Some insurance companies allow a lower employer contribution amount using a defined contribution arrangement. Get an exemption from the requirement to have coverage.

Group Health Insurance In California For Small Business

Group Health Insurance In California For Small Business

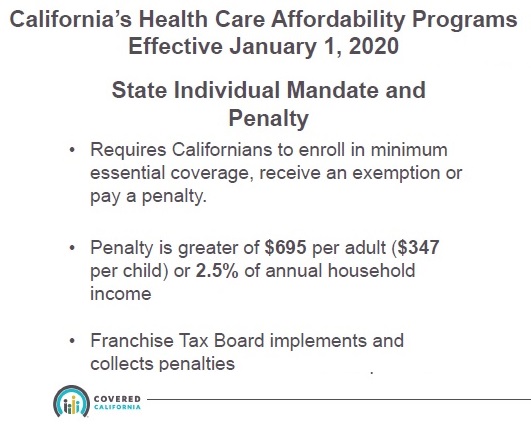

The California health insurance mandate is in effect requiring Californians to have health insurance.

Does california require health insurance. Have qualifying health insurance coverage. 1 requires Californians to have health insurance in 2020 or face a penalty on their state taxes. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance.

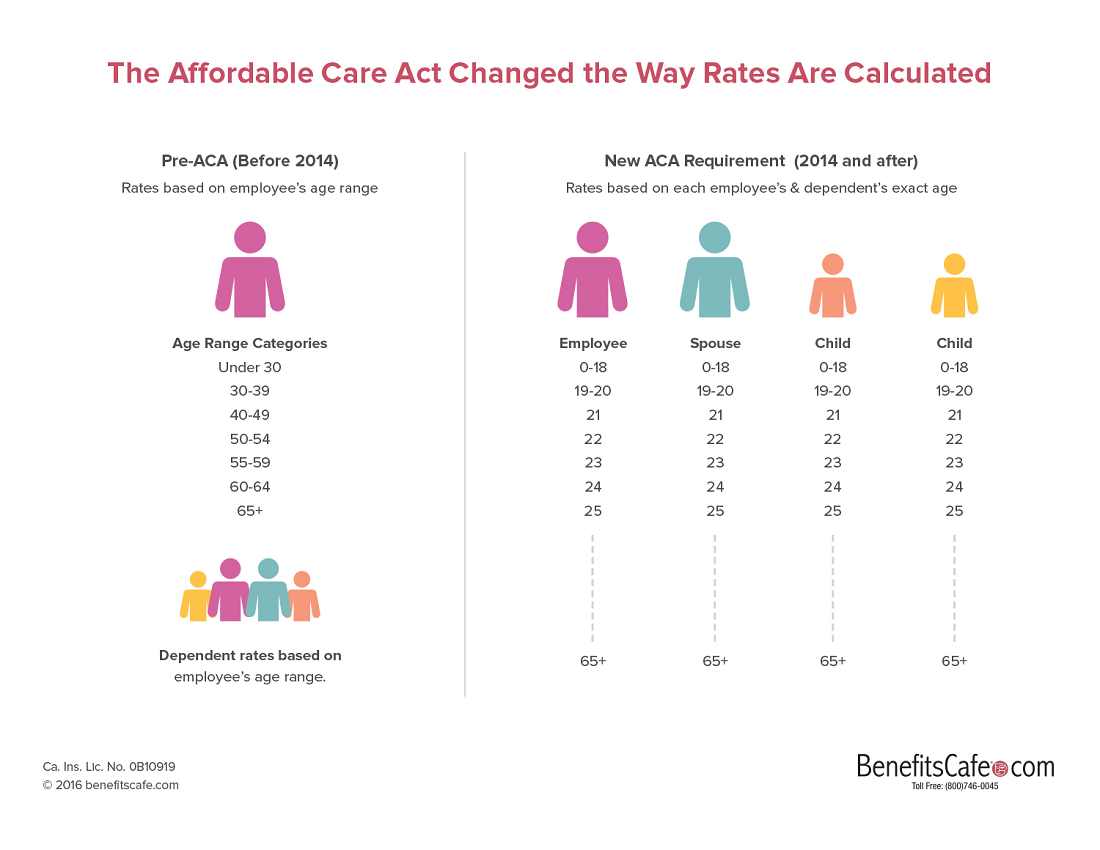

The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Under the current ACA law theres dividing line based on the size of your company.

December 02 2019 News Release The Franchise Tax Board FTB urges Californians to get health care coverage now and keep it through 2020 to avoid a penalty when filing state income tax returns in 2021. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150. This means that we add up the of full time employees 30 hours per week PLUS The equivalent of part-time employees.

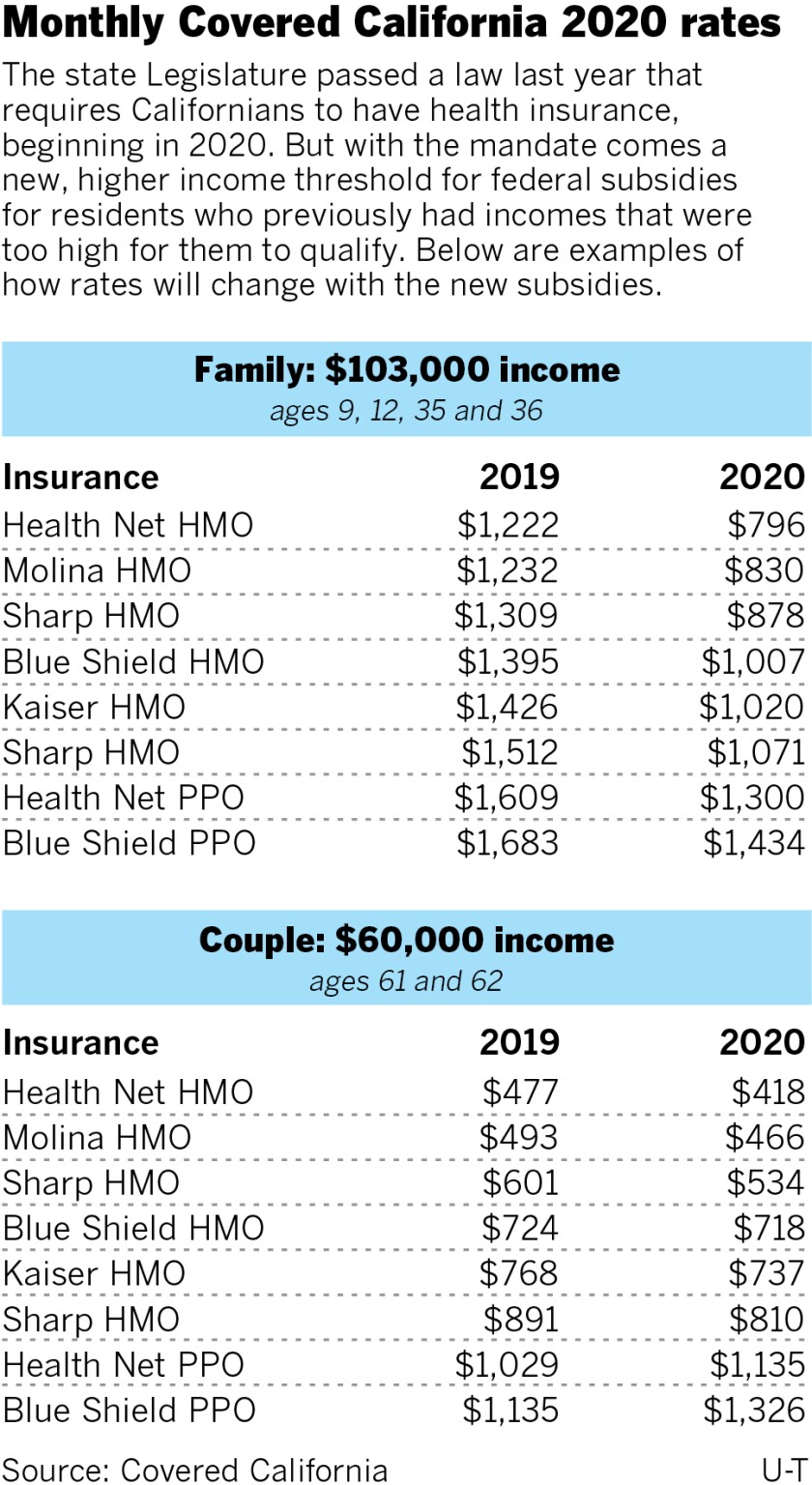

Heres what you need to know to understand the individual mandate and how this law can. The law speaks of full time equivalents. Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can.

But as with the now-defunct federal tax penalty for being uninsured some people will be exempt. Californians must have health insurance starting next year or face a hefty tax penalty. Starting in 2020 California residents must either.

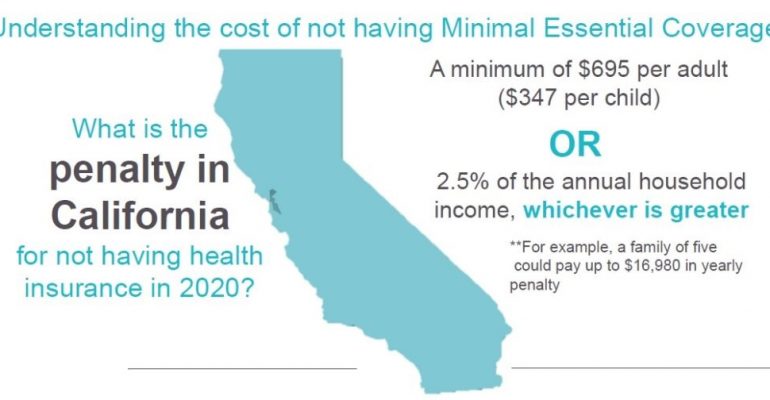

In a significant new change California will require people to buy health insurance next year or pay a tax penalty. State-level mandates for health coverage already exist in Massachusetts New. Imposes a tax penalty on Californians who go without health insurance but can afford it Provides state subsidies to help lower income residents afford health insurance The annual penalty for Californians who go without health insurance is 25 of household income or 696 per adult and 37550 per child whichever is greater.

Health insurance is complex confusing and often overwhelming even for the most savvy consumer. What you need to know. California residents with qualifying health insurance and new penalty estimator.

In fact 2020 marks the first year that Californians are required by state law to have health insurance. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. Beginning January 1 2020 California residents must either.

This requirement applies to each resident their spouse or. This follows the repeal of the individual mandate at the. There is a new state subsidy program that is expected to help 235000 Californians who previously did not qualify for federal assistance.

Pay a penalty when they file their state tax return. Obtain an exemption from the requirement to have coverage. Have qualifying health insurance coverage or.

First a note on how to calculate your size. If an employer provides health insurance Californias insurance laws require policies to cover certain benefits mandated benefits and give. The state needs to come up with 98000000 to pay for free health insurance for illeg.

Certain kinds of health insurance do not meet the requirements of Minimum Essential Coverage as set forth by the ACA. California employer requirements for health insurance. Pay a penalty when filing a state tax return or.

Starting January 1 2020 California will tax legal citizens if they dont have health insurance. Health Insurance Information We regulate health insurance policies in California to ensure vibrant markets where the health and economic security of individuals families and businesses are protected and insurers keep their promises. Effective January 1 2020 a new state law requires California residents to maintain qualifying health insurance throughout the year.

A new state law going into effect Jan. This law is referred to as the individual mandate because it means that all individuals in California are mandated to be covered by health insurance. There is currently no state law requiring employers to offer group healthcare insurance to their employees but most employers do provide this benefit.

Why Do I Have an Insurance Penalty in 2021. Having health insurance isnt just a good idea if you live in California its the law.

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

Insurance Mandate Returns In 2020 With Additional Sweetener The San Diego Union Tribune

Insurance Mandate Returns In 2020 With Additional Sweetener The San Diego Union Tribune

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

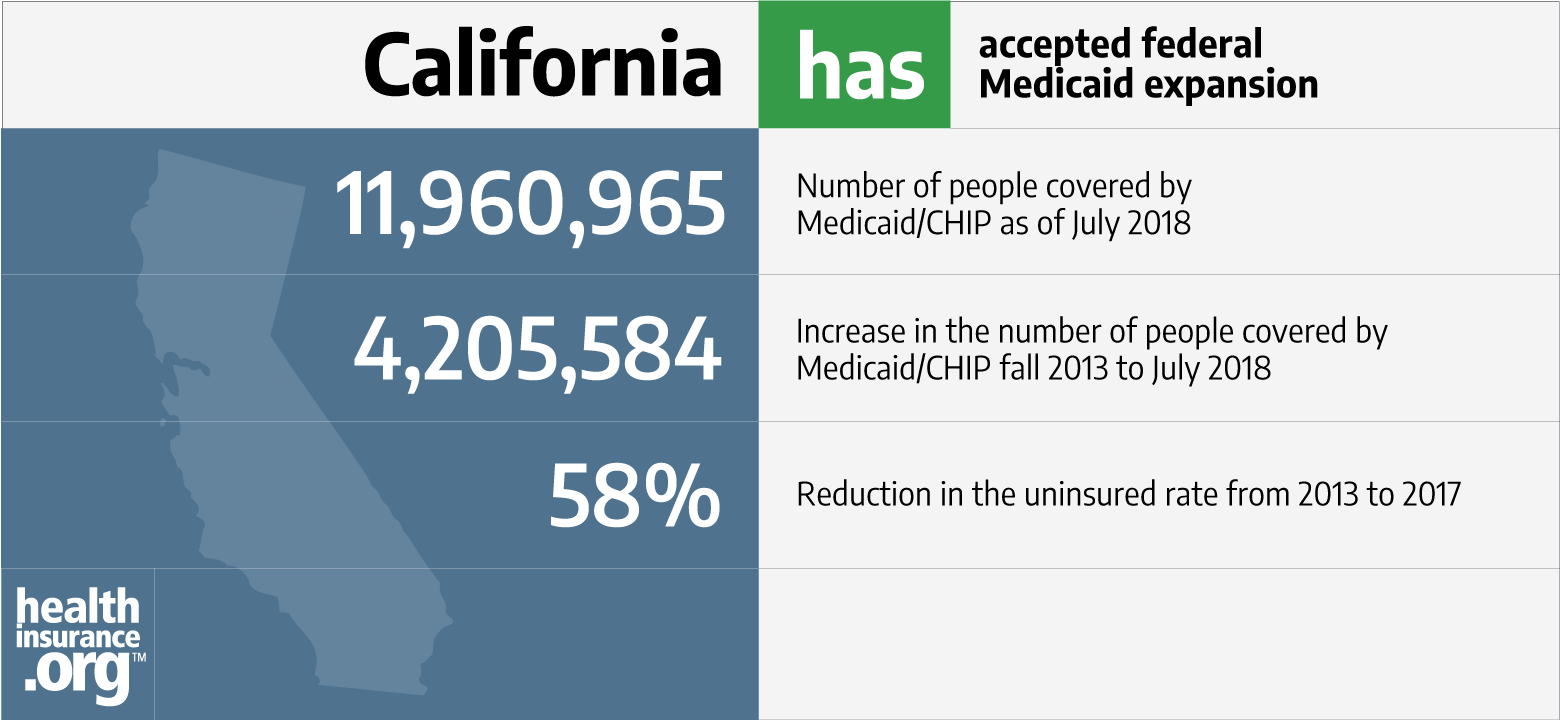

California And The Aca S Medicaid Expansion Healthinsurance Org

California And The Aca S Medicaid Expansion Healthinsurance Org

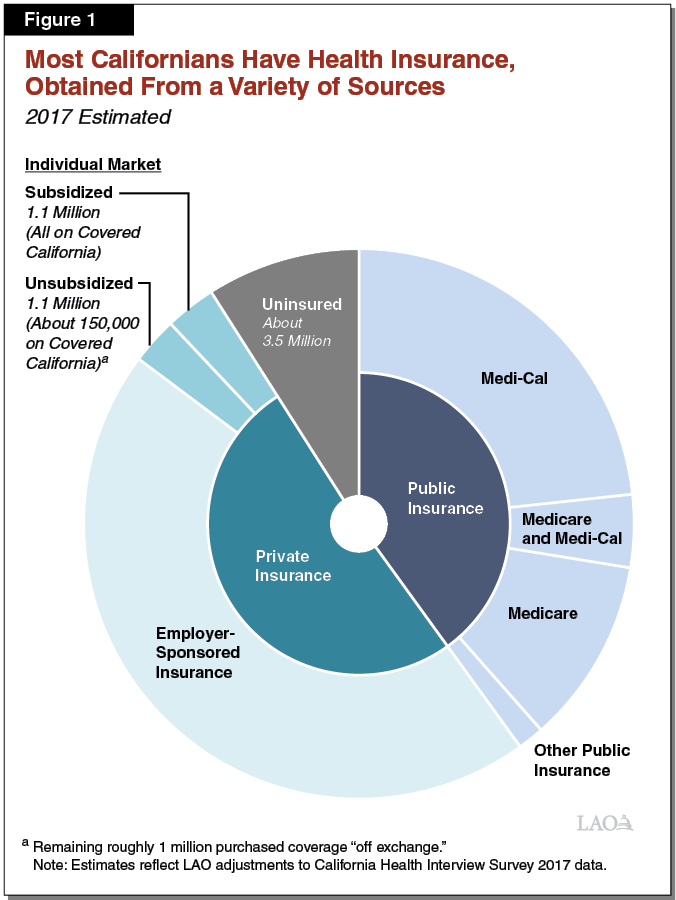

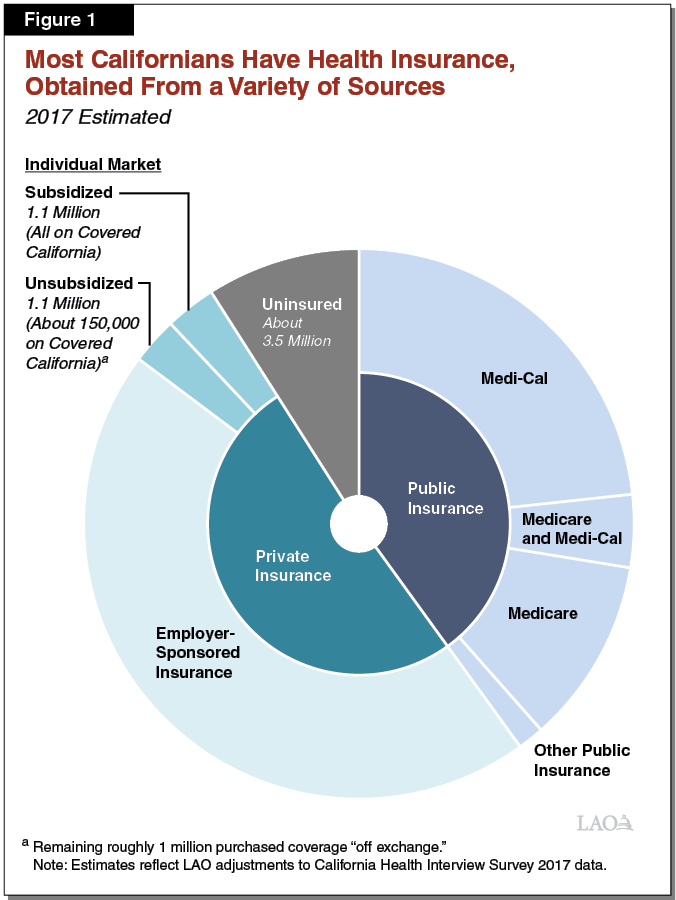

The 2019 20 Budget The Governor S Individual Health Insurance Market Affordability Proposals

The 2019 20 Budget The Governor S Individual Health Insurance Market Affordability Proposals

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

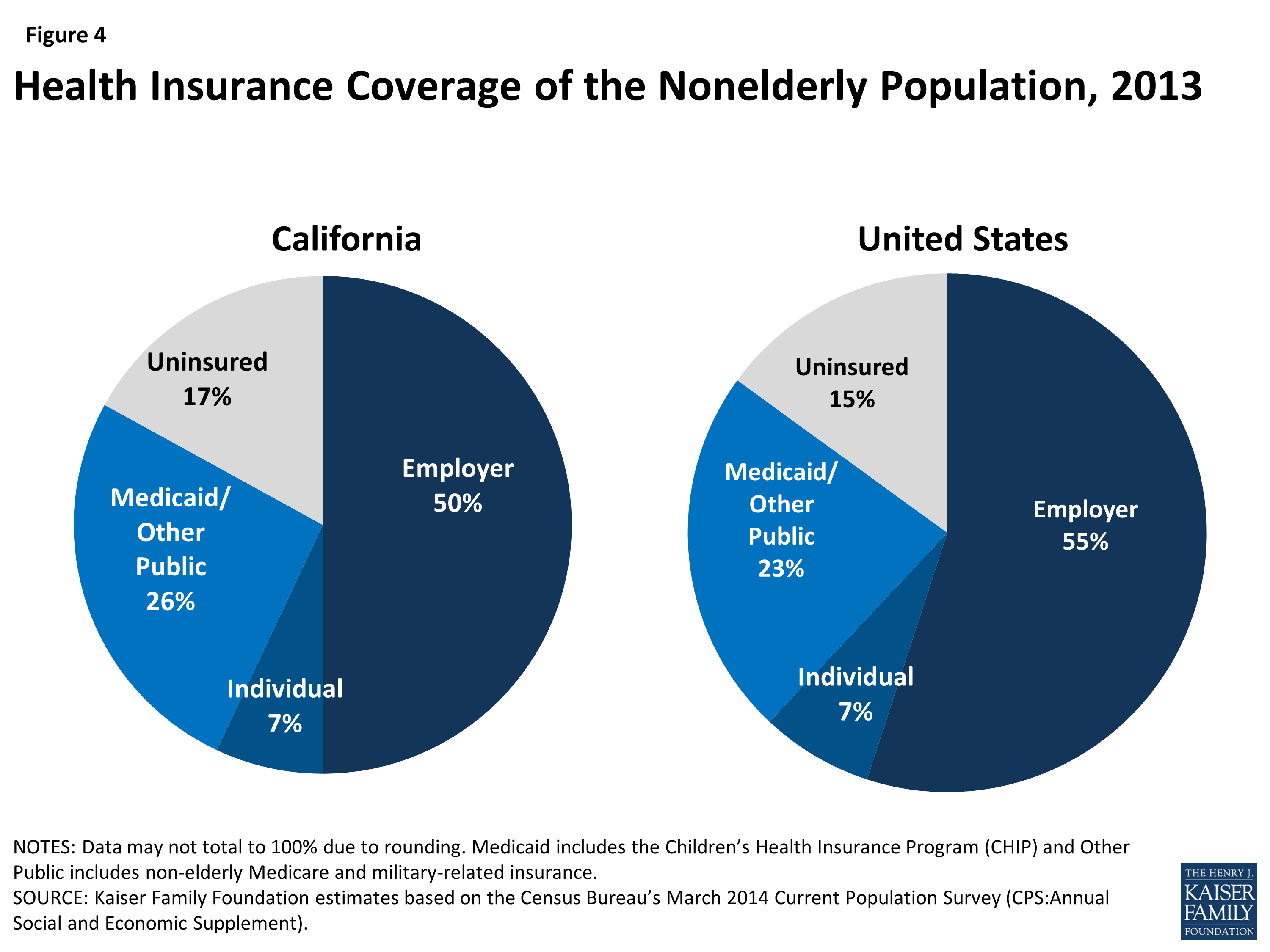

The California Health Care Landscape Kff

The California Health Care Landscape Kff

Insurance Options For 26 Year Olds In California

Insurance Options For 26 Year Olds In California

Health Insurance Companies In California Covered California

Health Insurance Companies In California Covered California

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.