Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. Form 8962 Premium Tax Credit Copy of your Form 1095-A Health Insurance Marketplace Statement A copy of the IRS letter that you received.

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Well help you create or correct the form in TurboTax.

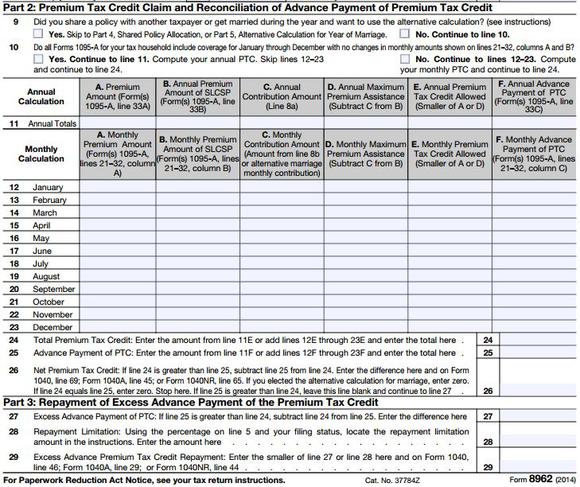

Tax form 8962 for 2019. The annual total amount found on line 33 of your 1095-A goes on line 11 of your Form 8962. The monthly amounts listed on lines 21-32 of your 1095-A go on lines 12-23 of your Form 8962. For more help I can be reach via my facebook page.

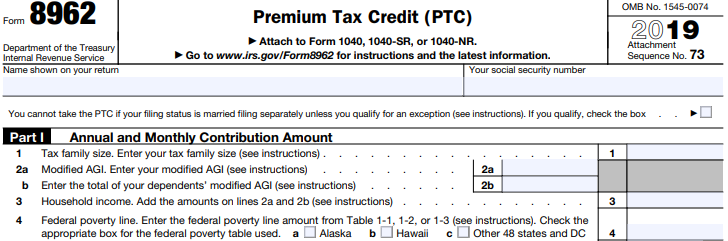

2019 Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Form 8962 examples Premium Tax Credit score reconciles 2019 advance funds of the premium tax credit score and can also affect a taxpayers skill to get advance payments of the premium tax credit score or value-sharing reductions.

Your social security number. Instructions for Form 8962 Premium Tax Credit PTC 2016 Form 8962. Go to wwwirsgovForm8962 for instructions and the latest information.

You may take the PTC and APTC may be paid only for health insurance coverage in a qualified health plan defined later purchased through a Health Insurance Marketplace Marketplace also known as an Exchange. You have to add the form to your tax return documents annually. That goes for agreements and contracts tax forms and almost any other document that requires a signature.

Name shown on your return. About Form 8962 Premium Tax Credit Internal Revenue Service. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Discover the premium for the bottom value Bronze plan that was obtainable to you for the present 12 months. Premium Tax Credit 2015 Inst 8962. 2019 Federal Tax Forms And Instructions for Form 8962 We recommend using the most recent version of Adobe Reader -- available free from Adobes website.

Below we do a walkthrough of filling out the PTC form and we simplify the terms found within. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Probably because the Form 1095-A was not entered on your 2019 tax return so the Form 8962 was not completed.

Instructions for Form 8962 Premium Tax Credit PTC 2017 Form 8962. Premium Tax Credit 2017 Inst 8962. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.

Quick steps to complete and e-sign Form 8962 Instructions online. Its a form you file if your your familys income is below the established poverty range to receive a premium credit for health insurance. Your social security number.

Premium Tax Credit 2018 Inst 8962. How to make an e-signature for signing the 2019 Form 8962 Premium Tax Credit Ptc in Gmail irs printable form 8962es have already gone paperless the majority of are sent through email. Start completing the fillable fields and carefully type in required information.

73 Your social security number You cannot take the PTC if your filing status is married filing separately unless. Go to wwwirsgovForm8962 for instructions and the latest information. Premium Tax Credit 2016 Inst 8962.

When to submit the IRS form 8962 for 2019. Form 8962 OMB No. Name shown on your return.

Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. Instructions for Form 8962 Premium Tax Credit PTC 2015 Form 8962. Add form 8962 to filed taxed 2019.

The question arises How can I e-sign the printable tax form 8962 I received right from my Gmail without. Use Get Form or simply click on the template preview to open it in the editor. Go to wwwirsgovForm8962 for instructions and the latest information.

When saving or printing a file be sure to use the functionality of Adobe Reader rather than your web browser. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return 2020 Attach to Form 1040 1040-SR or 1040-NR. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Form 8962 Premium Tax Credit PTC is the form you will need to report your household Modified AGI MAGI your Federal Poverty Level amount your familys health insurance premium exemptions and the cost assistance you received. Instructions for Form 8962 Premium Tax Credit PTC 2018 Form 8962.