Plan G 203 deductible then 100 coverage. If you are shopping for a Medicare SELECT Plan G Anthem Blue Cross is one option.

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

All plans offer the option of adding on vision and dental coverage for an additional monthly premium at various levels.

Anthem blue cross medigap plan g. You could join our popular fitness program SilverSneakers. The only difference is that Plan G does not cover the Medicare Part B deductible. Anthems Plan G in recent years became more popular because Plan G has lower premiums in exchange for you paying the Medicare Part B deductible.

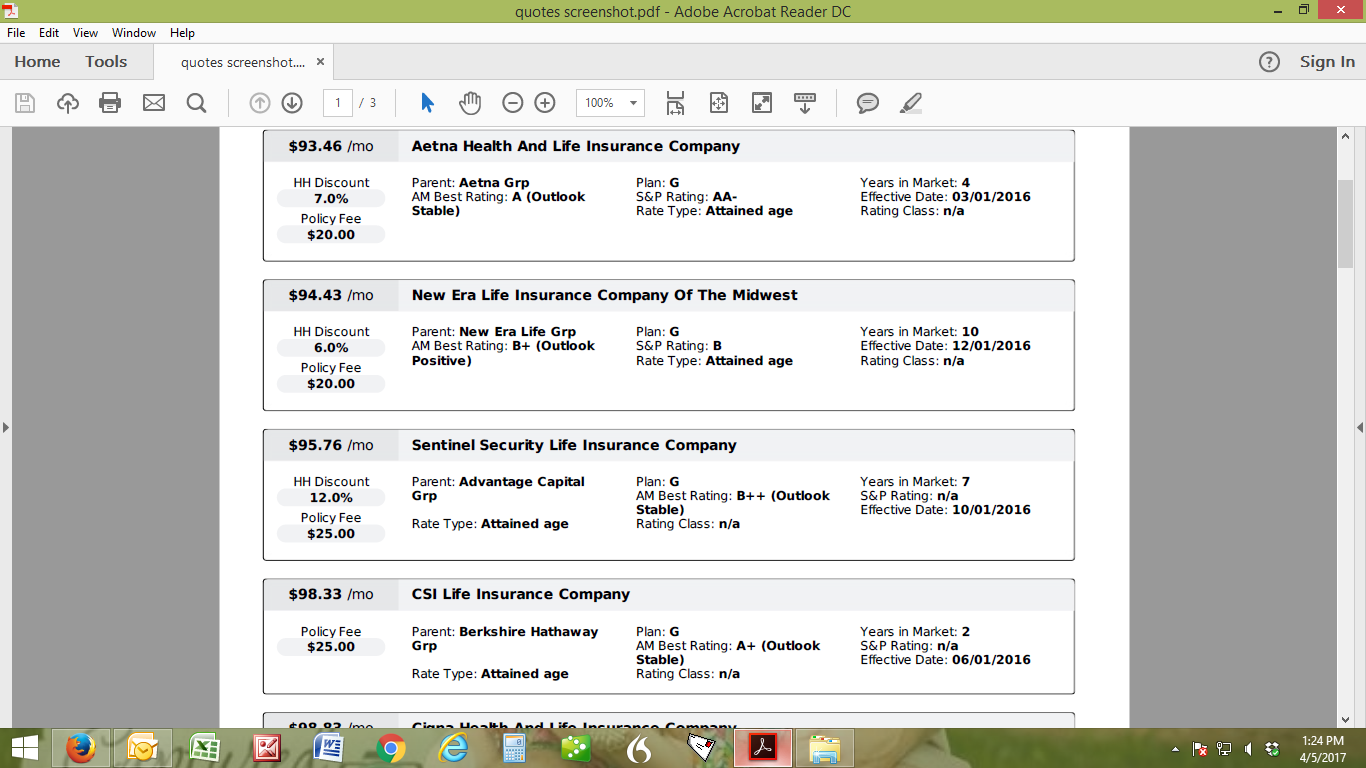

Anthem Medicare Supplement Plan G. However its pricey and can lead to big premium increases from year to year. The average cost of Medigap Plan G is around 100-200 per month.

In recent years Anthem Plan G has become a more popular plan. Includes discounts on products and services through Blue365. Our Medicare Supplement Plans Medigap When you sign up for a Medicare Supplement plan with Anthem Blue Cross and Blue Shield youll have access to some great extras.

Anthem Medicare Supplement Plan G. The big difference is that seniors on Plan G must pay their Part B deductible which was 185 in 2019. Anthem Medicare Supplement Plan N.

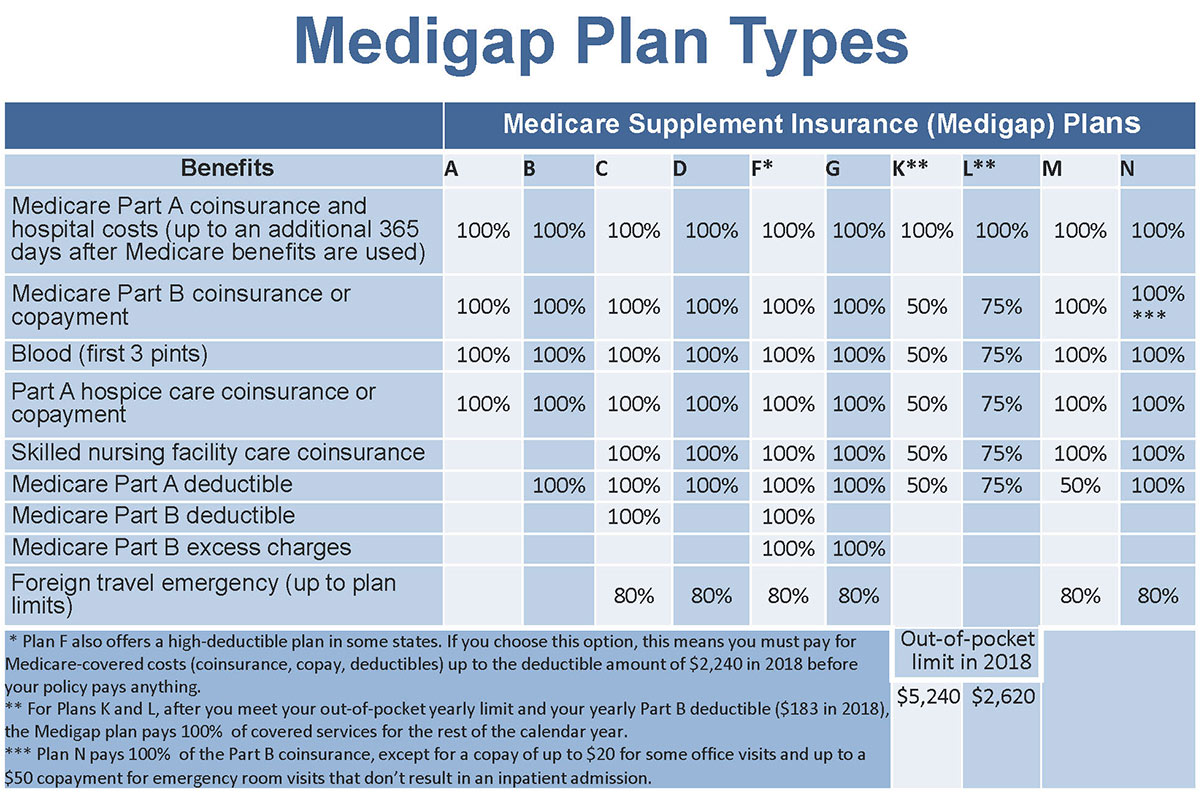

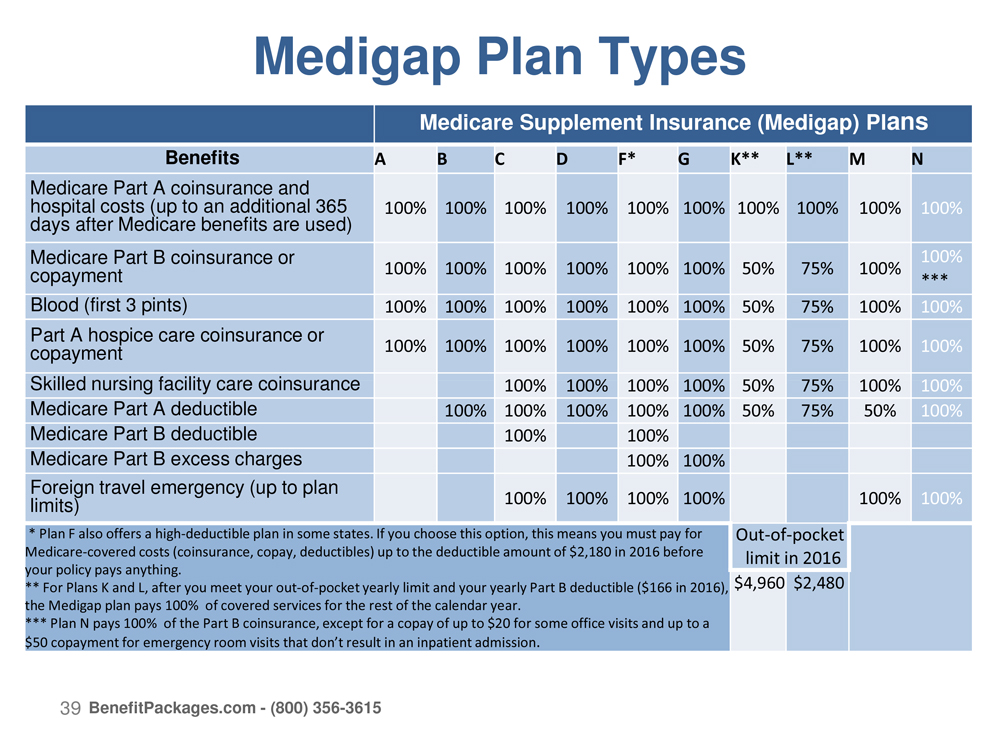

Plan G covers everything that Plan F covers except the Medicare Part B deductible. All three provide 100 coverage for Inpatient Hospital services. In fact Plan G is nearly identical to Plan F in terms of coverage.

The premium is lower and still includes a lot of benefits. BCBS Medicare Supplement Plan G. If you are shopping for a Medicare Supplement Plan G Anthem Blue Cross is one option.

This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits. Just be sure to enroll in Original Medicare before adding a Medicare Supplement plan. It was discontinued in 2020 for most new enrollees.

Medigap Plan G like Plan F covers the Part B excess charges. Medicare Supplement insurance also called Medigap is a type of plan you can add to Original Medicare to pay for things that Parts A and B dont cover like your coinsurance copays or the Part A and Part B deductibles. Since there are six benefit periods in a year thats an 8448 benefit.

Once you paid the Part B deductible. Plan F 100 coverage. Anthem Medigap Plan G.

What you pay depends on a number of factors your location being a major determinantGenerally Medigap. It does include coverage for foreign travel and Medicare preventive care Part B coinsurance. You are responsible for that but afterward your Plan G will pay just like Plan F for the rest of that calendar year.

Plan G offers lower premiums because it does not cover the Part B deductible. If you buy Plan G from Anthem youll find coverage for. Medicare Supplement MediBlue Plus HMO Part D Rx.

When you add up these hospital benefits Anthem Blue Cross Medigap plans F G N K and L benefits total 33808. The internet is full of information about traditional providers of Medicare Plan G policies like Anthem Blue Cross. Anthem Medicare Supplement Plan N.

Medigap Plan G is a Medicare supplement insurance plan. If youre new to Medicare in 2020 and would like a very inclusive Medigap plan. One of them is HealthNets Medigap Innovative G another one is Blue Shields Medigap G Extra and the last one is Medigap G Inspire.

These have the same exact network of doctors and standard benefits of a traditional Plan G but. It covers a variety of expenses that arent covered by Medicare parts A and B such as coinsurance copays and some deductibles. The panel above briefly outlines the coverage.

Medicare Supplement premiums are unique per individual. This plan is the second most common plan. There are currently three options in California to purchase a Medigap Plan G with additional hearing and vision benefits.

Anthem offers health insurance plans for almost every purpose including Medicare Supplement insurance also known as Medigap. The plans included in its roster are Plans A F Innovative F G and N. Plan N 203 deductible then 20 copay for outpatient visits.

Plan G will then pay the same as Plan F for the remainder of the calendar year. Fortunately Plan G is nearly identical and is more affordable. The internet is full of information about traditional providers of Medicare Plan G policies like Anthem Blue Cross.

The panel above briefly outlines the coverage. Plan G includes all the same benefits as Plan F minus your Part B excess charges that you might incur from a doctors visit. Every 60 day benefit period as a hospital inpatient Anthem Blue Cross Medigap plans except plan A pay 1408 Part A deductible in 2020.

Pays 100 of your hospital costs for up to 365 days after youve used up your Medicare benefits. Pays 100 of your Medicare coinsurance and copays for medical hospital and hospice services covered by Medicare. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits.

24 rânduri Innovative G Medigap is a new Medicare Supplement plan offered by.

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Anthem Blue Cross Medigap Plans Infographic Senior Healthcare Direct

Anthem Blue Cross Medigap Plans Infographic Senior Healthcare Direct

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Medigap Plan G Rates 65medicare Org

Medigap Plan G Rates 65medicare Org

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Https Www Anthem Com Ca Shared F0 S0 T0 Pw B144501 Pdf Refer Member

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Plan G Bcbs Plan G Hea

Blue Cross Blue Shield Plan G Bcbs Plan G Hea

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

Blue Cross Blue Shield Medicare Supplement Insurance Reviews

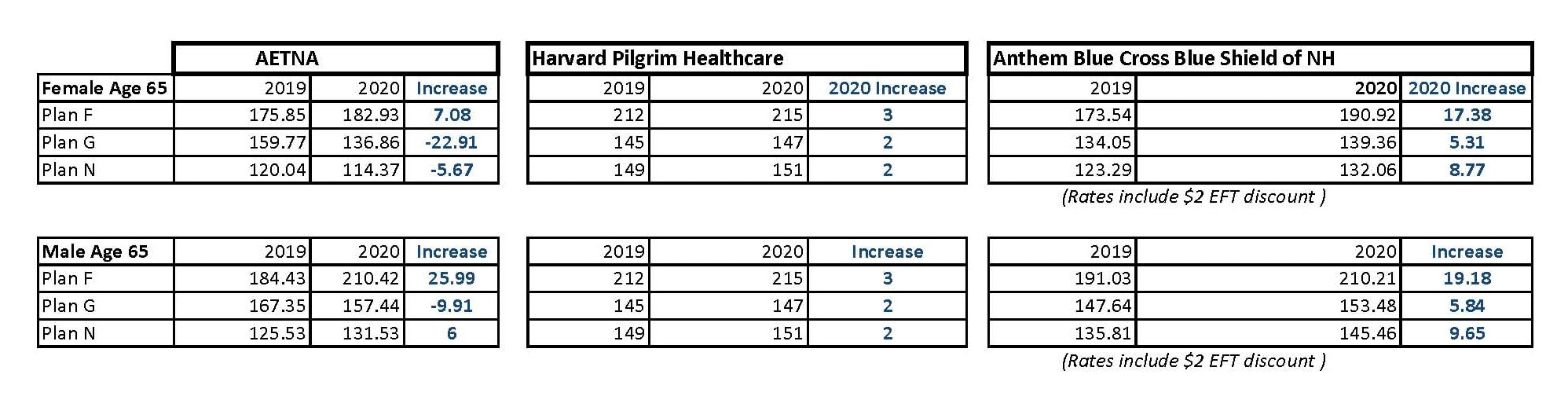

2020 And 2019 Nh Medicare Supplement Rates

2020 And 2019 Nh Medicare Supplement Rates

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.