There are two types of individual and family insurance plans. A type of plan where you pay less if you use doctors hospitals and other health care providers that belong to the plans network.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Unfortunately this question is not so straight forward.

Is my insurance hmo or ppo. To me a PPO. Another cost to consider is a deductible. Im looking to get my own individual plan but dont really get what the benefit of a PPO is versus an HMO.

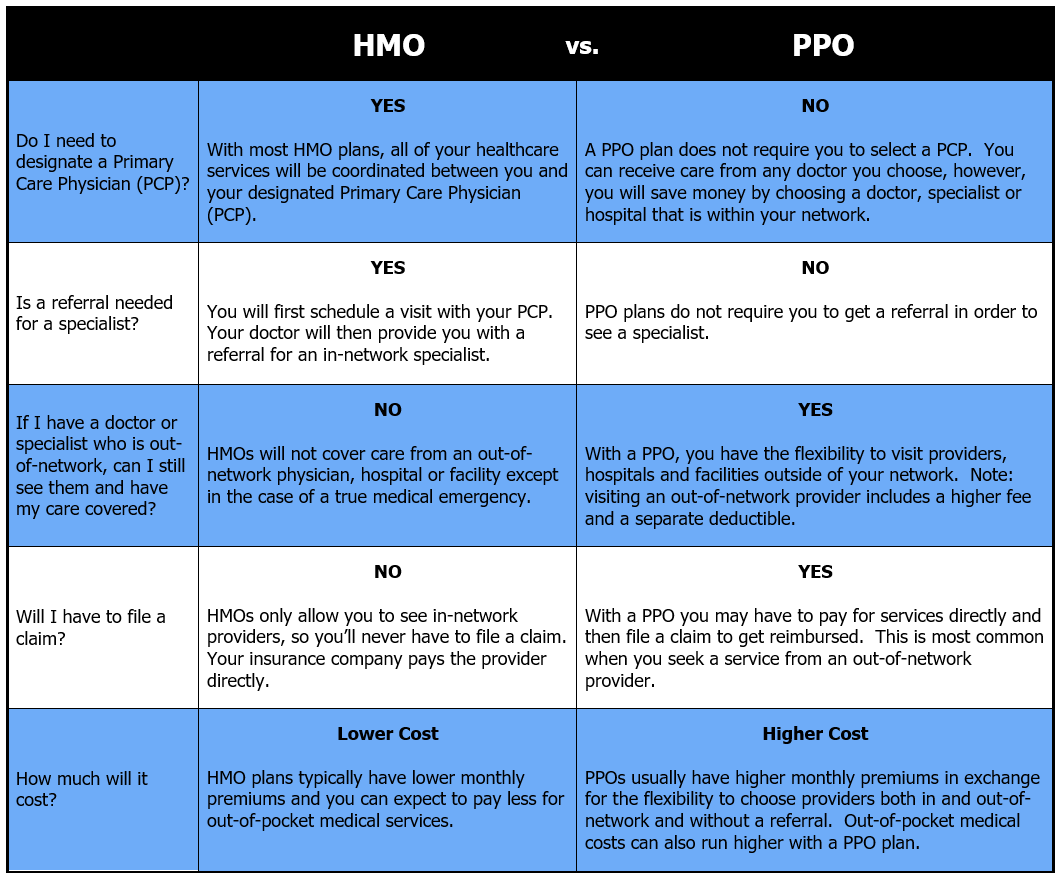

You pay a contracted rate less than full price to see network providers. There are also fewer restrictions on seeing out-of-network providers. HMOs often provide integrated care and focus on prevention and wellness.

I had to dish out 2000 for one recently and cant afford to keep that up. Currently on my parents dental insurance Humana. If your primary concern in monetary the HMO is probably a better selection.

What typeof health insurance coverage should I get HMO or PPO. A Health Maintenance Organization or HMO is one of the most popular healthcare plans. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization.

The insurance company employs the doctors binds them by contract controls their decisionsand thus controls costs. Think lower cost with less flexibility to choose health care providers. The HMO plan covers more of your drug costs in the gap than the PPO covers.

Freeway Insurance will help you and. Many fillings crowns and just general tooth restoration. HMO which literally does not cover any percentage of root canals or crowns.

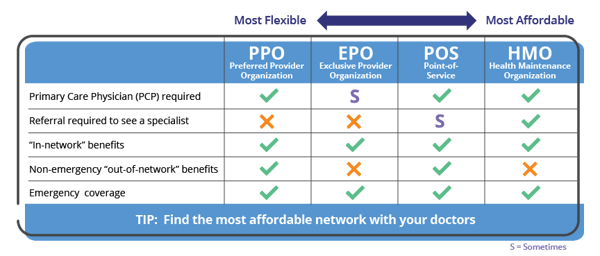

In general an HMO is more restrictive for the patient than a PPO requiring all treatment to be done inside the network. Additionally members are not required to choose a PCP. Call our team t.

But the major differences between the two plans. A decision between an HMO and a PPO should be based on whats most important to you. On the other hand an HM tends to be less costly than a PPO because the patient does not pay as many fees such as copays and deductibles.

In a PPO plan you can see doctors outside the network and might be covered but cover is generally better within the network. The latter rule even applies to specialists. Its known for lower deductibles than Preferred Provider Organizations or PPOs and its network of doctors and specialists that you must stick to as part of the plan.

However unlike an HMO with a PPO you can use doctors clinics and hospitals outside the network at a higher cost. It really depends on a. Point of Service POS.

Like HMO plans a PPO. 1 2016 you must enroll in an individual or family plan by Dec. See the table on this page and review your Guide carefully.

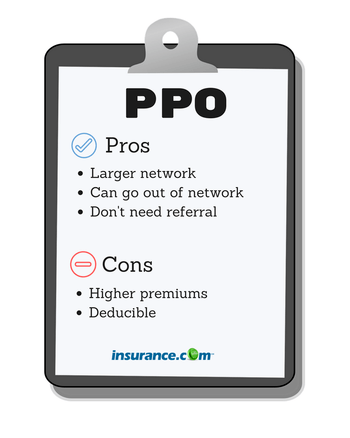

This is the amount of health care costs you must pay before your plan begins to cover your costs. An HMO may require you to live or work in its service area to be eligible for coverage. The additional coverage and flexibility you get from a PPO means that PPO plans will generally cost more than HMO plans.

A PPO is a type of insurance plan that uses a defined network of medical providers to meet your health care needs. See your Medicare Guide for detailed side-by-side comparisons of the two plans. An HMO plan might be right for you if lower costs are important and you dont mind choosing your doctors from within the HMOs network.

Unlike an HMO a PPO plan allows members to see any health care provider who is within the insurance companys network without a referral. Need to know the differences between HMO PPO and EPO health insurance. Health Maintenance Organizations HMOs and Preferred Provider Organizations PPOs Although annual open enrollment is open until January 31 2016 to ensure coverage by Jan.

HMO plans often have a lower premium and tend to have lower or no deductibles. When we think about health plan costs we usually think about monthly premiums HMO premiums will typically be lower than PPO premiums. The differences besides acronyms are distinct.

Freeway Insurance will help you and your family with the right plan. Not all HMOs have deductibles but when they do they tend to be lower than PPO. Whether you have an HMO or a PPO your insurer operates according to this model.

There are some other small differences between the HMO and PPO in terms of copays coinsurance and benefit coverages. The hospital is our hospital owned. The lack of PCP referral requirements makes this the preferred type of plan for individuals who need to regularly visit specialists.

Is an HMO or a PPO plan better.

Difference Between Hmo And Ppo Difference Between

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

You Re Aging Off Of Your Parents Health Insurance Plan Now What Thinkhealth

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Comparing Costs And Rates Of Hmo To Ppo Plans In California

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.