Certain Medigap plans are available to all persons who have Medicare. Due to recent changes in federal law Medigap Plans that cover the Part B annual deductible Plans C and F are only available you if you became eligible for Medicare before Jan.

Medicare Supplement Plan D Medigap Plan D Medicarehaven Com

Medicare Supplement Plan D Medigap Plan D Medicarehaven Com

You can embed and download infographic.

Medigap benefits chart 2020. Part A Hospice Care Coinsurance or Co-payment. Some plans may not be available. If you bought a Medigap between July 31 1992 and June 1 2010 you can keep it even if its not being sold anymore.

Look for the best deal. Every company must make Plan A available. Use the scroll bar at the bottom of the chart to view all plans and information.

No means the Medicare Supplement plan. Copay Blood First Three Pints 50. Skilled Nursing Facility Care Coinsurance 50.

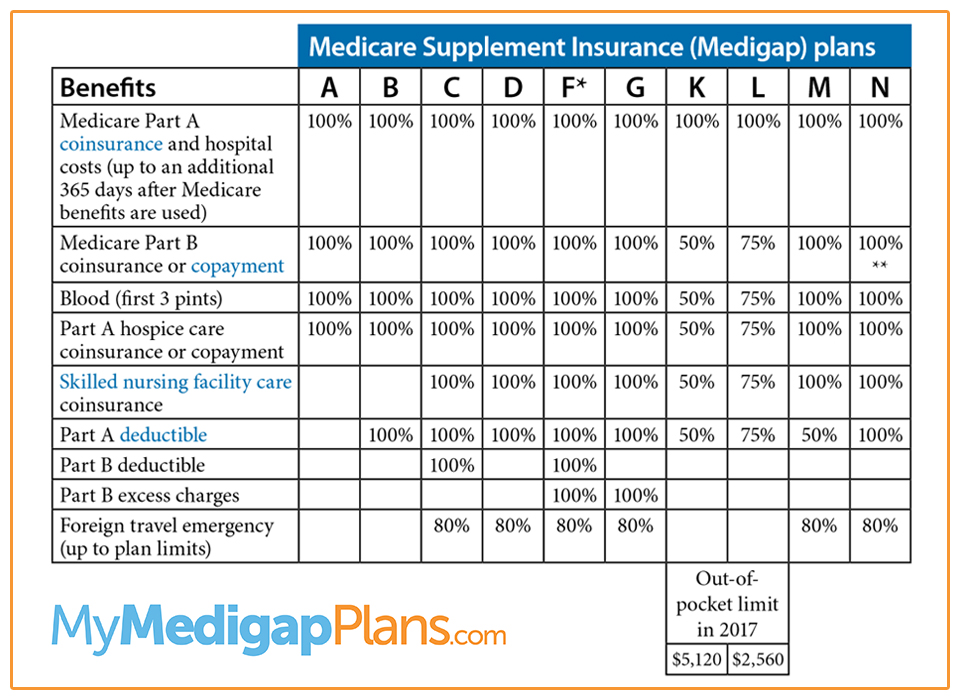

The following 5 benefits are covered at least in part by some Medicare Supplement insurance plans. Medicare Part A Deductible 50. Medigap Plans Benefits Grid The chart below shows the benefits of the standard Medigap plans.

However some Medigap plan options do not cover them. This chart shows the benefits included in each of the standard Medicare supplement plans. Medicare supplement policies available in 2021 include the plans A B D G K L M and N.

Medigap Plan F Versus Plan G. The Medicare Supplement comparison chart shows you exactly which benefits each plan may cover. 12 Zeilen As of January 1 2020 Medigap plans sold to new people with Medicare arent.

The Medicare Supplement comparison chart shows you exactly which benefits each plan may cover. Medicare Supplement insurance also known as Medigap insurance may help cover your Original Medicare Part A and Part B out-of-pocket costs such as deductibles and coinsurance. Only applicants first eligible for Medicare before 2020 may purchase Plans C F and high deductible F.

Click here to view enlarged chart. If you have a Medigap policy it will cover the first 3 pints of blood. Below you will find basic information about the benefits deductibles and copayments of each plan helping you choose a Medigap policy.

In the Medicare Supplement comparison chart Yes means the lettered Medigap plan may pay 100 of the benefit. How to use these charts 1. If a percentage appears in the row the Medigap insurance plan may pay part of the benefit.

Benefit Chart of Medicare Supplement Plans Sold on or after January 1 2020. Use this chart to compare each plans benefits. If you choose the high-deductible option it.

If a percentage appears in the row the Medigap plan may pay part of the benefit like 50 or 75 and you will typically pay the rest. In most states there are 10 standardized Medigap plans each with a letter designation Medigap Plan A Medigap Plan B and so on. Comparison of monthly premiums.

A 3means 100 of the benefit is paid Benefits Plans Available to All Applicants Medicare first eligible before 2020. 2020 Medigap Plans Chart This chart shows the benefits covered by Medigap Plans A through N. The Medigap comparison chart allows you to see and compare Medicare Supplement plans side by side.

Medigap Plan F is also offered as a high-deductible plan by some insurance companies in some states. Other Medicare Supplement Insurance benefits offered by some plans. People new to Medicare are those who turn 65 on or after January 1 2020 and those who get Medicare Part A Hospital Insurance on or after.

Infographic visually shows the benefits of all Medigap Plans with a side-by-side comparison. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Medicare Part B Coinsurance or Co-payment.

Medigap Benefits Chart Infographic. Scroll to the right to continue reading the chart. Medigap Benefits Chart 2021.

Benefit Chart of Medicare Supplement Plans Sold on or after January 1 2020 Medigap Blue - Benefit Plans A B C D F High Deductible F G and N This chart shows the benefits included in each of the standard Medicare supplement plans. In the Medicare Supplement comparison chart Yes means the lettered Medigap insurance plan may pay 100 of the benefit. Part B excess charges.

Some plans may not be available. Some plans may not be available. The 2020 out-of-pocket maximum is 5880 for Plan K and 2940 for Plan L.

A ümeans 100 of the benefit is paid. Only applicants first eligible for Medicare before 2020 may purchase Plans C F and high deductible F. Plans E H I and J stopped being sold June 1 2010.

A means 100 of the benefit is paid. Some plans may not be available. Medicare Part A Coinsurance and Hospital Costs up to an additional 365 days after Medicare benefits are used up.

Use this chart to compare the monthly costs of Medigap plans in your area. The Medicare Supplement comparison chart below shows you exactly which benefits each plan covers. Benefit Chart of Medicare Supplement Plans Sold on or after January 1 2020 The chart shows the benefits included in each of the standard Medicare supplement plans.

Benefit Chart of Medicare Supplement Plans Sold on or after January 1 2020 The chart shows the benefits included in each of the standard Medicare supplement plans. 2020 but not yet enrolled you may be able to buy one of these plans. Your benefits are different from whats on the chart above.

The benefits for each lettered plan eg Plan A are the same no matter which company sells it or what the premium is. You can compare Medigap insurance plans side-by-side using the Medicare Supplement comparison chart below. Only applicants first eligible for Medicare before 2020 may purchase Plans C F and high deductible F.

Each plan offers a set of benefits to help pay costs original Medicare does not cover.