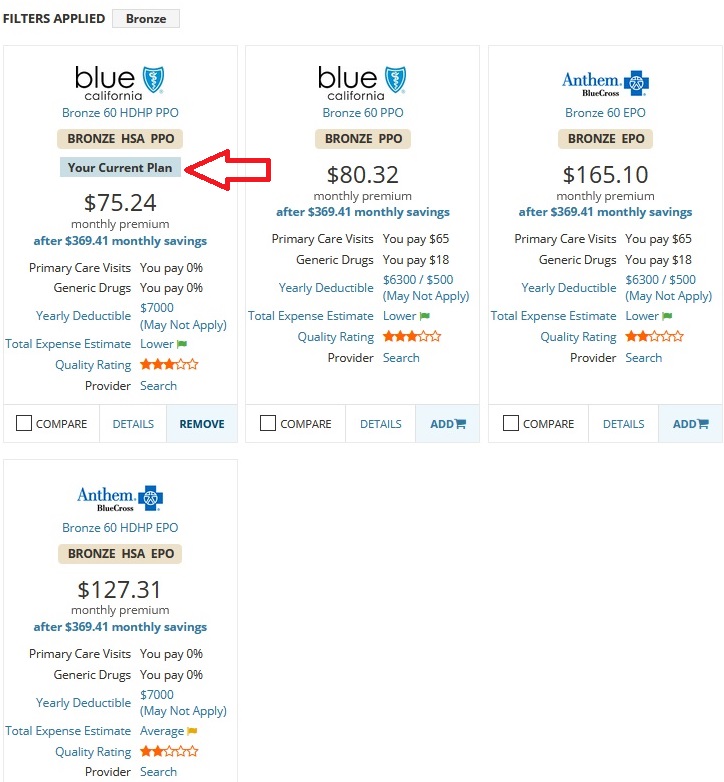

This way you keep your monthly costs down by taking the chance that you may not need to pay your deductible. A deductible is the amount you pay toward your health care before we come in to pay some of your claims.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Obamacare Off-Exchange Plans.

Blue cross blue shield 0 deductible. Deductible vs Out-of-Pocket Here is an example of how the deductible coinsurance and maximum limit you would need to pay work together. Instructions for submitting your claim are on the claim form available here. Starting on July 1 2021 this plan will have an in-network deductible of.

Your deductible your coinsurance and your monthly premium. If you have ahospital stay Facility fee eg hospital room 0 after deductible 30 after deductible Prior authorization may be required or services will not be covered. That means for most services youll pay 100 percent of your medical and pharmacy bills until the total amount you have paid reaches 1500.

If you need mental health behavioral health. Your health insurance deductible is the amount you must pay before the health plan starts paying for your covered care. However you pay lower out-of-pocket costs when you visit in-network doctors and hospitals.

In the United States Puerto Rico and US. Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. For example if your deductible is 5000 your plan wont pay for some services until youve paid 5000.

If youre willing to pay more when you need care you can choose a higher deductible to reduce the amount you pay each month. Physiciansurgeon fees 0 after deductible 30 after deductible None. Allow us to define deductible.

Then well share some of the costs with you. So if your deductible is say 1000 youll have to pay 1000 in medical costs like lab tests x-rays and hospital stays. Otherwise the Default Option will be used.

You must pay 4000 toward your medical costs before your plan begins to cover costs. Out-of-pocket maximum of 5000. You have an insurance plan that has a.

You must pay the first 5000 of your medical costs. The lower a plans deductible the higher the premium. What this Plan Covers What You Pay For Covered Services Coverage for.

In most cases the higher a plans deductible the lower the monthly premium. We provide health insurance in. Blue Care Elect Deductible PPO With a PPO plan you have both in-network and out-of-network coverage.

Your health insurance plan has a. Youll pay more each month but your plan will start sharing the costs sooner because youll reach your deductible. Health insurance plan details for BlueSelect Bronze 2139 0 Deductible 50 PCP Visits 100 in Rewards offered by Blue Cross and Blue Shield of Florida.

Outside the United States. Out-of-pocket maximum of. When the amount of coinsurance youve paid reaches 6000 the plan covers 100 until your plan year renews.

When it comes to paying for your health insurance there are three primary components. Out-of-pocket maximum of 5000. After that your plan covers 80 of the costs and you pay the other 20.

Lets say your plans deductible is 1500. All of BlueCross BlueShields products include a 0 medical deductible more than 20 no-cost preventive services and a 0 gym membership to more than 12000 fitness locations through SilverSneakers. Blue Cross Blue Shield Settlement co JND Legal Administration PO Box 91390 Seattle WA 98111.

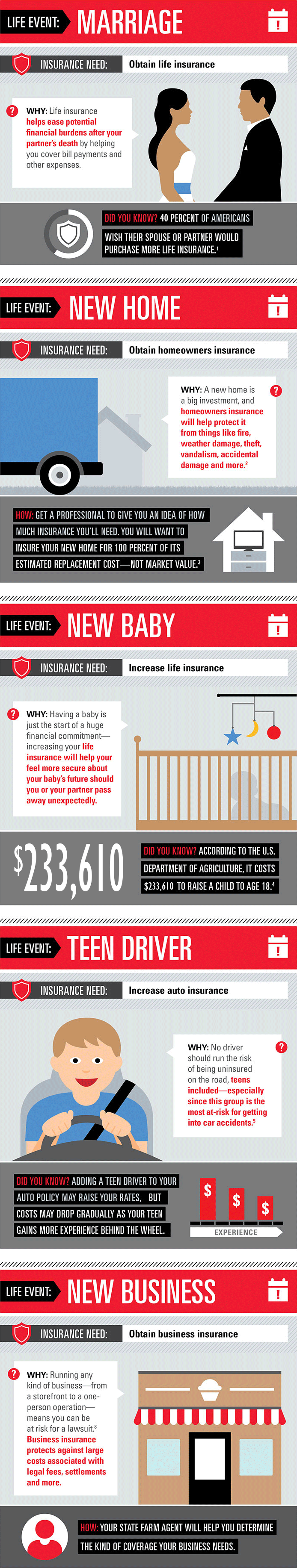

Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States. Eagan Minnesota October 21 2020 As part of an array of plan options designed to help Seniors better manage their health care costs Blue Cross and Blue Shield of Minnesota Blue Cross has announced 0 insulin benefit and 0 drug deductible on all drug tiers for Medicare Advantage PPO Complete members in 2021. A deductible is the amount you pay out-of-pocket each plan year for covered health care services before your insurance plan begins to pay.

After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. PPO Group Number 007000285-0014 0015 1 of 8. A plan is good for 1 year.

After you pay the 4000 deductible your plan covers 75 of the costs and you pay the other 25. Out-of-pocket maximum of 6000. Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage.

If you select the Alternative Option you must submit relevant data or records showing a higher contribution percentage. 1996-Blue Cross Blue Shield of Michigan and Blue Care Network are nonprofit corporations and independent licensees of the Blue Cross and Blue Shield Association. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs.

Urgent care 0 after deductible 0 after deductible None. When it comes to your plan lets start with your deductible. Blue Cross Blue Shield members can search for doctors hospitals and dentists.

After that you share the cost with your. IndividualFamily Plan Type. What are the pros and cons of a high or low deductible.

/best-dental-insurance-providers-4169737_final2-a801550ef6a64ef99aed716a2503078b.png)