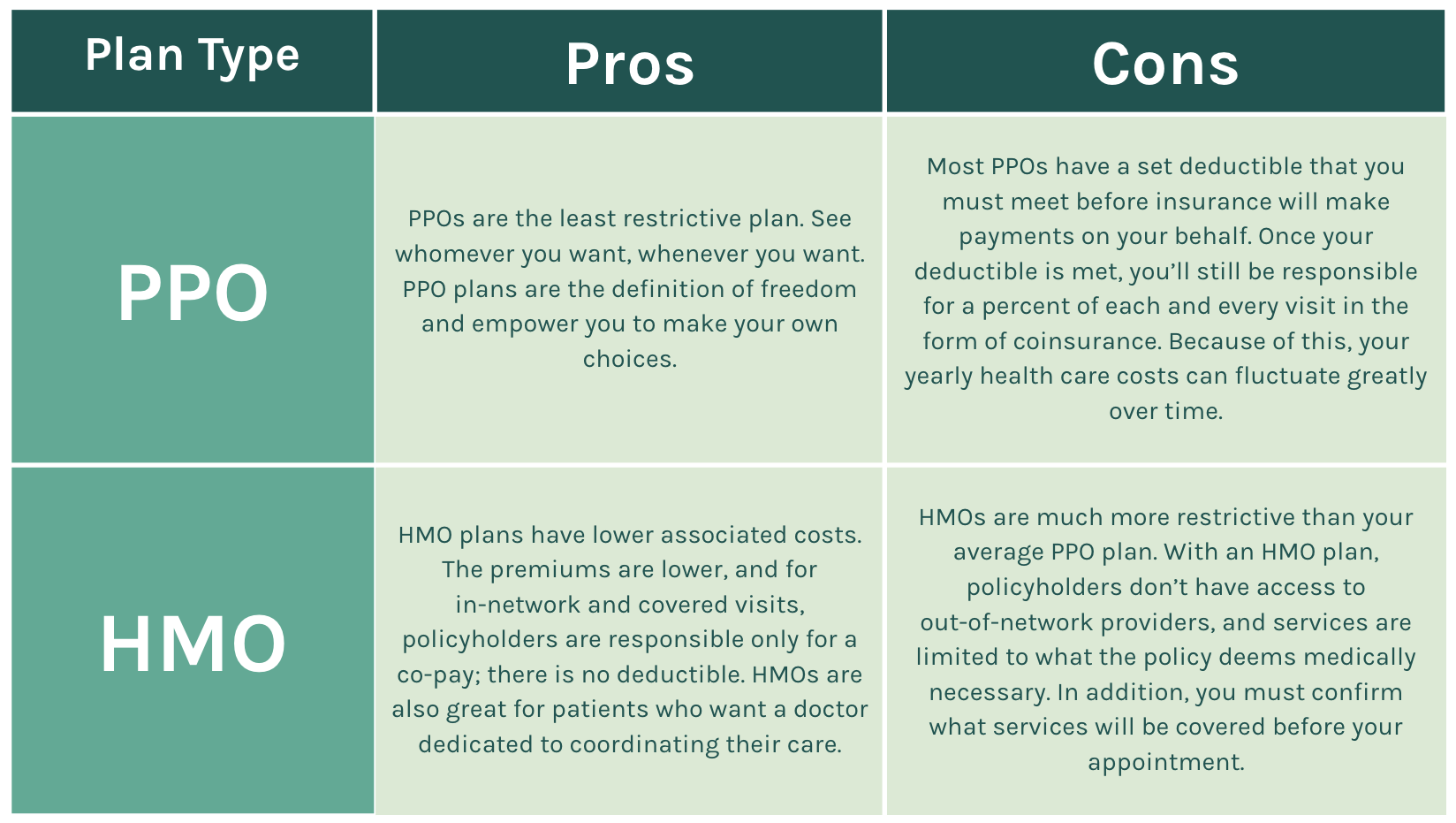

The difference between them is the way you interact with those networks. A PPO plan is also generally more expensive than an HMO plan.

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

In addition with a HMO you might have a low deductible or even a no deductible health plan.

Difference between ppo and hmo health plans. These savings are passed on to the consumer. Would like a central doctor who will serve as a coordinator for specialist care Are not tied to particular doctors that are outside of the HMO network. Of course you will pay less when using providers within the networks coverage.

Less choice in where to receive care. All health care plans arent the same. The differences besides acronyms are distinct.

But the provider network for a HMO is less expansive. Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it. The monthly payment for an HMO plan is lower than for a PPO plan with a comparable deductible and out of pocket maximum.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Doctor options close to where you live. HMO Pros and Cons.

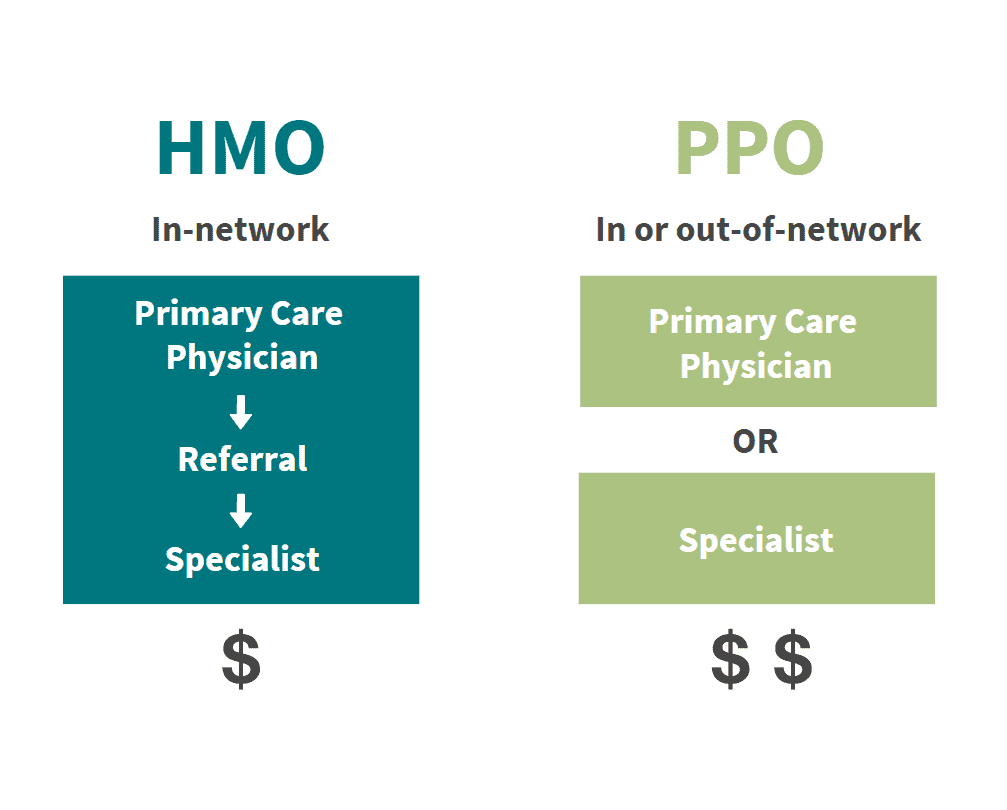

Referrals and Primary Care Physicians PCPs In HMOs. HMOs require primary care provider PCP referrals and wont pay for care received out-of-network except in emergencies. 5 Patients in with an HMO must always first see their primary care physician PCP.

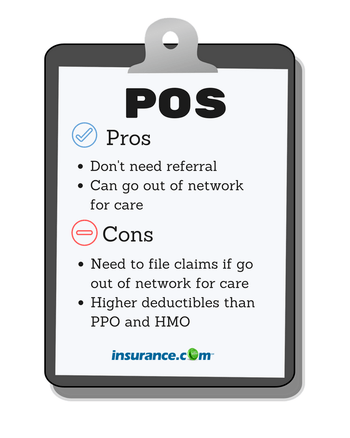

One kind might work better for you than another. With a PPO plan you can see a specialist without a referral. PPO - Which ones for you.

If your PCP cant treat the problem they will refer you to an in-network specialist. PPO stands for preferred provider organization. HMO plans typically have lower monthly premiums than PPO plans.

PPO also known as Preferred Provider Organization is a health plan that offers a broad network of doctors and health facilities. Emergency coverage available anywhere. However PPO plans offer flexibility by covering out-of-network providers at a higher cost.

How HMOs differ from PPOs Different Characteristics. As a result of these smaller more targeted networks HMOs usually cost less money than PPO and NPOS networks. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. HMO stands for health maintenance organization. In most cases if you belong to an HMO you must use in-network care meaning care from those health care facilities or doctors that are in the HMOs network.

A PPO plan might be right for you if you already have a doctor or team of specialists you want to continue seeing but might not be in your employers HMO plan network. Both HMO and PPO plans rely on using in-network providers. The significant differences between the two plans HMO Health Maintenance Organization and PPO Preferred Provider Organization Are the cost size of the plan network ability to see specialists and coverage for out-of-network services.

Other than on preventative visits you will need to pay copayment fees when you make doctors visits with an HMO. Premiums and out-of-pockets costs for HMO plans are usually lower than a PPO. Out-of-network care is allowed in emergency cases only.

An HMO plan is a good choice if you. Unlike HMO you can visit any in-network physical or. Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan.

5 rows Compare Plans Select plan to compare Select 2 or more plans to compare Compare plans. 5 rows Read a more detailed definition of PPO in our PPO Plans article. Which type of health insurance plan is more likely to practice more extensive and intense.

Think higher cost with greater flexibility. The biggest differences between an HMO and a PPO plan are. Other types of health plans.

2 But they tend to have lower monthly premiums than plans that offer similar benefits but come with fewer network restrictions. While HMO and PPO plans are the 2 most common plans especially when it comes to.

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Difference Between Hmo And Ppo Difference Between

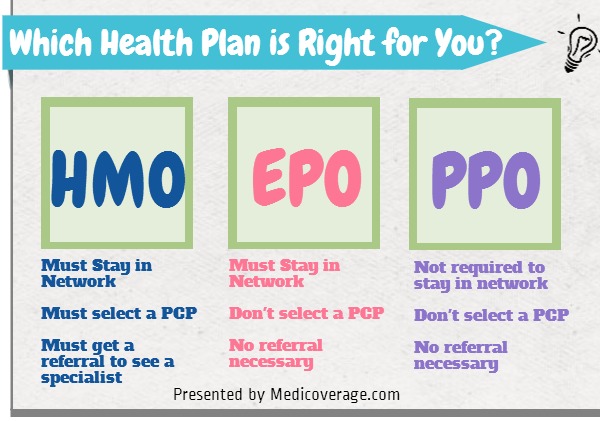

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

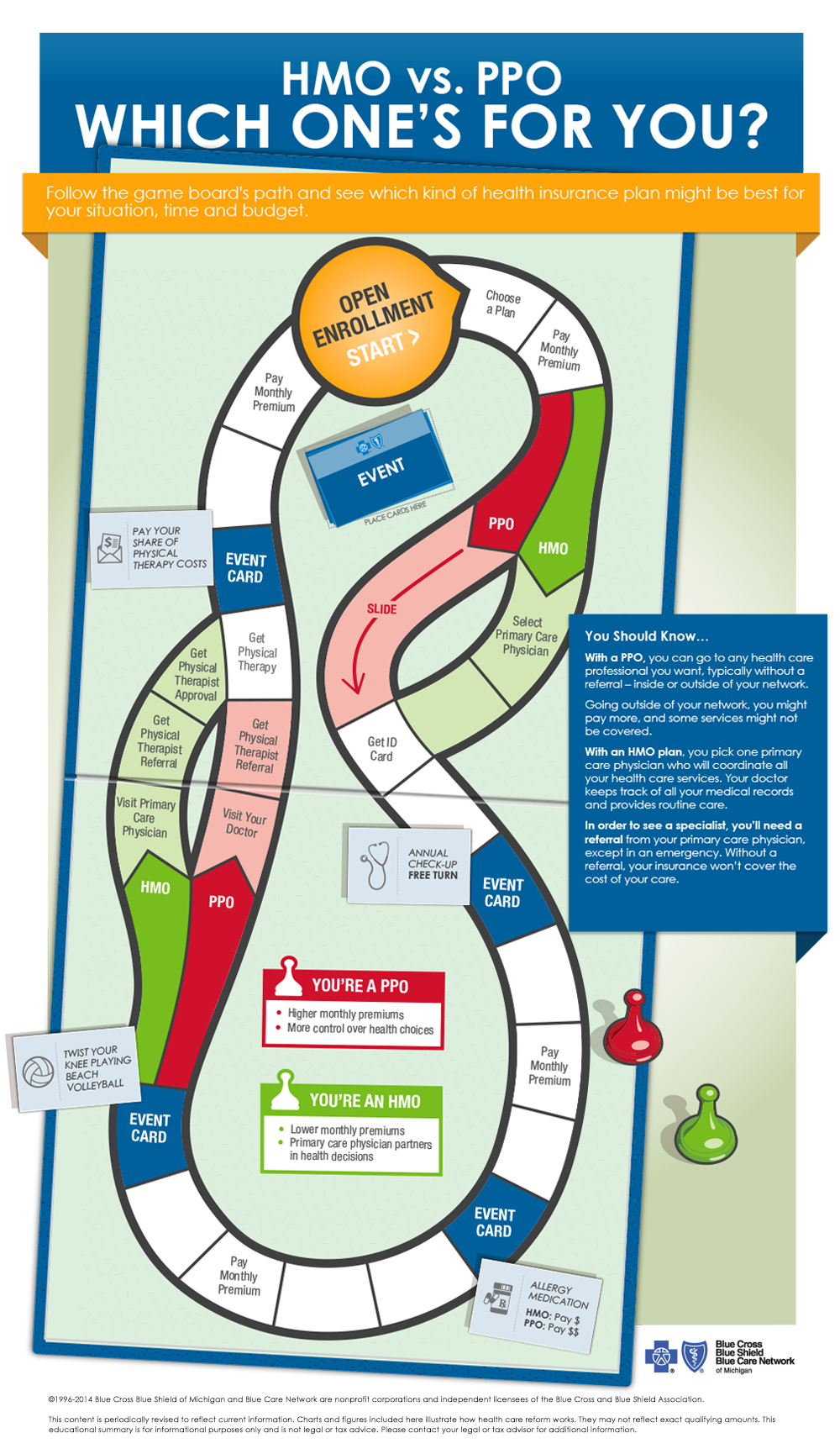

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Benefits Cost Comparison

What Is An Hmo About Hmo Health Insurance Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.