This means that once you have paid your deductible for the year your insurance benefits will kick in and the plan pays 100 of covered medical costs for the rest of the year. Your insurance company would pay the.

What Is A Deductible Copay And Coinsurance Policy Advice

What Is A Deductible Copay And Coinsurance Policy Advice

Well talk about health plans with high deductibles later When a family has coverage under one health plan there is an individual deductible for each family member and family deductible that applies to.

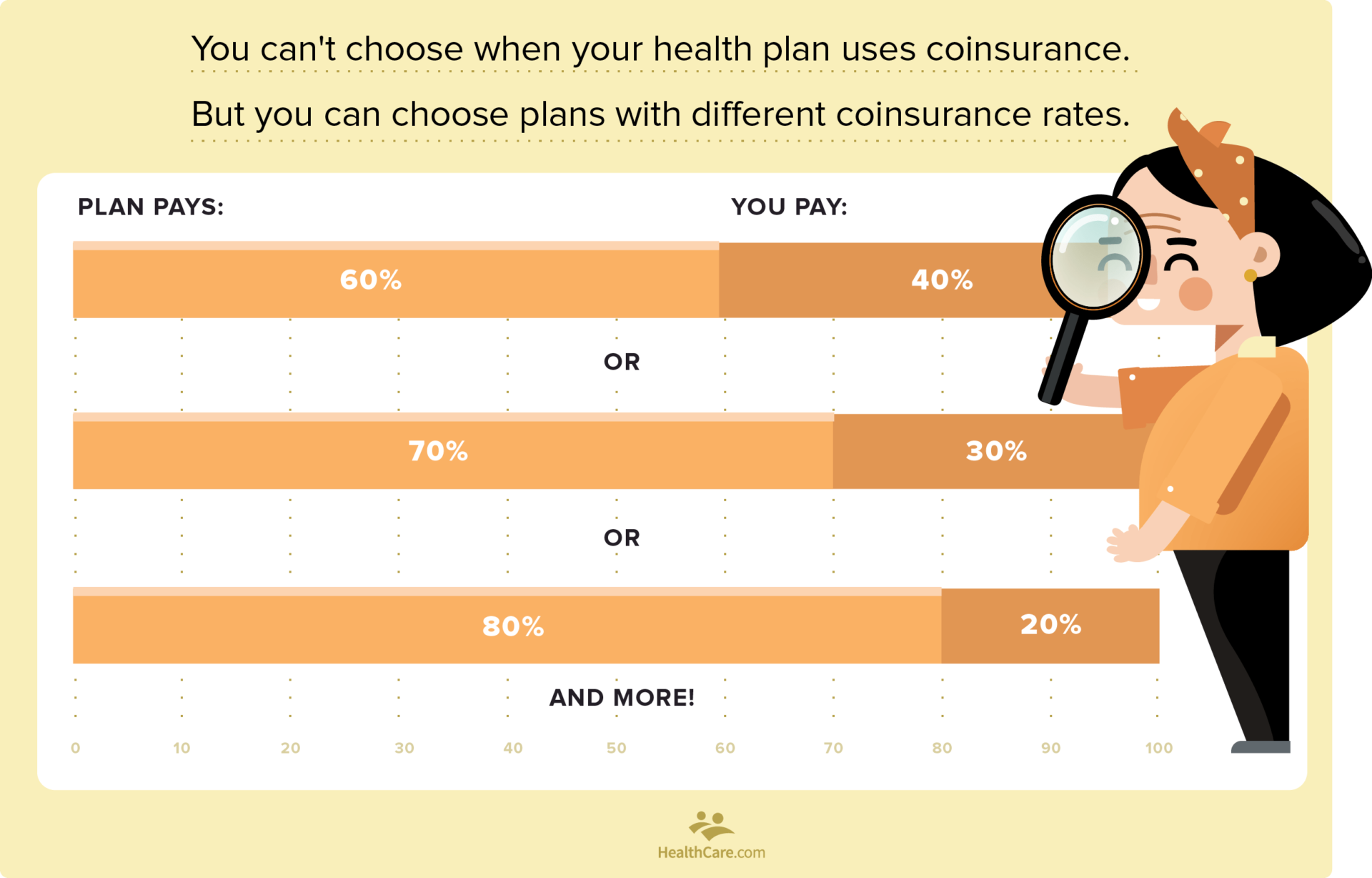

What does 40 after deductible mean. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. In March he sprains his.

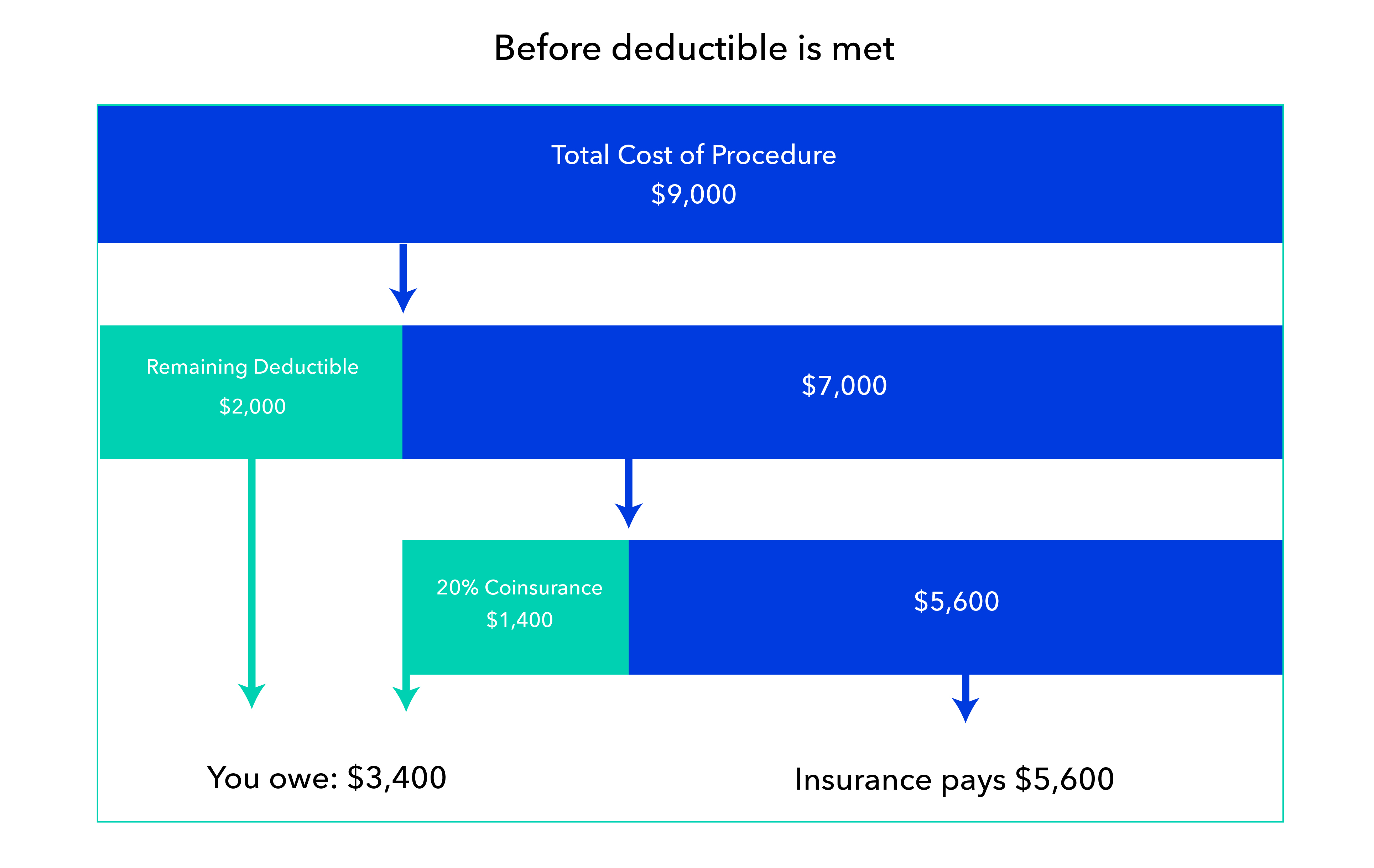

So its really like having no insurance until we have spent at least 3600. You pay 20 of 100 or 20The insurance company pays the rest. If youve already hit your deductible and your coinsurance is 40 you will pay 160 and your insurance will pay the remaining 240.

The phrase 40 Coinsurance after deductible means that you may be responsible for 40 of the approved part of the bill plus the delta between what they bill and what they cover. Coinsurance is an additional cost that you must pay even after the deductible has been met. Its usually figured as a percentage of the amount we allow to be charged for services.

If you purchase coverage through the marketplace youll choose from tiered metal levels. Learn More. They are Bronze Silver Gold and sometimes Platinum.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20. If you are on either plan and have hit your Tier 1 deductible and visit a Tier 1 urgent care provider the plan covers that service at 90 coinsurance after deductible This means you will pay 10 of the cost of the visit and your insurance will cover the remaining 90.

Now suppose the same patient has a 2000 annual deductible before insurance starts to pay and 20 coinsurance after that. Coinsurance is the share of the cost of a covered health care service that you pay after youve reached your deductible. Everything You Need to Know.

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. The phrase 40 Coinsurance after deductible means that you may be responsible for 40 of the approved part of the bill plus the delta between what they bill and what they cover.

A deductible is an upfront cost you must pay out of pocket before your insurance coverage will kick in. If you understand how each of them works it will help you. Deductibles coinsurance and copays are all examples of cost sharing.

You start paying coinsurance after youve paid your plans deductible. The phrase no charge after deductible signifies that once you pay the full deductible amount the insurance company will cover 100 percent of the cost. Its usually a percentage of the approved medical expense.

If youve paid your deductible. So a 10 percent coinsurance and a 2000 deductible means you owe 2800 on a 10000 operation. The amount of money you pay after the deductible that you pay is based on the type of insurance you purchase.

Deductible amounts typically range from 500 to 1500 for an individual and 1000 to 3000 for families but can be even higher. Each level of insurance dictates how much your. Coinsurance is your share of the costs of a health care service.

Insurer paying 85 on claims after deductible is fairly standard as in our case the deductible being 3600 for my wife and I annual maximum out-of-pocket 6000. When you go to the doctor instead of paying all costs you and your. What Is Your Coinsurance After Deductible.

The bill from the ER is 2000 but if you had gone to your in-network primary care physician and then received a referral for the X-rays at an in-network provider then the cost. After youve reached this limit you will not have copayments coinsurance or other out-of-pocket costs. Ready to shop health insurance.

Once youve met your deductible you might pay 20 of the cost of the health service or procedure for instance. The 10 you pay will count towards your deductible. Learn more about out-of-pocket medical costs.

A deductible is an upfront or out-of-pocket cost that an insurance policyholder must pay toward a loss or expense covered by an insurance plan before the insurance company will pay for costs. The bill from the ER is 2000 but if you had gone to your in-network primary care physician and then received a referral for the X-rays at an in-network. Youve paid 1500 in health care expenses and met your deductible.

How Much Is Health Insurance Cost Sharing Explained

How Much Is Health Insurance Cost Sharing Explained

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

What You Need To Know About High Deductible Health Plans

What You Need To Know About High Deductible Health Plans

Benefits A Z What Is Coinsurance Financial Benefit Services Blog

Benefits A Z What Is Coinsurance Financial Benefit Services Blog

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Guide To Mental Health Co Payments Co Insurance And Deductibles

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Five Terms You Need To Know Before Buying Obamacare Coverage

Understanding Key Health Insurance Terms Simplyinsured Blog

Distinction Sandwich Between Coinsurance Deductible Out Of Pocket Bounds Copayment With Freebie What Does 60 Coinsurance After Deductible Mean

Distinction Sandwich Between Coinsurance Deductible Out Of Pocket Bounds Copayment With Freebie What Does 60 Coinsurance After Deductible Mean

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

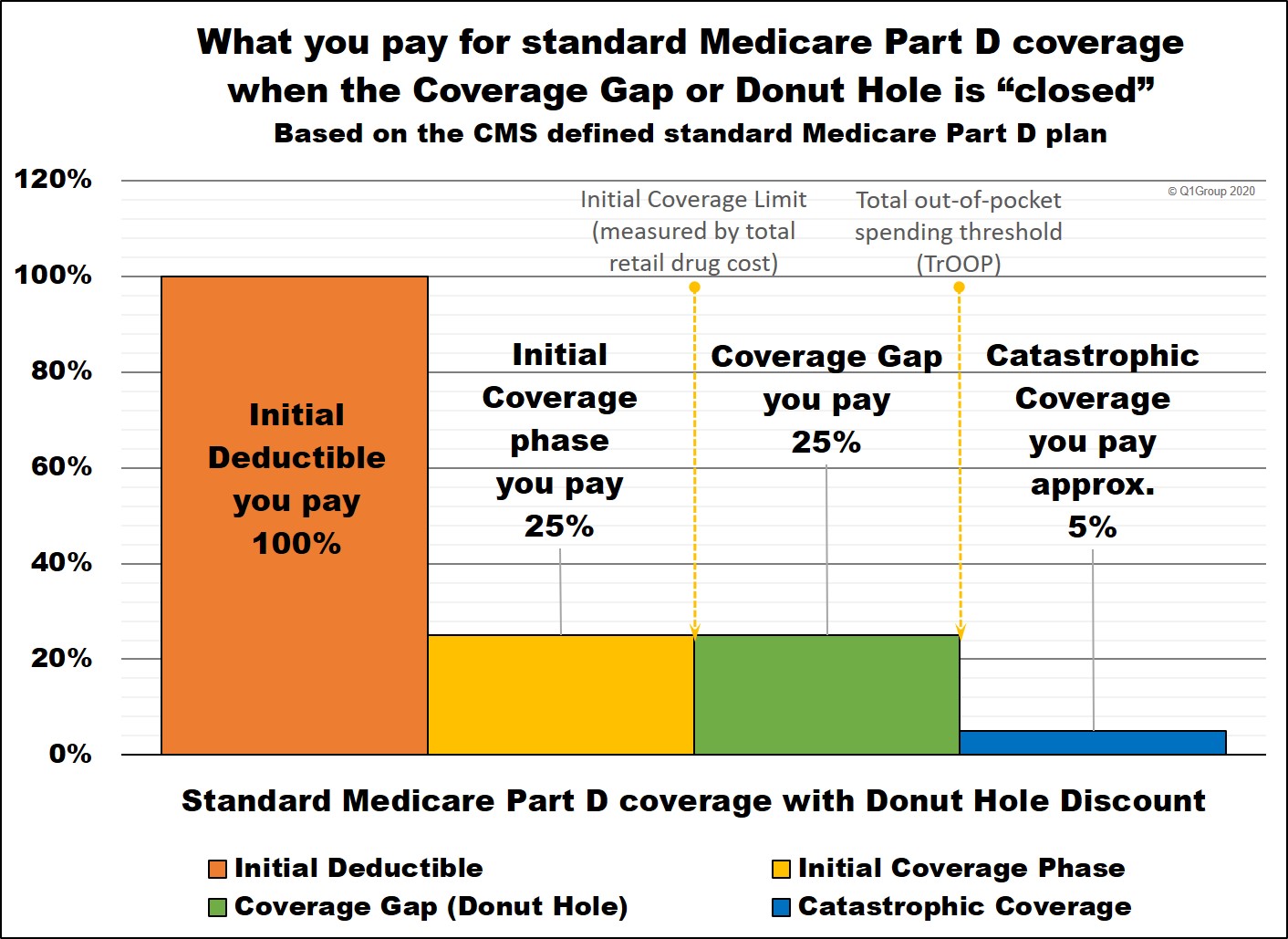

What Is The Initial Deductible And How Does It Work

What Is The Initial Deductible And How Does It Work

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.