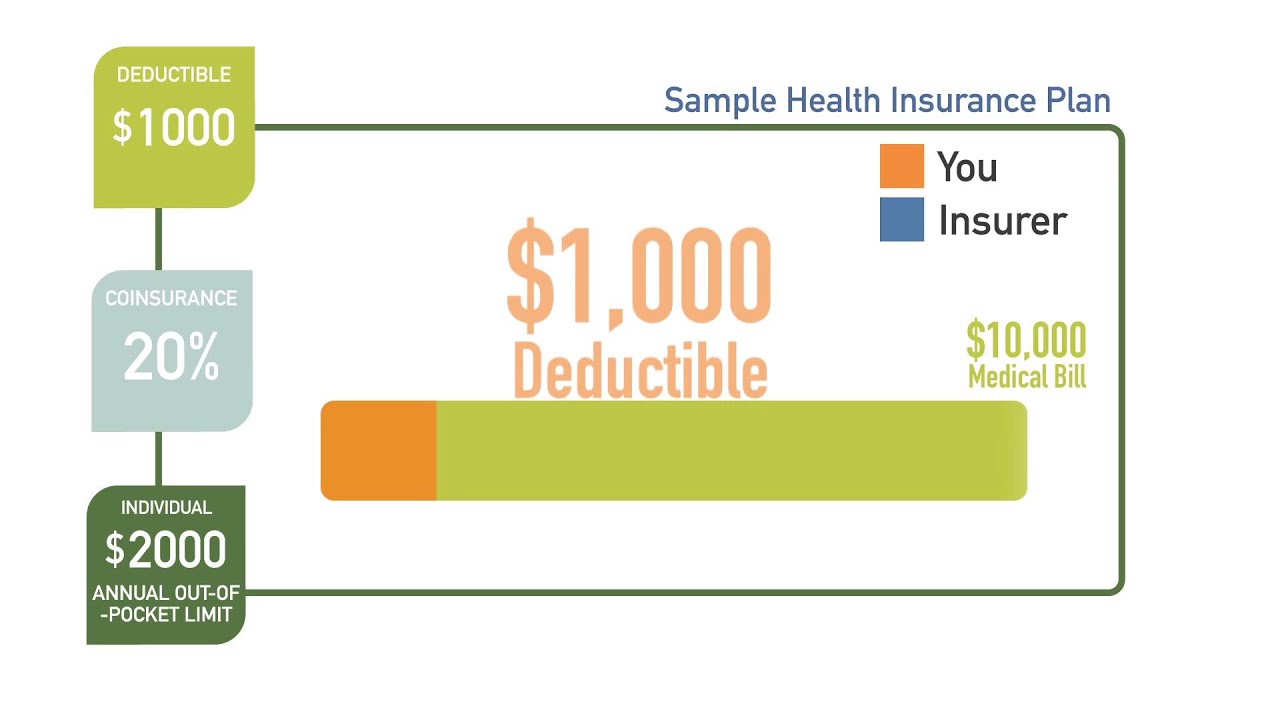

Example Of Deductible For Health Insurance There is deductible example uses deductibles work as preventive care facility to keep it gets d. For example with a 1000 deductible youll independently pay the first 1000 of your care.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Examples of deductible in health insurance The most effortless approach to delineate how deductibles work would be through some basic examples.

Example of deductible for health insurance. If your deductible is 2500 and your medical visit costs 5000 for example you would be responsible for the 2500 portion. Health plans usually include a deductible that you must pay before your insurance plan will start to cover your eligible healthcare expenses. Advertentie Unlimited access to Health Insurance market reports on 180 countries.

Health Insurance Deductible Unlike in car or home insurance where the deductible is paid per claim the deductible in health insurance can be spread out over the year. For example if you have a 1000 deductible you. Health Insurance Deductible Definition.

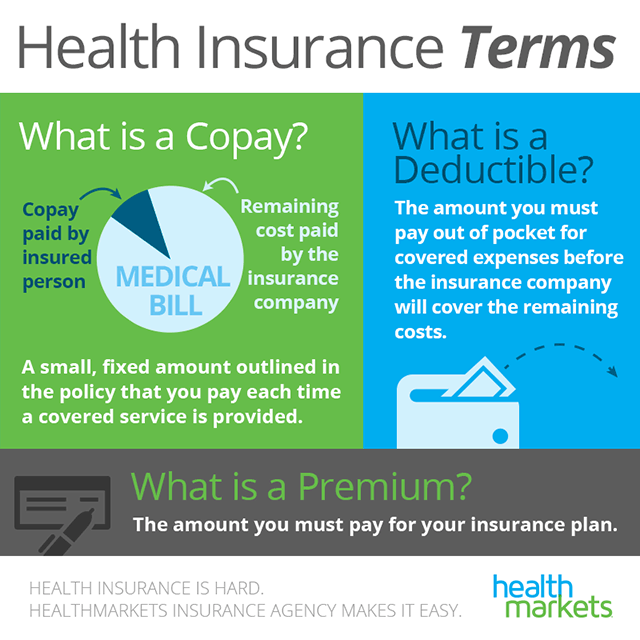

A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs. Check out our affordable health plans and calculate your premium. If individual A has a deductible of 500 and requires treatment equaling 4000 their insurance plan would cover 3500 after individual A met their 500 deductible.

But soon after that they need another treatment costing 5000. Family plans may have two deductibles. Get the Best Quote and Save 30 Today.

For instance your comprehensive deductible will be applicable if your car incurs damages due to fallen tree branches after a typhoon. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Individual B has a deductible of 2000 and requires treatment equaling 1000.

Download Reports from 10000 trusted sources with ReportLinker. Advertentie Compare Top Expat Health Insurance In Netherlands. Just like with many other kinds of deductibles your health insurance deductible is the amount you pay before your insurance policy coverage kicks in.

Advertentie Compare Top Expat Health Insurance In Netherlands. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Many health insurance plans also cover other benefits like doctor visits and prescription drugs even if you havent met your deductible.

Check out our affordable health plans and calculate your premium. A health insurance deductible is defined by HealthCaregov as the minimum balance you pay before your insurance company starts to cover medical costs. In 2014 theres a 6350 maximum for individual out-of-pocket costs for in-network services.

Total bill after your insurers network discount 200. How a Deductible Worksan Example Lets say your health insurance requires a 1000 annual deductible and all non-preventive services are counted towards the deductible as opposed to being partially paid by the insurance company under a copay system. Advertentie Get more out of your healthcare insurance.

Advertentie Get more out of your healthcare insurance. If individual A has a deductible of 500 and required treatment equalling 4000 at that point their insurance would cover 3500 after individual A met their deductible. Screenings immunizations and other preventive services are covered without requiring you to pay your deductible.

Get the Best Quote and Save 30 Today. If your health insurance plan has a deductible. If your health plan covers you along with other dependents you may have an individual deductible which applies to each person and a family deductible which applies to the whole family.

The non-comprehensive deductible can be defined as a deductible that only applies to specified coverages or medical expenses in a health insurance policy For example some coverages may have a deductible others may not and some medical expenses may require the deductible paid before starting to pay benefits. 10000 will be paid from your pocket because it is your policy plans deductible amount. 1 In January you get bronchitis.

Once youve reached your out-of-pocket maximum your plan covers 100 of costs for the rest of the year.