Including vision screening 0 no deductible 50 after deductible Well baby care ages 0 to 6 including vision screening 0 no deductible 0 no deductible. Michigan Health Insurance Plans BCBSM.

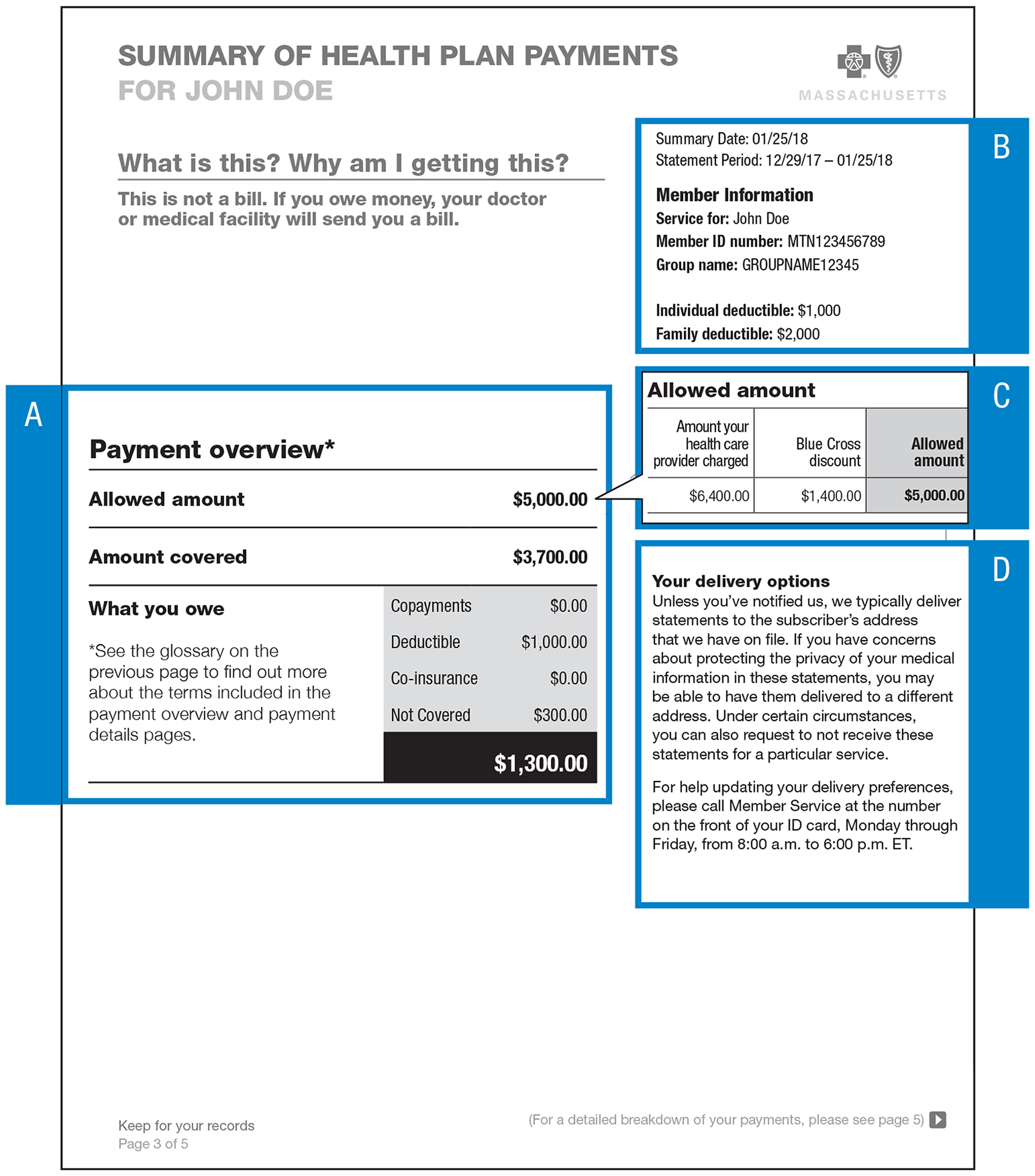

Summary Of Health Plan Payments Myblue

Summary Of Health Plan Payments Myblue

Obamacare Off-Exchange Plans.

Blue cross blue shield no deductible plan. Your health plan has a. Beginning on or after 07012021 Summary of Benefits and Coverage. Funds from your HSA account including the Blue Cross contributions can be used to pay for the charges.

PPO Group Number 007000285-0014 0015 2 of 8. You may have a copay before youve finished paying toward your deductible. When the amount of coinsurance youve paid reaches 6000 the plan covers 100 until your plan year renews.

Then you will pay your copay or coinsurance amount until you meet your yearly out-of-pocket maximum. Out-of-pocket maximum of 5000. Enroll in a plan between now and Aug.

What happens after I meet the deductible. And some types of medicines may be available at a lower cost as little as 0 even if the deductible has not been met first. However you pay lower out-of-pocket costs when you visit in-network doctors and hospitals.

You must pay the first 5000 of your medical costs. Under this plan the member is billed 100 of the charges until the deductible is met. Health insurance plan details for BlueSelect Bronze 2139 0 Deductible 50 PCP Visits 100 in Rewards offered by Blue Cross and Blue Shield of Florida.

Plaintiffs allege that Settling Defendants violated antitrust laws by entering into an agreement not to. Blue Care Elect Deductible PPO With a PPO plan you have both in-network and out-of-network coverage. Because of this High Deductible Plan F isnt available if youre new to Medicare on or after January 1 2020.

What this Plan Covers What You Pay for Covered Services Coverage for. Your plan determines what your copay is for different types of services and when you have one. After that your plan covers 80 of the costs and you pay the other 20.

Class Representatives Plaintiffs reached a Settlement on October 16 2020 with the Blue Cross Blue Shield Association BCBSA and Settling Individual Blue Plans. PPOs Preferred Provider Organizations this type of plan contracts with medical providers such as hospitals and doctors to create a network of participating providers Most often you pay less if you use doctors hospitals and other health care providers that belong to the plans network and pay more if you go outside the network. By presidential executive order you can.

All of BlueCross BlueShields products include a 0 medical deductible more than 20 no-cost preventive services and a 0 gym membership to more than 12000 fitness locations through SilverSneakers. 30 visits for speech therapy. This plan has a slightly higher deductible and out-of-pocket maximum but these increases are offset by a lower cost per paycheck and by using your HSA for your medical expenses.

A plan is good for 1 year. Habilitation services 0 after deductible 30 after deductible Combined 30 visits for physical occupational therapy and chiropractic services. Prior authorization may be required or services will not be covered.

After you pay the 4000 deductible your plan covers 75 of. You must pay 4000 toward your medical costs before your plan begins to cover costs. Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Medical Prescription Plan Coverage Period.

You may also have a copay after you pay your deductible and when you owe coinsurance. Skilled nursing care 0 after deductible 30 after deductible Coverage is limited to 60 days. Your Blue Cross ID card may list copays for some visits.

As of January 1 2020 Medicare supplements sold to people who are new to Medicare are no longer allowed to cover the Part B deductible. Starting on July 1 2021 this plan will have an in-network deductible of 250 per member and 500 per family. Out-of-pocket maximum of 6000.

IndividualFamily Plan Type. BCBSA and Settling Individual Blue Plans are called Settling Defendants. Out-of-pocket maximum of 5000.

Having a high deductible can reduce your monthly premiums. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. But some plans do not have a deductible.

No charge after deductible No charge after deductible Mileage limits apply Urgent care No charge after deductible 20 coinsurance after deductible None If you have a hospital stay Facility fee eg hospital room No charge after deductible 20 coinsurance after deductible Preauthorization is required. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.