Whats considered an HDHP. De leergang is ism.

High Deductible Health Insurance Plans Hdhp The Hartford

High Deductible Health Insurance Plans Hdhp The Hartford

If you have a 1000 medical bill and your coinsurance is 20 youll pay 200.

Hdhp insurance quotes. High-Deductible Health Plan HDHP Preferred Provider Organization PPO Deductible. Those costs include deductibles copays and coinsurance. Find online quotes for high deductible health insurance.

Individual deductible medical pharmacy 28006500 In-network coinsurance 70100. With an HDHP you pay the full cost for services until your annual deductible is met for services other than in-network preventive care services which are covered 100. HDHPs offer a lower premium with a higher annual deductible.

Here is a quick overview of the two plans Note. Advertentie NIBE-SVV de opleider voor de financieel dienstverlener. Here are some HDHP options.

Most high deductible health plans come with lower monthly premiums. A high-deductible plan has a maximum of 7000 for in-network out-of-pocket costs for single coverage and 14000 for family coverage. Until you reach your annual Out-Of-Pocket Maximum and all.

Your insurance company will cover the final 800. For 2020 HDHPs can have a maximum out-of-pocket of 6900 for an individual and 13800 for a family. The remaining amount is paid by your insurance company.

If you anticipate only needing preventive care which is covered at 100 under most plans when you stay in-network then the lower premiums that often come with an HDHP may help you save money in the long run. After you meet your deductible you may only be responsible for a small percentage of the costs called a co-insurance. De leergang is ism.

In 2014 the minimum individual deductible for a HDHP is 1250 in 2015 it will increase to 1300. De Insurance Academy van het Verbond van Verzekeraars ontwikkeld. A qualified high deductible health plan QHDHP is a plan that meets the requirements for plan members to utilize a health savings account along with their health plan.

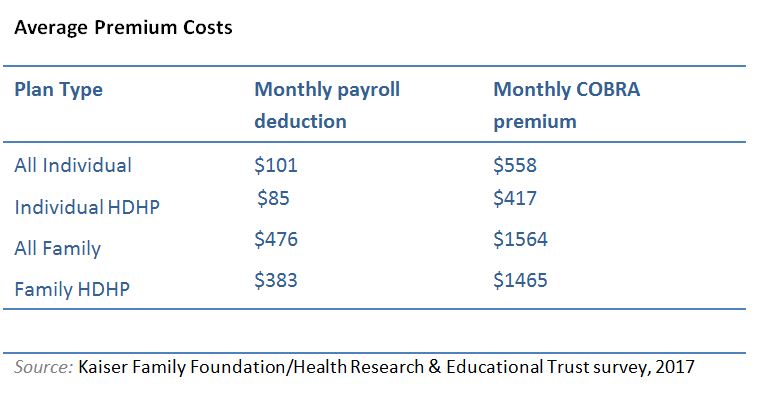

Advertentie NIBE-SVV de opleider voor de financieel dienstverlener. All of the figures below are for in-network coverage for an employee and spouse. De Insurance Academy van het Verbond van Verzekeraars ontwikkeld.

2018 Out of Pocket Maximum. Re-designs of health insurance plan benefits prompted by the Affordable Care Act have introduced new health insurance plans that have substantially higher deductibles that previously were most often associated with an HSA based plans. This includes getting as many different quotes as you can in a quick and reliable manner.

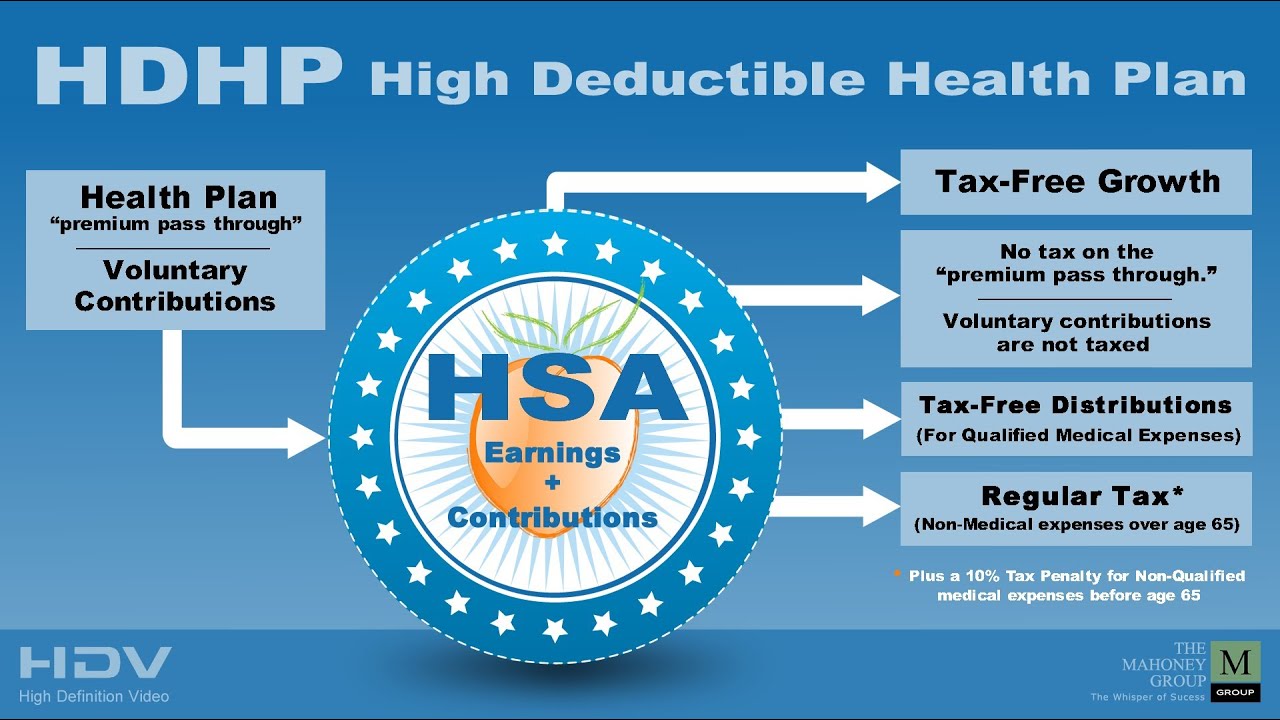

The maximum allowable contribution tax-deductible each year is 3550 for an individual and 7100 for a family and earnings grow tax-free. Heres what we did to prepare financially for our second son and how much it ultimately cost to have a baby with an HDHP. But the 2020 upper limit for out-of-pocket costs on ACA-compliant plans is 8150 for an individual and 16300 for a family.

An HDHPs total yearly out-of-pocket expenses including deductibles copayments and coinsurance cant be more than 6900 for an individual or 13800 for a family. HDHPs have higher deductibles than traditional insurance plans but they also have a lower premium. Choose a family deductible option.

On top of that we have health insurance through my husbands company which only offers a high-deductible health plan HDHP so we expected to pay some high out-of-pocket medical costs. An HDHP has an annual deductible of at least 1400 for single coverage and 2800 for family coverage. For 2020 these health insurance plans have a minimum deductible of 1400 for individual plans and 2800 for family plans.

The underlying HDHP see below for definition plan must have a minimum deductible of 1400 for. To make high deductible health insurance work for you you still need to follow many of the other general guidelines for shopping for health insurance coverage. So there are non-HDHP plans available that have higher out-of-pocket exposure and thus lower premiums than HDHPs.

For 2020 the IRS defines a high deductible health plan as any plan with a deductible of at least 1400 for an individual or 2800 for a family. The paper by Justin Sydnor a professor of risk and insurance at the University of Wisconsin-Madison and Chenyuan Liu UN agency is following a degree with the University of Wisconsin-Madison finds that at corporations providing each an HDHP and a low-deductible product choosing the HDHP generally saves 500 a year. Individual maximum out-of-pocket 28006550 Preventive exams screenings and immunizations 100.

Major Medical HDHP Quote - Kurtesy Insurance Services.

How Hsa Health Insurance Works

51 Of U S Workforce Enrolled In High Deductible Health Plans Which May Leave Some Underinsured Valuepenguin

Only 8 Of Americans Have An Hsa And May Be Missing Out On Savings

Only 8 Of Americans Have An Hsa And May Be Missing Out On Savings

:max_bytes(150000):strip_icc()/shutterstock_129463487_insurance_money_stethescope-5bfc3c8f46e0fb0051c220f4.jpg) High Deductible Health Plan Hdhp Definition

High Deductible Health Plan Hdhp Definition

Health Insurance Plans Health Mybenefits Department Of Management Services

Health Insurance Plans Health Mybenefits Department Of Management Services

/healthinsurance-5bfc32ab46e0fb00511afacf.jpg) High Deductible Health Plan Hdhp Definition

High Deductible Health Plan Hdhp Definition

Picturequotes Com Life Insurance Quotes Good Life Quotes Life Insurance Marketing

Picturequotes Com Life Insurance Quotes Good Life Quotes Life Insurance Marketing

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Hdhp High Deductible Health Plan Georgia Youtube

Hdhp High Deductible Health Plan Georgia Youtube

High Deductible Health Insurance Plans Hdhp The Hartford

High Deductible Health Insurance Plans Hdhp The Hartford

What You Need To Know About High Deductible Health Plans

What You Need To Know About High Deductible Health Plans

Instant Online Health Insurance Quote Get Free Quotes Fast Txt By Bebe Kero Issuu

Instant Online Health Insurance Quote Get Free Quotes Fast Txt By Bebe Kero Issuu

:max_bytes(150000):strip_icc()/GettyImages-125766335-597bcf83d963ac0011035757.jpg) High Deductible Health Plan Hdhp Definition

High Deductible Health Plan Hdhp Definition

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.