The number of people in your household. Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

I have to pay the penalty for having no insurance for 9 months of the year.

Tax penalty for no health insurance california. Be the first to share what you. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. Starting in 2020 California residents must either.

Get an exemption from the requirement to have coverage. In 2015 the penalty is the greater of 325 per adult and 16250 per child or 2 of your taxable household income minus the federal tax-filing threshold which is the minimum income required by the IRS for someone to file an income tax return. Californians be warned.

You were not eligible for an exemption from coverage for any month of the year. Beginning January 1 2020 all California residents must either. My CA refund says I owed almost 400.

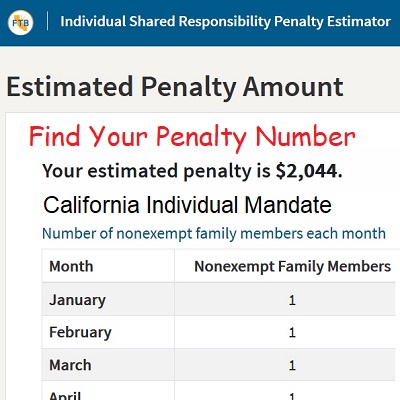

Some states have their own individual health insurance mandate. A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. If you had no health coverage Unlike in past tax years if you didnt have coverage during 2020 the fee no longer applies.

You can get qualifying health insurance coverage through an employer-sponsored plan Covered California Medicare most Medicaid plans and coverage bought directly from an insurer. You will have to pay a penalty the Individual Shared Responsibility Penalty when you file your state tax return if. California Health Insurance Penalty.

What is the health insurance penalty. The penalty for no coverage is based on. The penalty for no health insurance increases each year.

Or do I owe 400 and the additional penalty. 695 per each adult in a household as well as 34750 per each child. Log in or sign up to leave a comment Log In Sign Up.

This means you dont need an exemption in order to avoid the penalty. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. Is this the penalty.

A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. Under the new California state law the failure to obtain minimal coverage before January 1 2020 will result in penalties of.

You did not have health coverage. A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty There is a new state subsidy program that is expected to help 235000 Californians who previously did not qualify for federal assistance.

The penalty is waived if you obtain an. Most of the states with individual mandates have modeled their penalties on the federal penalty that was used in 2018 which is 695 per uninsured adult half that amount per child up to 2085 per family or 25 of household income above the tax filing thresholdm although there are some state-to-state variations. To find out more about health insurance options and financial help visit Covered California.

Starting in 2020 California residents must have qualifying health insurance coverage or face a penalty when you file your state tax returns.