For example both parents could be eligible for tax credits through Covered California while the children are eligible for Medi-Cal. Back to Medi-Cal Eligibility.

Covered California Income Tables Imk

The majority of your eligible employees live in California.

Covered california qualifications. COVERED Household Size For each additional person. Resident a legal alien or a US. You have at least one employee who receives a W-2.

Any documents and information provided by individuals applying for coverage through Covered California. Children qualify regardless of their immigration status. Learn more about who qualifies for a subsidy.

It is common that members of the same family or tax household are eligible for different programs. A parent or caretaker relative of. Any Californian who qualifies can purchase private health insurance through Covered California regardless of income.

We use your income to help us find the health insurance that is most affordable for your family. Covered California only requires that the person seeking health coverage show proof of immigration status. On refugee status for a limited time depending how long you have been in the United States.

Once each Statement of Qualifications. Covered California CEA positions are posted on the CalCareers website for a minimum of ten 10 days but are typically posted for thirty 30 days. The Covered California application is a single application for multiple health coverage programs.

Its the only place where you can get financial help when you. The law requires that lawfully present residents who enroll in Covered California show proof of lawful presence. You are eligible for Covered California for Small Business if.

Citizen a state resident of California a permanent US. You are eligible to receive benefits if you are. To receive Medi-Cal benefits in California you must be a US.

Keep in mind that Tax deductions can. You can also get Medi-Cal if you are. Over the age of 65.

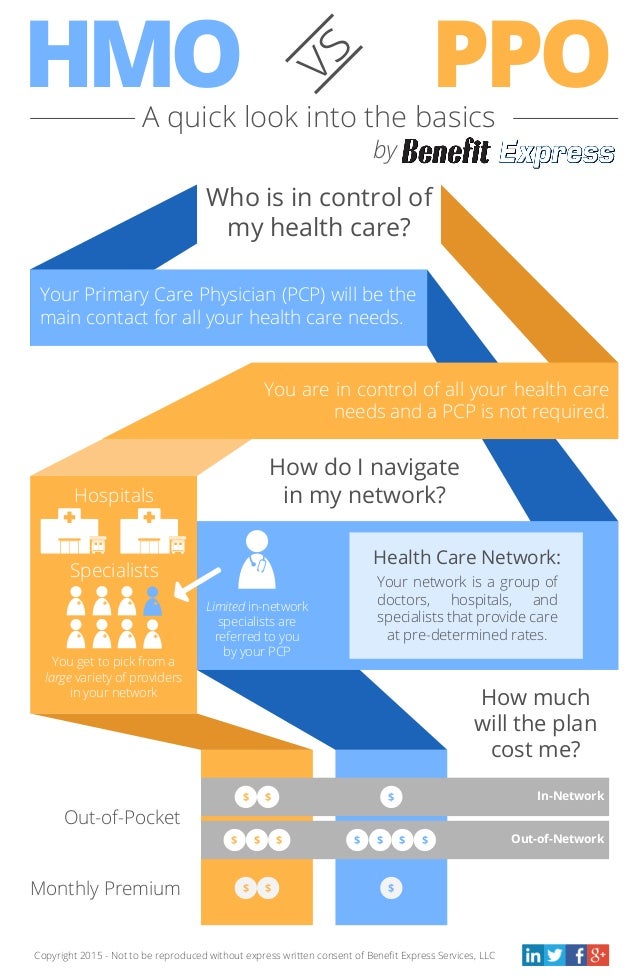

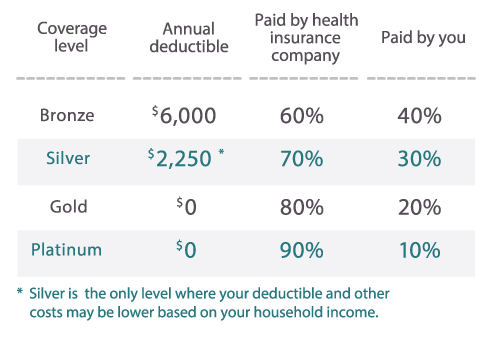

Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL. All plans cover treatment and vaccines for COVID-19. If you make 601 of the FPL you will be ineligible for any subsidies.

Family members who are not applying for medical coverage will not be asked for their proof of lawful presence. Medi-Cal Eligibility and Covered California - Frequently Asked Questions. In a skilled nursing or intermediate care home.

The following Covered California income restrictions apply to adults. I dont make a lot of money. This is because the eligibility.

The majority of our customers get financial help. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance.

Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. Eligible candidates must submit a Statement of Qualifications SOQ along with their application. Documents Needed to Enroll in Covered California.

The unshaded columns are associated with Covered California eligibility ranges. Children are covered in a family of four with a household income of 68495 or less. Both Covered California and Medi-Cal have plans from well-known companies.

Can anyone get Covered California. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. In order to be eligible for assistance through Covered California you must meet an income requirement.

The purpose of this Agreement is to provide Covered California with qualified individuals to perform project management analysis business process re-engineering process and procedure development training documentation defined tasks and activities related to the business process transformation and organizational readiness of Covered California for the migration to the. Specific instructions for the ExaminationStatement of Qualification document are located on the job posting. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

Medi-Cal has free or low-cost coverage if you qualify. Its the only place to get financial help to pay for your health insurance. You have at least one but no more than 100 eligible employees and meet certain contribution and participation requirements.

Add 100 S15930 S20090 S24250 S32570 96730 S4160 MAGI Medi- Cal 13800 S16394 S22107 S27820 93534 99247 S56428 Program Eligibility by Federal Poverty Level FPL for 2016 Coverage Year Eligible for Premium Tax Credit PTC 2100 to. Qualification for a subsidy on a Covered California plan. Qualification for Medi-Cal 138 to 400 Percent of FPL.

The breakdown of the subsidies between 138 and 400 percent of. 0 to 138 Percent of FPL.