From employee pensions managed by the California Public Employees Retirement System CalPERS to health dental and vision plans state employment offers you many benefits. You will be interviewed by your county.

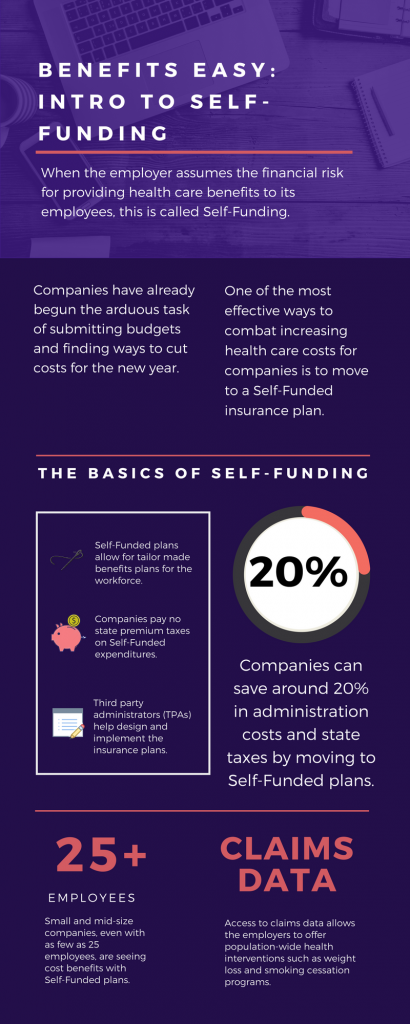

Benefits Easy Intro To Self Funding California Employee Benefit Advisors Johnson Dugan Insurance Services Corporation San Francisco Bay Area

Benefits Easy Intro To Self Funding California Employee Benefit Advisors Johnson Dugan Insurance Services Corporation San Francisco Bay Area

Expanded unemployment benefits due to COVID-19.

California employee benefits. The benefits listed below are available to eligible employees as well. CalFresh provides monthly food assistance to people and families with low income including those who lost their job because of the pandemic. Use Benefit Programs Online to access the Employment Development Departments online benefit services.

State health benefits are administered through the California Public Employees Retirement System CalPERS. Benefits may include dental medical disability life insurance and the like. However if benefits are offered to full-time employees employers must use the same standards for each employee when determining who shall and who shall not receive benefits.

Some cities also require employers to provide certain benefits to employees. California State Employee Benefits Quick Reference Guide Benefit Description and Information WebsitePhone Alternate Retirement Program ARP Retirement savings program that certain state employees first hired 8112004 6302013 were automatically enrolled in for their first two years of employment. Even if a company is only paying 50 toward the Bronze level plan the employee feel taken care of.

Many California employers still contribute to employees individual plans without the QSEHRA and theyre running a risk by doing so. Wages up to a certain amount according to law are taxed in order to provide retirement. The federal Family and Medical Leave Act FMLA and the related California Family Rights Act CFRA give.

However when the employee is requesting Paid Family Leave PFL the law gives an employer the option to require an employee to take up to two weeks of earned but unused vacation leave andor paid time off PTO prior to receiving PFL. From employee pensions managed by the California Public Employees Retirement System CalPERS to health dental and vision plans state employment offers you many benefits. CalPERS also offers disability retirement partial service retirement and death benefits for eligible employees.

Its highly valued by employees. This option does not relieve employers. Additional information on these benefits is available in this chart from the California Labor and Workforce Development Agency.

Employees are eligible for health benefits if they have a permanent appointment or a limited-term appointment of more than six months at least six months plus one day. California has laws that relate to employee pay and benefits including temporary disability insurance health care continuation pay statements wage deductions and wage notice requirements. Apply for Disability Insurance DI and Paid Family Leave benefits and manage your DI claim.

The 2021 DIPFL maximum weekly benefit amount is 1300. See Pay and Benefits. Learn more about the defined benefit plan that is offered to state employees through the California Public Employees Retirement System CalPERS based on years of service age and final compensation.

Federal and California laws require that you provide certain benefits to your employees. California Personal Income Tax PIT Withholding California PIT withholding is based on the amount of wages paid the number of withholding allowances claimed by the employee. Small business exemption may apply 23 of regular.

And a time base of half-time or more. Your account will provide access to. If approved you can get up to 204 a month in food benefits.

Employees are not required to use vacation paid time off or sick leave when receiving Disability Insurance benefits. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150. For leave taken prior to December 31 2020 up to an additional 10 weeks of paid leave for employees who work for public employers or private employers with fewer than 500 employees.

Employers are not required to offer benefits even to classified full-time employees. The Savings Plus Program provides additional opportunities to save for retirement with 401k and 457 Plans. The Savings Plus Program provides additional opportunities to save for retirement with 401k and 457 Plans.

The cost to vet hire and train employees is a significant cost. The benefits listed below are available to eligible employees as well. Heres more information about available benefits like unemployment insurance paid and unpaid leave and other worker benefits.

What Kinds of Employee Benefits are Required in California. Not every employer is required to provide all of these benefits some are only required for companies over a certain size.

8 Hidden Benefits Your Health Insurance May Be Offering California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

8 Hidden Benefits Your Health Insurance May Be Offering California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Shrm Survey Findings Employee Benefits In California Flexible

Shrm Survey Findings Employee Benefits In California Flexible

Guide To California Employee Benefits During Covid 19 Gusto

Guide To California Employee Benefits During Covid 19 Gusto

2017 Edition California Employer Health Benefits California Health Care Foundation

2017 Edition California Employer Health Benefits California Health Care Foundation

Advantages Of Automation California Employee Benefits Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Advantages Of Automation California Employee Benefits Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Employee Benefit Trends Of 2017 Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

Employee Benefit Trends Of 2017 Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

What You Need To Know About Voluntary Benefits California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

What You Need To Know About Voluntary Benefits California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

New Year S Resolutions That Stick California Employee Benefits Arrow Benefits Group Complex Questions Straight Answers

New Year S Resolutions That Stick California Employee Benefits Arrow Benefits Group Complex Questions Straight Answers

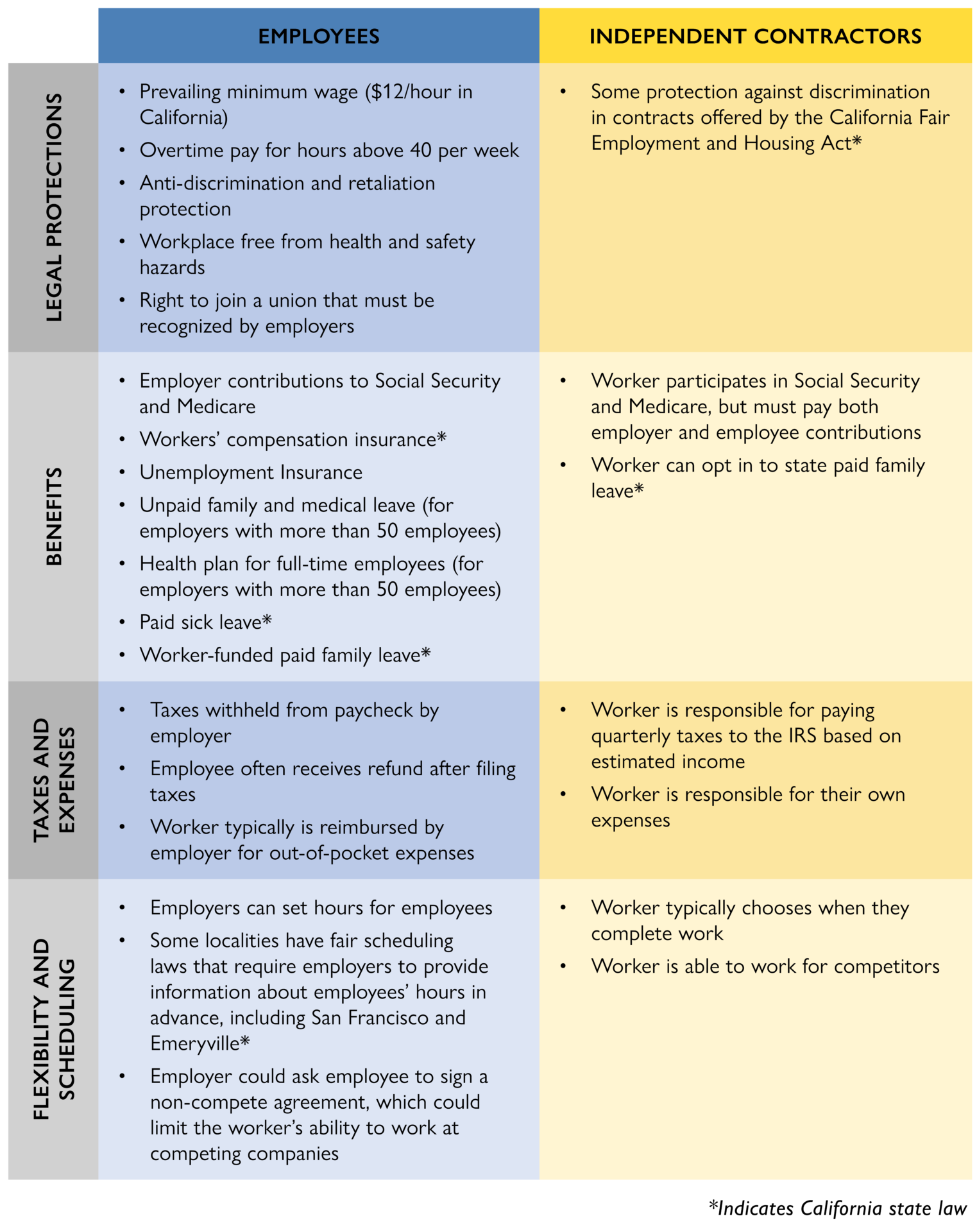

Expanding Benefits And Protections For Today S Workers California S Ab5 Brings Attention To Classification The Aspen Institute

Expanding Benefits And Protections For Today S Workers California S Ab5 Brings Attention To Classification The Aspen Institute

California Paid Family Leave What Employers Need To Know Gusto

California Paid Family Leave What Employers Need To Know Gusto

Does A Company Have To Offer Health Insurance To Employees In California

Does A Company Have To Offer Health Insurance To Employees In California

7 Kind Of Employee Benefits Legally Required In California

7 Kind Of Employee Benefits Legally Required In California

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.