It was first offered in 2010. Medicare Supplement Medigap Plan N is a standardized Medicare Supplement insurance plan meaning it has the same benefits across all carriers.

Medicare Supplement Plan N Is It Right For You

Medicare Supplement Plan N Is It Right For You

Those plans are ways to get Medicare benefits while a Medigap policy only supplements your Original Medicare benefits.

What is medicare supplement part n. Medicare Supplemental plans or Medigap cover the costs youre responsible for with Original Medicare. Original Medicare Parts A and B only cover 80 of hospital and medical bills. Take a look at Medicare supplement plan N as a viable alternative.

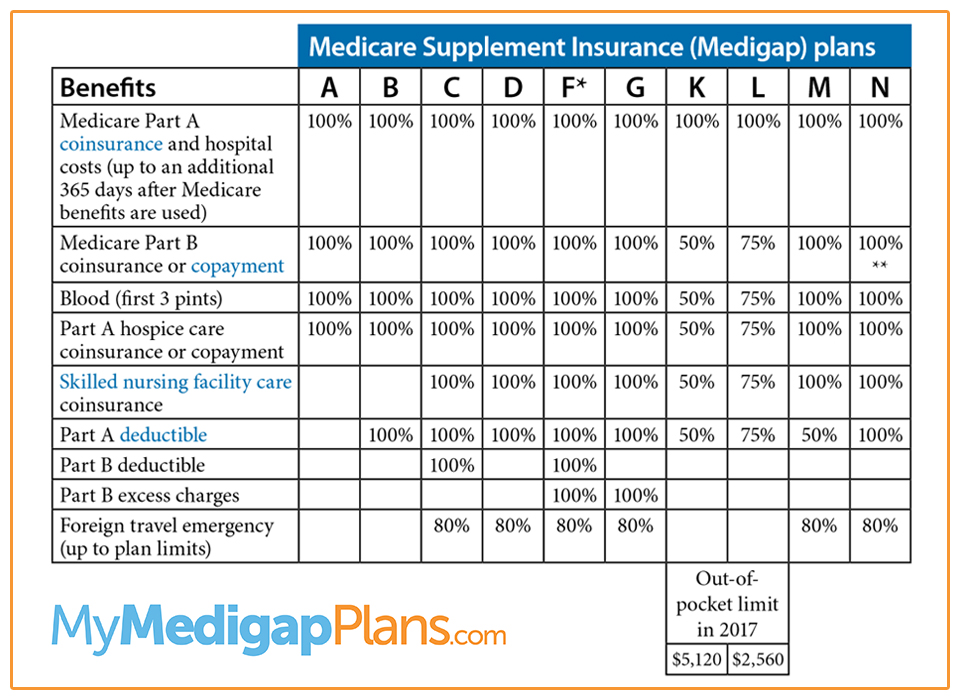

It also covers your skilled nursing facility coinsurance. Plan N will usually have lower premiums than Plan F or Plan G. There are 10 plan types available in most states and each plan is labeled with a different.

A B C D F G K L M and N. Learn more about the benefits of Plan N and whats covered. A Medigap policy is different from a Medicare Advantage Plan.

Moreover Medicare Plan N is a standardized plan with the same coverage benefits for all insurance carriers. The Part A Hospital deductible in 2021 this is 1484 and your coinsurance 20 An extra one year 365 days of hospital benefits after Medicares coverage runs out Hospice care at any certified hospice center. Plan N offers more freedom than an Advantage plan as well as lower premiums than most supplements.

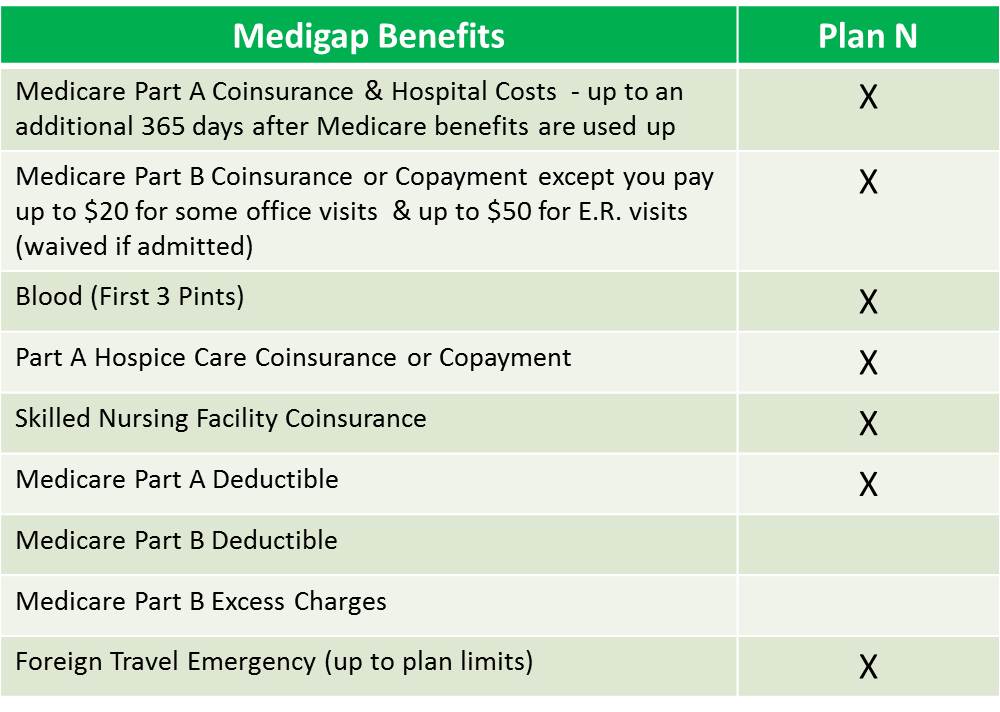

Medicare Supplement Plan N is one of the newer Medigap plans. Like the other Medigap plans such as Plan F or G Plan N is sold by private insurance companies such as Accendo Insurance Company or Lumico. Medigap Plan N covers 100 of the Medicare Part B coinsurance costs with the only exception being that it requires a 20 co-payment for office visits and up to 50 for emergency room visits.

You will pay a doctor copay up. Plan N is one of the Medicare Supplement plan options which are plans that help pay for gaps Medicare leaves behind. Medigap Plan N is another name for Medicare Supplement Plan N.

Medigap Plan N pays the 20 coinsurance not covered by Parts A and B. Heres a quick list of items covered in the hospital by Medicare Supplement Plan N. Medicare Supplement insurance can help you cover the gaps in Medicare but many people have difficulty deciding which plan is right for themIf youre unsure which plan to choose you arent alone.

What is Medicare Supplement Plan N. Plan N has very similar benefits to Plan F and Plan G but it has a lower premium. In some cases plan N will have lower premiums than some Advantage plans.

With Plan N you. You must have Medicare Part A and Part B. There are 10 Medicare Supplement plan options available.

You pay the private insurance company a monthly Premium for. Plan N does have a 0-20 copayments at a doctor or specialist 50 copay at the emergency room waived if admitted the annual Part B deductible of 203 and also excess charges are not. Medicare Supplement also known as Medigap or MedSupp insurance plans help cover certain out-of-pocket costs that Original Medicare Part A and Part B doesnt cover.

Part A coinsurance and hospital costs Part B coinsurance and copayment except 20 for some office visits and 50 for emergency room visits Blood first 3 pints. Fortunately Medicare Supplement Plan G and Medicare Supplement Plan N two of the most popular plans are relatively simple to compare. Medicare Supplement Plan N covers the following Medicare expenses.

Medicare Supplement Plan N is a more affordable option when compared to Plans F and G. Medigap Plan N was introduced in June 2010 as one of the new Modernized Medicare supplement plans. Each plan has different yet standardized benefits and coverage that must follow federal and state laws and must be clearly identified as.

Medicare Plan N is a type of Medigap insurance that supplements the expenses of Original Medicare. What is Medicare Supplement Plan N. However you will do more cost-sharing along the way.

Plan N covers your entire Part A deductible and is one of the six out of 10 Medicare Supplement plans that pay for emergency medical services outside the US.