If your total out-of-pocket costs reach 6850 youd pay only that amount including your deductible and coinsurance. Out-of-Network Some plans have two sets of deductibles copays coinsurance and out-of-pocket maximums.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

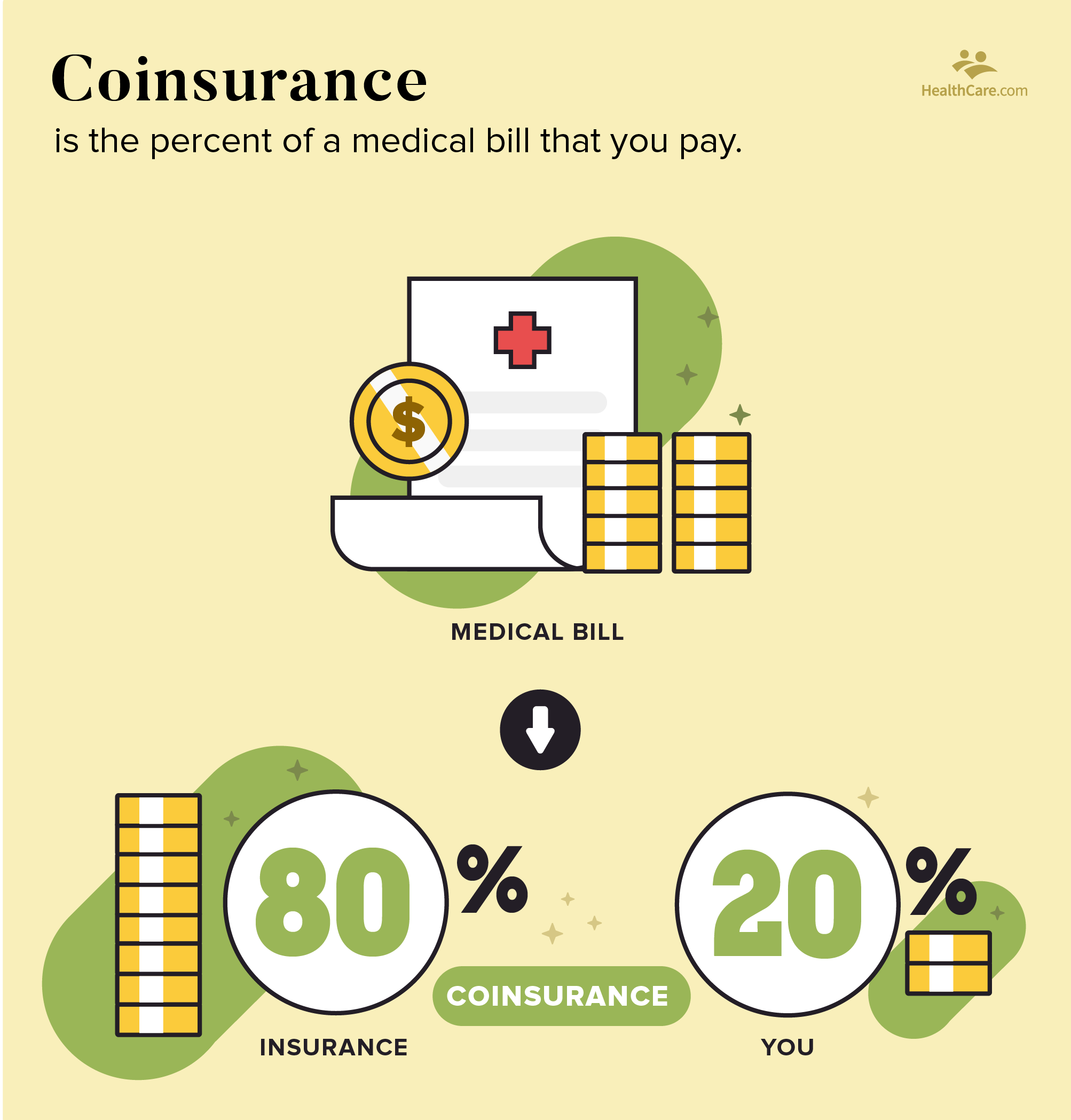

Coinsurance is a percentage of a medical charge that you pay with the rest paid by your health insurance plan that typically applies after.

In network coinsurance. Your health insurance plan will pay the other 80 percent. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. 2 Heres how it works.

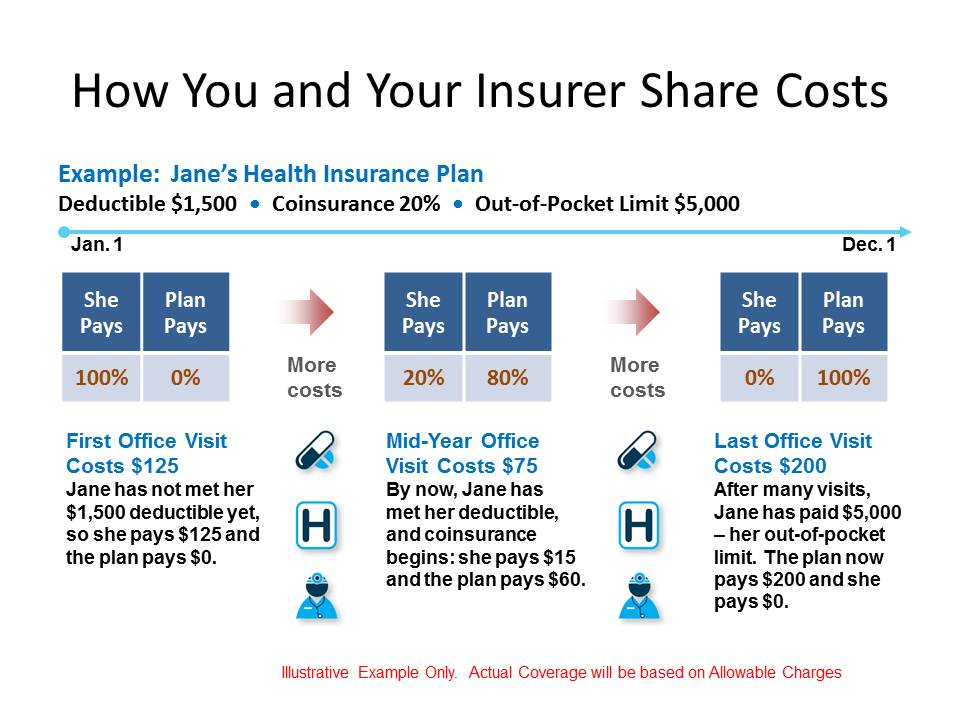

Youd pay all of the first 3000 your deductible. Youll pay 20 of the remaining 9000 or 1800 your coinsurance. The percentage for example 40 you pay of the allowed amount for covered health care services to providers who dont contract with your health insurance or plan.

Getting care at an in-network facility or through an in-network provider is vital to keeping down health care costs. If one of these ifs isnt true expect to pay more possibly 100 percent of the cost. The cost-sharing stops when medical expenses reach your out-of-pocket maximum.

You typically pay coinsurance after meeting your annual deductible. The 30 percent you pay is your coinsurance. Youve paid 1500 in health care expenses and met your deductible.

For example if your coinsurance is 20 it means you pay 20 for covered health care services and your insurer pays the remaining 80. Coinsurance is another type of cost-sharing where you pay for part of the cost of your care and your health insurance pays for part of the cost of your care. When you go to the doctor instead of paying all costs you and your plan share the cost.

This means that after John has met his deductible his plan pays 80 of. The percent you pay of the allowed amount for covered health care services to providers who contract with your health insurance or plan. Coinsurance is health care costs sharing between you and your insurance company.

For example your plan pays 70 percent. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. In-network coinsurance usually costs you less than out-of-network coinsurance.

Back to Glossary Index. Johns health plan has 8020 coinsurance. Typically 20 - 30.

Your insurance plan should pay its coinsurance share if youve met your deductible if youre receiving care from an in-network provider and if your policy covers the care youre getting. Health plans have contracts with in-network providers. But with coinsurance you pay a percentage of the bill rather than a set amount.

In-network coinsurance usually costs less than out-of-network coinsurance. The percent you pay of the allowed amount for covered health care services to providers who contract with your health insurance or plan. This amount is a discounted cost that doctors in your plan network agree to charge.

Its usually figured as a percentage of the amount we allow to be charged for services. Gold plans in the ACA marketplace have 20 coinsurance. Out-of-network coinsurance usually costs you more than in-network coinsurance.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. So your total out-of-pocket costs would be 4800 your 3000 deductible plus your 1800 coinsurance. This co-insurance amount is always lesser tha.

Importance of staying in-network. The percent for example 20 you pay of the allowed amount for covered health care services to providers who contract with your health insurance or plan. Insured individuals usually pay less when using an in-network provider because those networks provide services at lower cost to the insurance companies with which they have contracts.

Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer. The coinsurance typically ranges between 20 to 60. Lets use 20 coinsurance as an example.

How do I calculate my coinsurance costs. Coinsurance is your share of the costs of a health care service. You start paying coinsurance after youve paid your plans deductible.

How much you need to pay depends on the allowed amount that a doctor can bill for a health care service. Back to Glossary Index. Coinsuranceis what youthe patientpay as your share toward a claim.

One for in-network providers and one for out-of-network providers. In-network coinsurance usually costs you less than out-of-network coinsurance. Those contracts dictate how much a health insurance company pays a provider or facility.

The percentage of the allowed amount an individualpatient pays as their cost share for an in-network provider. In network refers to providers or health care facilities that are part of a health plans network of providers with which it has negotiated a discount. Heres an example of how coinsurance costs work.

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance 9 Mysteries Of Health Insurance Solved Black Women S Health Imperative

What Is Coinsurance 9 Mysteries Of Health Insurance Solved Black Women S Health Imperative

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

What Is Health Insurance Coinsurance Healthcare Com

What Is Health Insurance Coinsurance Healthcare Com

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

100 Coinsurance A Phrase To Trip People Up Hsa Medical Plan Health Insurance Private Insurance Medicare Medicaid Military Cobra City Data Forum

100 Coinsurance A Phrase To Trip People Up Hsa Medical Plan Health Insurance Private Insurance Medicare Medicaid Military Cobra City Data Forum

/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Understanding Your Plan Benefits Ppo Plan Kaiser Permanente Northwest

Understanding Your Plan Benefits Ppo Plan Kaiser Permanente Northwest

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

Is There A Difference Between Coinsurance And Coinsurance After Deductible Personal Finance Money Stack Exchange

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Everything You Need To Know Harris Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.