2 Evaluation fitting and follow-up fees fully covered for non-specialty lenses and covered up to 60 for specialty contact lenses. Our vision insurance plans cover check-ups so you can keep your prescription up-to-date.

With so many choices members are sure to find an eye care professional thats close to home or work.

Blue vision insurance benefits. Accepted at over 102000 nationwide providers including Visionworks LensCrafters Costco Walmart Sams Club and more. Material Lenses Frames or Contact Lenses. We also offer allowances for your frames lenses or contact lenses and discounts at some of your favorite places to shop.

There are a few things you can do to help with your blue light exposure. CareFirst Vision Plan BlueVision Plus. 0 copays are for comprehensive routine eye exams and lenses.

Access to one of the nations largest vision networks. From 0 copays 1 to fully-covered frames 2 BCBS FEP Vision is here to help. The FCPS vision plan is included with your health plan premiums and is administered by CareFirst BlueVision Plus.

If youre buying a full set of frames and lenses you can get 40 off of your prescription lenses with blue light filtering. Taking care of your vision and. With plans starting at 2128month our health insurance options are.

The biggest benefit of vision insurance is it covers or cuts the cost of eye exams and medical eye care. Choose from thousands of independent providers and national retailers for services eyeglasses and contact lenses. Watch video 26s Learn more.

Out of network services are subject to higher cost sharing amounts and reduced benefits. Watch video 26s 1. Because most optical stores accept vision insurance for payment they have increased all the prices of their prescription lenses and glasses.

Through Anthem Whole Health Connection Dental we help your employees achieve optimal oral and overall health with. We pledge to honor and support all. 2020 Summary of Benefits Blue Cross and Blue Shield is a trusted provider of health insurance for federal employees retirees and their families.

The savings can add up to hundreds of dollars a year. BCBS FEP Vision offers the coverage you want. Our comprehensive and tailored health insurance plans include vision care options allowing you to find a plan that makes sense for both you and your family.

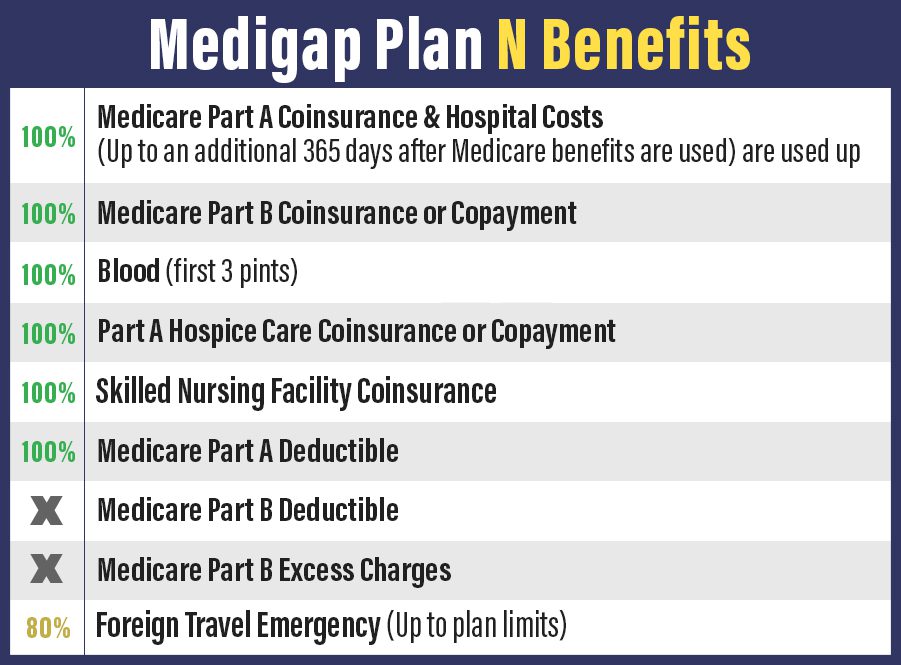

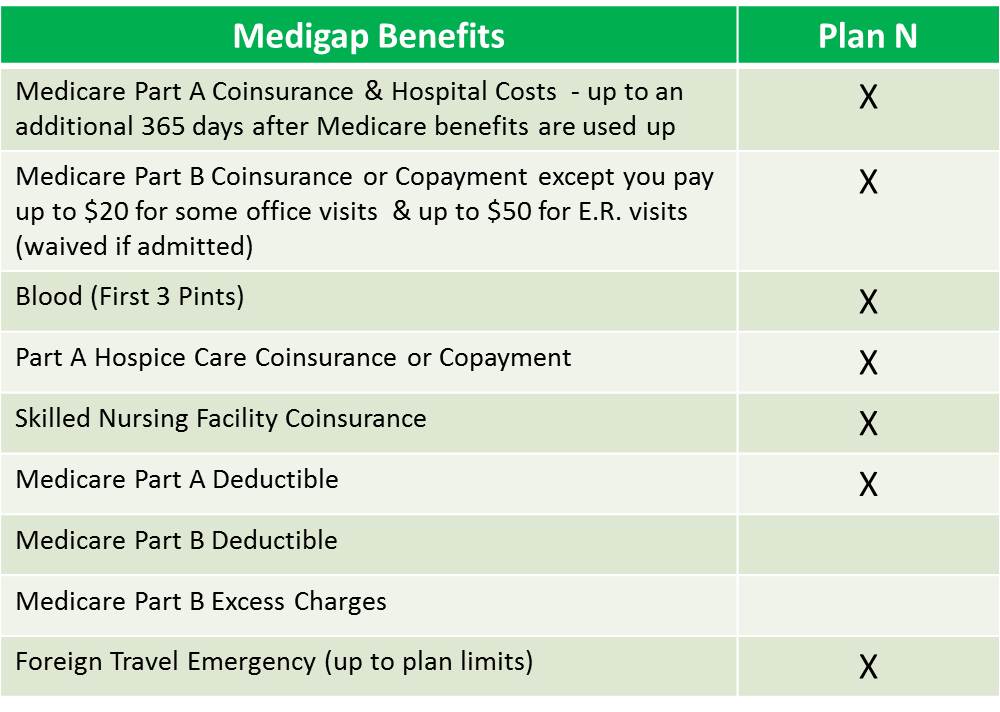

It does not pay your Medicare deductibles or coinsurance and is not a substitute for Medicare supplement insurance. No copays for comprehensive eye exams and frames. Fully-covered frames based on the BCBS FEP Vision Collection which is available at participating independent.

Clearly these are great benefits. Access to over 33000 eye doctors at more than 26000 locations nationwide. VSP is an independent company providing vision benefit management services and access to the VSP vision network for Blue Cross Blue Shield of North Dakota vision products.

Save hundreds while keeping your eyes healthy with great vision care benefits. What Blue Cross covers. You can add a blue light filtering tint to any of your prescription lenses.

Extensive fully covered frame collection at participating providers. 7 Zeilen Blue View Visionsm Benefits The benefits are clear. The CareFirst BlueVision Plus Plan offers vision benefits every 12 months.

Our supplemental vision plan FEP BlueVision offers the coverage you need to keep eyes healthy for years to come. This insurance provides limited benefits if you meet the policy conditions for expenses relating to the specific services listed in the policy. This means too much blue light exposure can lead to eye strain vision loss or macular degeneration.

In lieu of eyeglasses Up to 150 per calendar year toward contact lenses plus 15 off charges over 150. Thank You for Being a Caregiver. CareFirst BlueVision Plus Plan Highlights.

We provide vision care coverage to help offset the expenses OHIP doesnt cover. From no-cost eye exams to discount for progressive lenses FEP BlueVision can save you hundreds of dollars on vision services throughout the year. How much vision insurance will save you depends on your particular plan.

If you have Blue View Vision you have access to more than 32000 vision care providers all over the United States. Some plans also save you money on eyeglasses contact lenses and even vision correction surgery like LASIK. See the impact that serious eye conditions can have on your overall health according to the Blue Cross Blue Shield Health of America report.

Blue View Vision covers your eye health through Anthem a large insurance provider. Blue View Vision SM comes with many benefits. Learn More Health of America Report.

Check out all you can do with Blue 2020. This insurance duplicates Medicare benefits when any of the services covered by the policy are also covered by Medicare. With Blue View Vision you will have all the help you need to manage your eye health.

Enjoy additional discounts savings and special offers. Our health insurance plans offer you a variety of coverage options. Benefit info and pricing.

1Collection is available at participating independent provider offices.