can be. Most of that amount 317 million is expected to come from penalties paid by people who.

If you arent covered and owe a penalty for 2020 it. People who purchase insurance for. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

There are several major changes to California health insurance in 2020. Get health care coverage now to avoid state penalty later. December 02 2019 News Release.

Links in this document Enlaces en este documento. A taxpayer who fails to get health insurance that meets the states minimum requirements. Have qualifying health insurance coverage or.

California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. Tax Penalty for No Health Insurance 2020. A complicated formula determines the penalty you may face but its similar to the former ACA penalty.

A new state law going into effect Jan. This follows the repeal of the individual mandate at the. However California has now introduced a new state mandate for individual health care in 2020.

The state subsidies will cost an estimated 429 million in 2020. Beginning January 1 2020 California law requires you to have health insurance. This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty.

Pay a penalty when filing a state tax return or. 31 to buy a health plan for 2020. Obtain an exemption from the requirement to have coverage.

Have qualifying health insurance coverage. California is implementing its new state individual mandate in 2020. 1 2020 including a requirement that all Californians have health insurance according to.

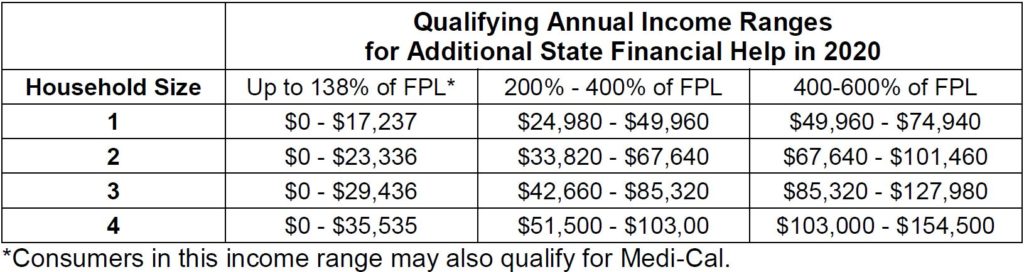

The state needs to come up with 98000000 to pay for free health insurance for illeg. Those who earn between 400 and 600 of the federal poverty line FPL will be eligible for. What is the penalty for not having health insurance.

1 2020 California will be the first state in the nation to provide a new subsidy program that will help lower health insurance costs for low and middle-income residents. Starting in 2020 California residents must either. It requires all California residents to maintain Minimum Essential Coverage MEC medical health insurance coverage for themselves and their dependents beginning January 1 2020.

Read our blog to learn more. Pay a penalty when they file their state tax return. Massachusetts Health Insurance Penalty-.

People who purchase insurance for themselves and their families either through Covered California the states health insurance exchange or the open market will have until Jan. Get an exemption from the requirement to have coverage. Most types of insurance including Medi-Cal Medicare and employer-sponsored coverage will satisfy Californias requirement.

Starting January 1 2020 California will tax legal citizens if they dont have health insurance. The Franchise Tax Board FTB urges Californians to get health care coverage now and keep it through 2020 to avoid a penalty when filing state income tax returns in 2021. CALIFORNIA Californias new health laws will kick in on Jan.

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

Changes To California Health Insurance In 2020 Freeway Insurance

Changes To California Health Insurance In 2020 Freeway Insurance

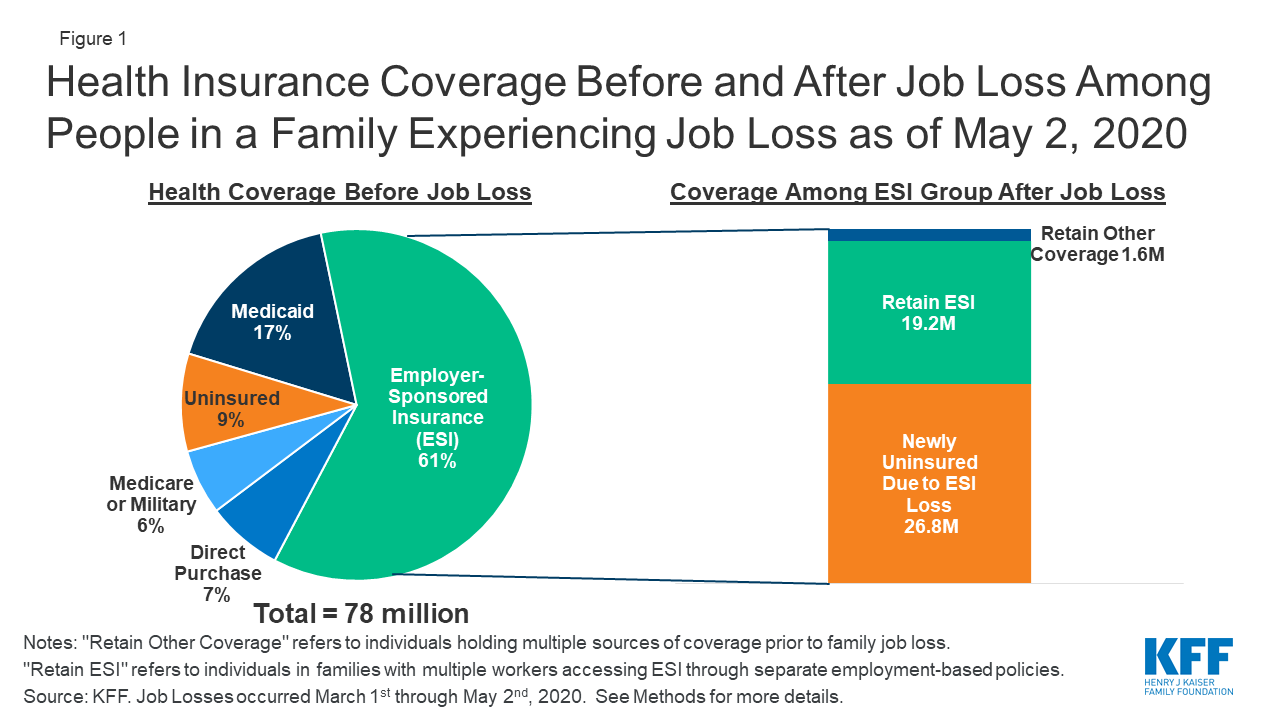

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

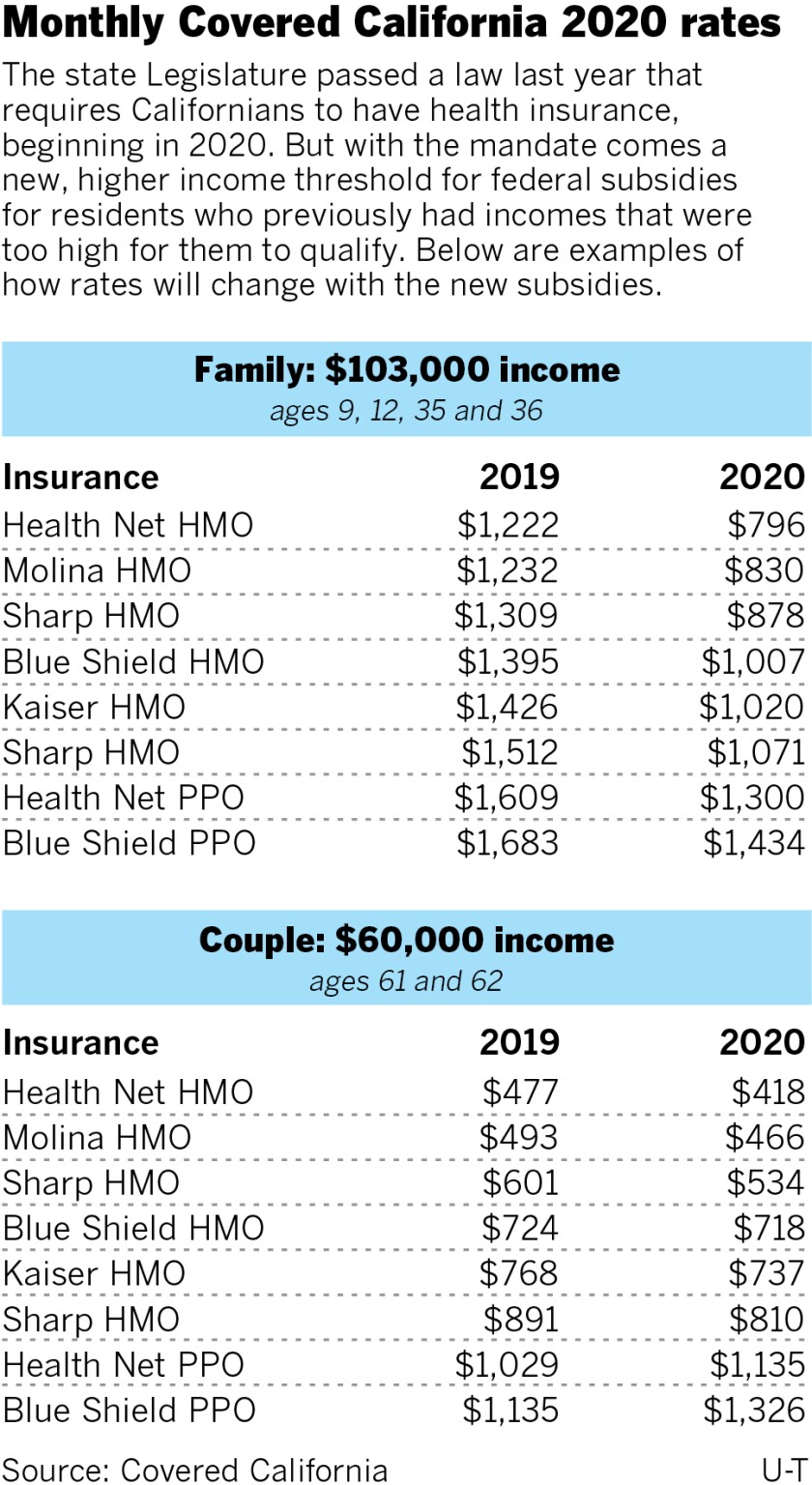

Insurance Mandate Returns In 2020 With Additional Sweetener The San Diego Union Tribune

Insurance Mandate Returns In 2020 With Additional Sweetener The San Diego Union Tribune

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

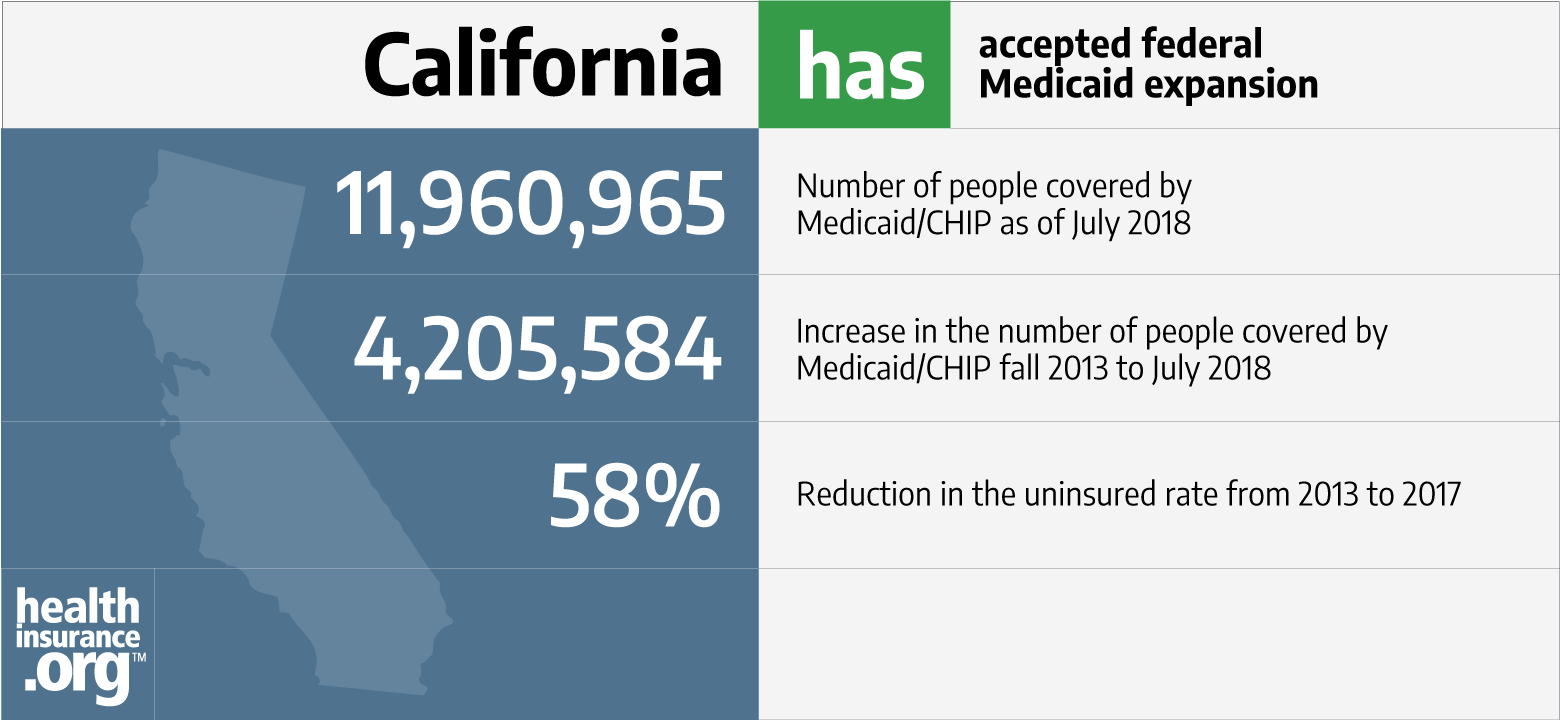

California And The Aca S Medicaid Expansion Healthinsurance Org

California And The Aca S Medicaid Expansion Healthinsurance Org

2020 Open Enrollment Period In California Must Know Information For You

Penalty For No Health Insurance 2020 In California Choi Hong Lee Kang

Penalty For No Health Insurance 2020 In California Choi Hong Lee Kang

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.