How does Step Therapy work. This is general information about how plan benefits work.

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

How you pay for care at the doctor pharmacy or hospital will depend on the cost sharing details you choose.

How does blue cross insurance work. You may have a copay before youve finished paying toward your deductible. Your plan determines what your copay is for different types of services and when you have one. You and your health insurance company become partners who work together to pay for your health care.

How does Medicare work. Before coverage is allowed for certain costly second-step medications we require that you first try an effective but less expensive first-step medication. Here are 25 things to know about BCBS.

With other health plans such as a Health Maintenance Organization HMO or a Preferred Provider Organization PPO costs are shared at the onset of coverage. How does it work. With COB you submit a claim to your benefits carrier first for adjudication and payment and once the claim is adjudicated you can submit a claim for the eligible outstanding amount to your spouses plan or your second plan.

Understanding Health Insurance How Drug Benefits Work. Insurance companies coordinate benefits to. Some years you may require lots of medical services other years you may need less but the whole point of having it is so you can avoid paying the full cost of medical services on your own.

Blue Cross has made strides in the health and life insurance industries and covers nearly one-third of Americans. For more than 70 years the Blue Cross name in Canada has stood for affordable quality supplementary individual health and travel insurance coverage as well as group benefits and group life insurance delivered with trustworthy and personalized service. Step Therapy is a key part of our Prior Authorization program that allows us to help your doctor provide you with an appropriate and affordable medication treatment.

Medicare Supplement Insurance Plans are identified by. After you pay the deductible you pay 20 percent of your health care costs until you reach your maximum out-of-pocket amount 6000. Getting prescription drugs is simple.

Not all providers are in every network. The members Plan then processes the claim and approves payment The Local Blue Cross and Blue Shield will pay you. Blue Cross Blue Shield of Michigan and Blue Care Network members under age 65.

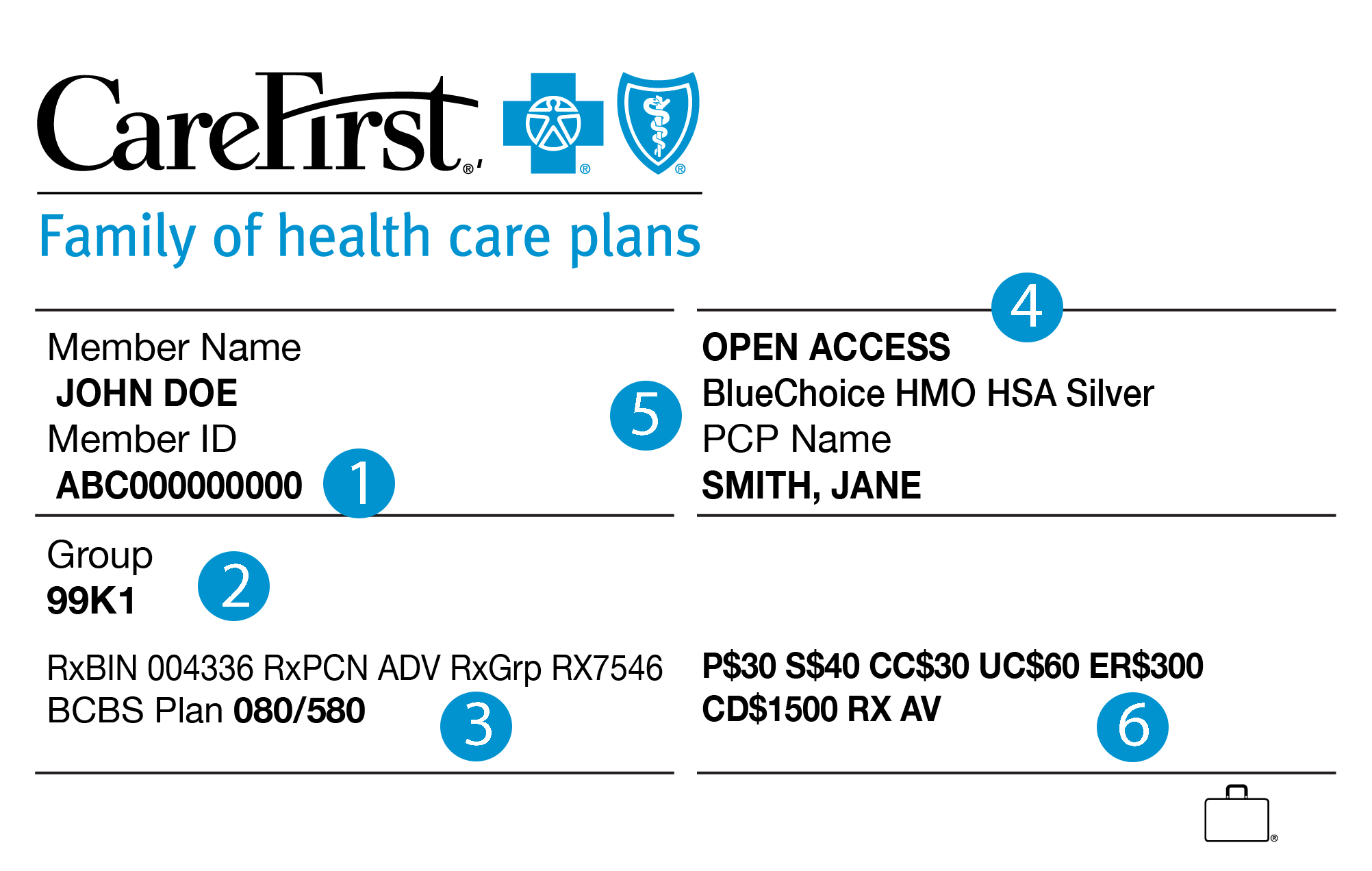

Copayments Deductibles and Coinsurance are the basic elements of cost sharing. Review the Summary of Benefits and Coverage and your specific health plan benefits book for information about how your plan works. Try our Find a Drug or Pharmacy search tool then visit a participating pharmacy with your prescription and your Blue Cross NC member ID card.

You may also have a copay after you pay your deductible and when you owe coinsurance. Your Blue Cross ID card may list copays for some visits. In every ZIP code Blue Cross Blue Shield offers a personalized approach to healthcare based on the needs of the communities where their members live and work.

You can also log in to your account or register for one on our website or. How it works In this example you pay the first 5000 your deductible before your plan begins to pay. Once The Local Blue Cross and Blue Shield receives a claim it will electronically route the claim to the members Blue Cross and Blue Shield Plan.

Sometimes two insurance plans work together to pay claims for the same person. There are several Medicare Supplement Insurance Plans each with different benefits and premiums so you can choose the plan that works best for your specific needs. Blue Cross was founded in 1929 as a way to provide prepaid hospital care.

Blue Cross Blue Shield auto insurance doesnt currently exist. Medicare Supplement Insurance1 Optional coverage helps to pay for expenses beyond what is covered by Medicare. Its up to you to always check if your provider is in your health plan network before you receive services.

Heres how a standard plan works for pharmacy and prescription drug coverage. This is known as cost sharing. They work closely with hospitals and doctors in the communities they serve to provide quality affordable healthcare.

With a consumer-driven or consumer-directed health plan CDHP you are required to pay your medical costs before your health plan does. Your plan outlines your out-of-pocket costs for each service whether its a copay deductible or coinsurance. A decade later Blue Shield was founded to.

Policyholders however can stay on the lookout for possible automotive insurance companies partnering with Blue Cross Blue Shield to offer discounts. That process is called coordination of benefits. You may pay more or for all of your health care costs if your provider is out of.