Employers engaged in a trade or business who pay compensation Form 9465. This falls under the penalty of perjury.

Comment Remplir Le Formulaire D Impots W 9 2018 2020 Pdf Expert

Comment Remplir Le Formulaire D Impots W 9 2018 2020 Pdf Expert

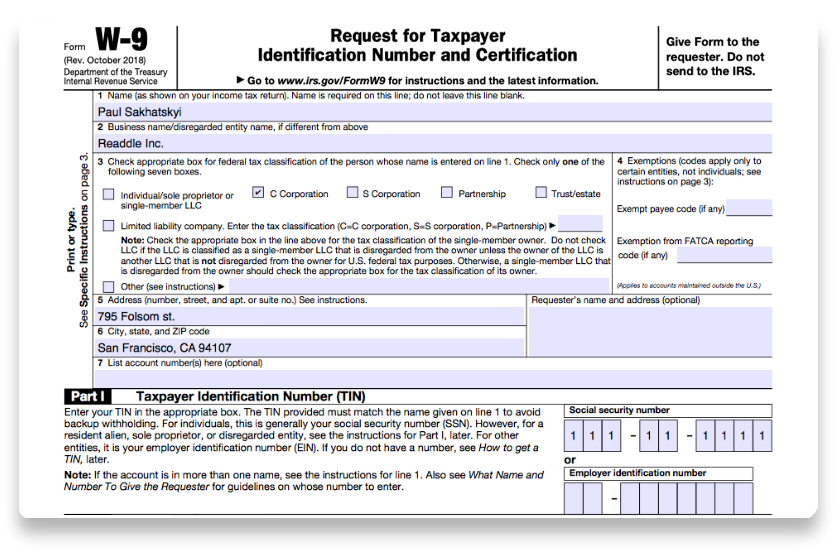

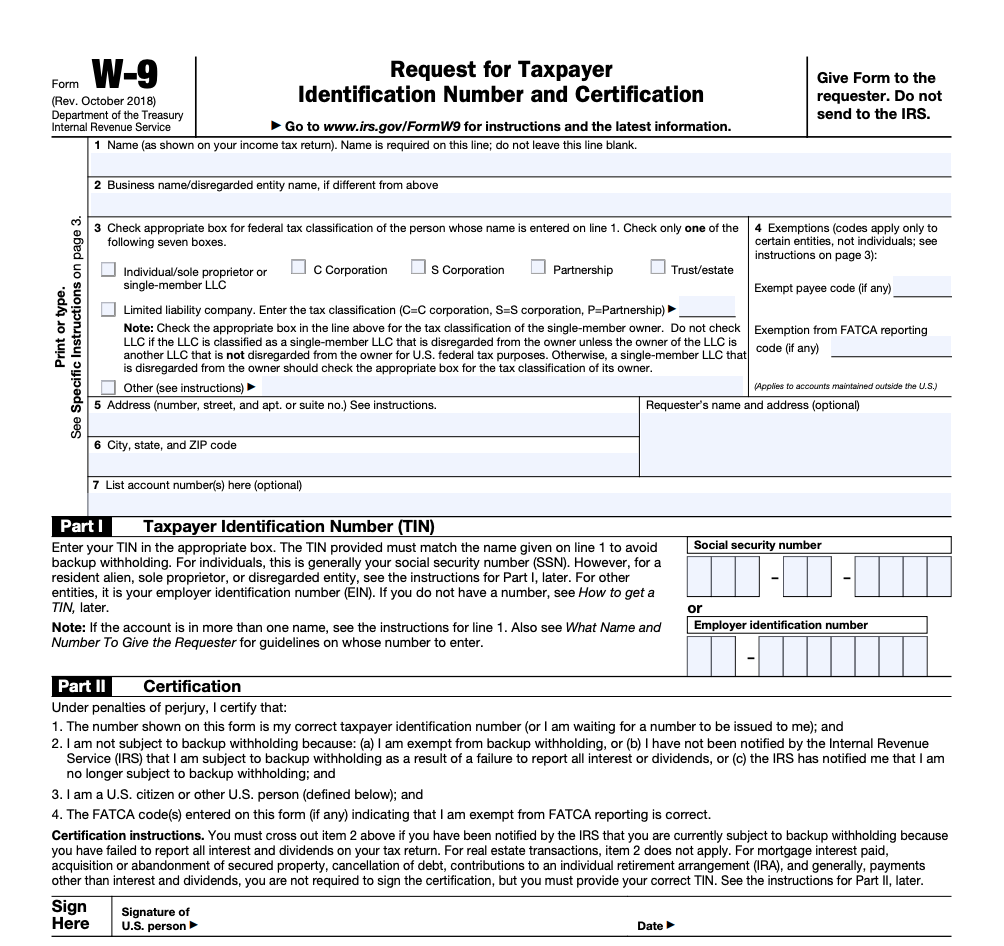

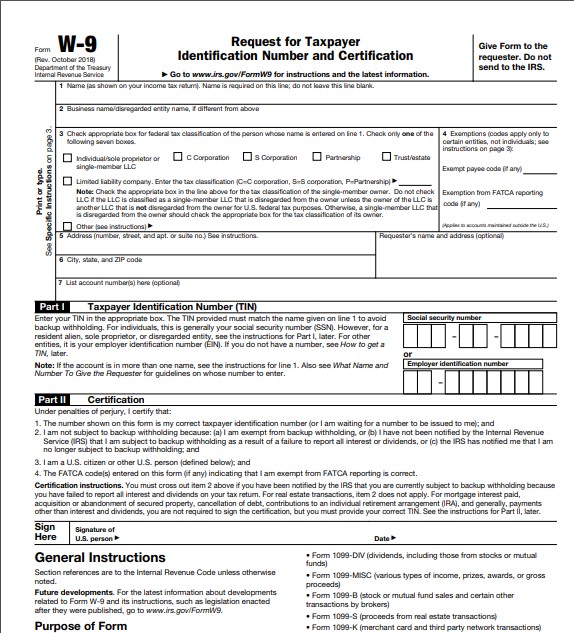

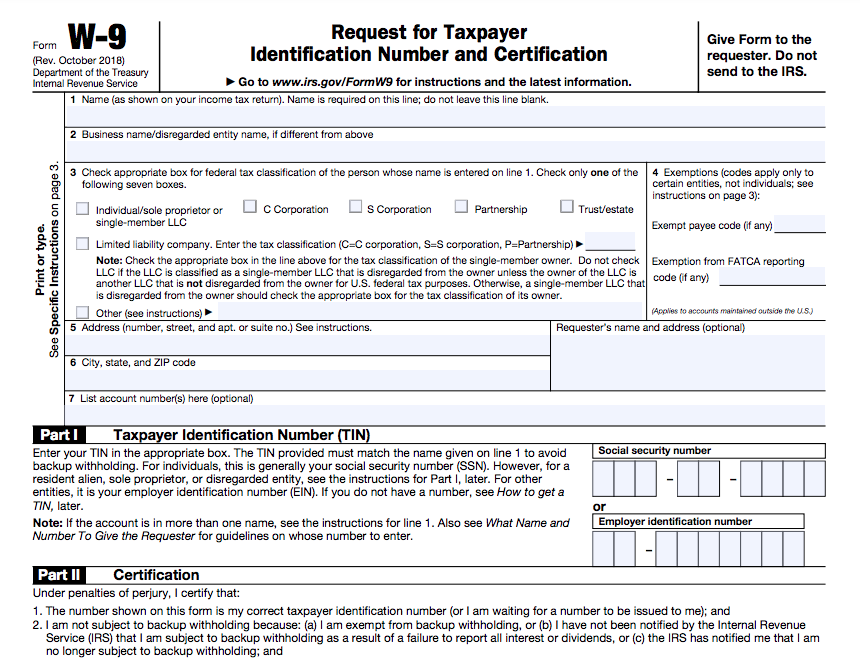

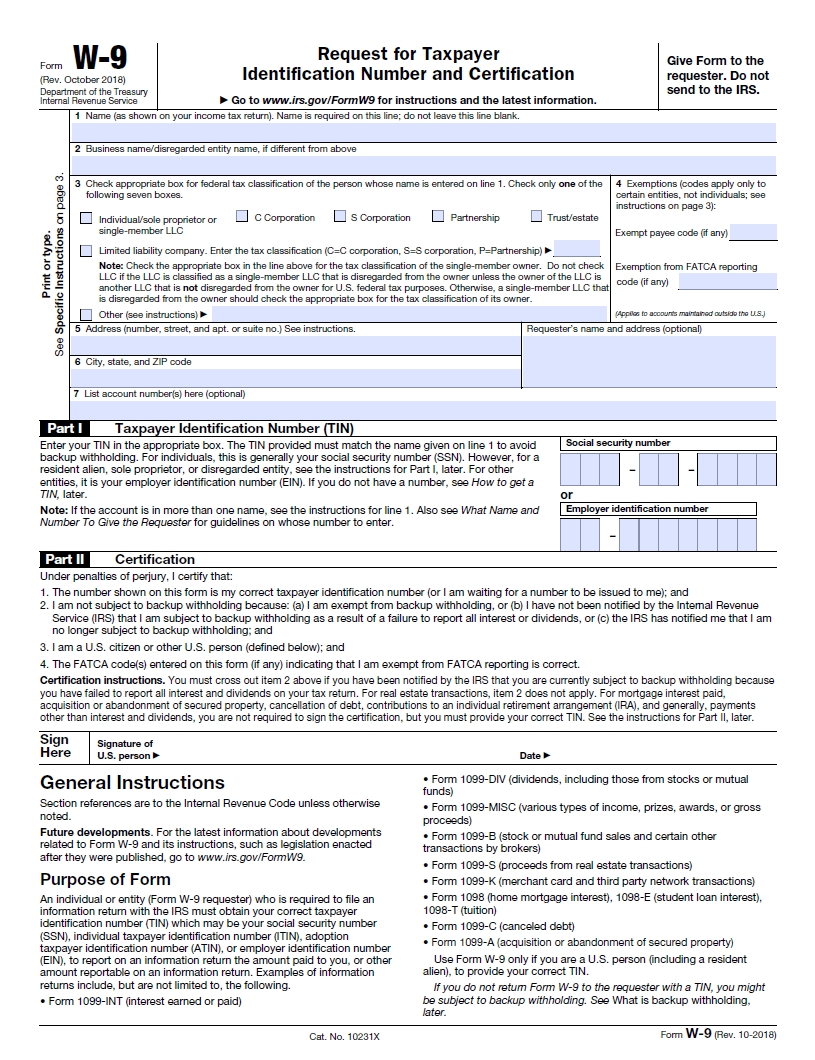

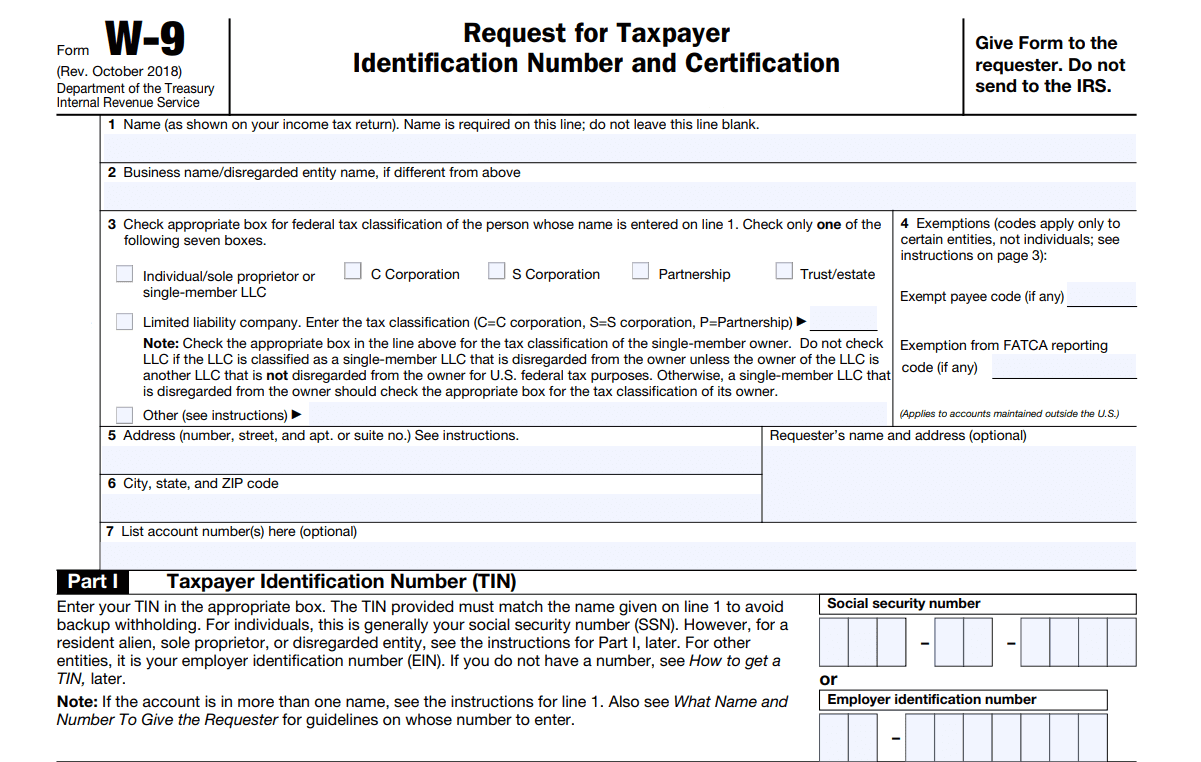

Form W-9 is a tax document that must be signed by independent contractors to provide a taxpayer ID number Social Security Number or Employer ID.

Employer tax forms w 9. In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. Taxpayers use the W-9 tax form to verify their. Form W-4P Withholding Certificate for Pension or Annuity Payments.

Access and download ATT domestic and international W-8 and W-9 tax forms for all ATT legal entities with their own specific tax identification number. Income paid to you. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example.

United States provide Form W-9 to the partnership to establish your US. It lets you send your Tax identification number TINwhich is your employer identification number EIN or your social security number SSNto another person bank or other financial institution. Get A 100 Accuracy Guarantee With HR Block for your US.

ATT W-8 and W-9 Forms Code snippet. The form officially called Form W-9 Request for Taxpayer Identification Number and Certification is typically used when a person or entity is required to report certain types of income. The W-9 tax form can also show the legal organization of the contractors business.

If your employer sends you a W-9 instead of a W-4 the company has likely classified you as an independent contractor. Form W-4 Employees Withholding Certificate. If you work as an independent contractor or sole proprietor you can use an Employer Identification Number EIN on your W-9 form and avoid using your Social Security number SSN.

You should confirm with the company that this is the case. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. 4 lignes A W-9 is a form used by the Internal Revenue Service IRS and is also known as the Request for.

Signing the W-9 form certifies that the information on the document is correct. If you are fully employed and your employer asks you to fill in. At the start of every working relationship youll complete a Form W-9 providing your Social Security number and contact information to the person hiring you.

Legal business entities include sole proprietor C Corporation S Corporation Partnership or Limited Liability Company. You need to use it if you have earned over 600 in that year without being hired as an employee. Employees Withholding Certificate Form 941.

The form helps businesses obtain important information from payees to prepare information returns for the IRS. Form W-9 is one of those really simple IRS Forms that has precisely one function. Independent contractors freelancers and part-time employees responsible for their own tax returns are required to fill in the W-9.

This makes it easy at the end of the year for that same hirer to complete a Form 1099 reporting all. W-9 forms are for self-employed workers like freelancers independent contractors and consultants. Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity and Welfare-to-Work Credits.

Employers Quarterly Federal Tax Return Form W-2. Get A 100 Accuracy Guarantee With HR Block for your US. Annonce Its Easy To File US.

It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification Number. Status and avoid section 1446 withholding on your share of partnership income. Taxes From France With The Guidance Of HR Block Expat.

Mortgage interest you paid. If the employer doesnt have a taxpayer ID or if the taxpayer ID is incorrect the independent contractor must have federal income taxes withheld known as backup withholding. Online hours for the IRS EIN service are Monday.

Annonce Its Easy To File US. Taxes From France With The Guidance Of HR Block Expat. Apply for an instant EIN number for free at irsgov.

Form W-9 Request for Taxpayer Identification Number and Certification. Informational Returns to Furnish to Payees and to File to the Appropriate Governmental.

Https Www Irs Gov Pub Irs Pdf Fw9 Pdf

Irs W9 Form 2021 Printable W9 Form 2021 Printable

Irs W9 Form 2021 Printable W9 Form 2021 Printable

What Is A W 9 Form Why You Need To Fill It Out Bench Accounting

What Is A W 9 Form Why You Need To Fill It Out Bench Accounting

W9 Form 2021 Printable Payroll Calendar

W9 Form 2021 Printable Payroll Calendar

Https Resources Quadient Com M 330942c82bf97e93 Original W 9 Quadient Leasing Usa Inc Po Box 3811 Corporate Headquarters Pdf

:max_bytes(150000):strip_icc()/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.