The State of Texas like other employers that offer medical coverage to their. If you got Form 1095-B or 1095-C dont include it with your tax return.

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

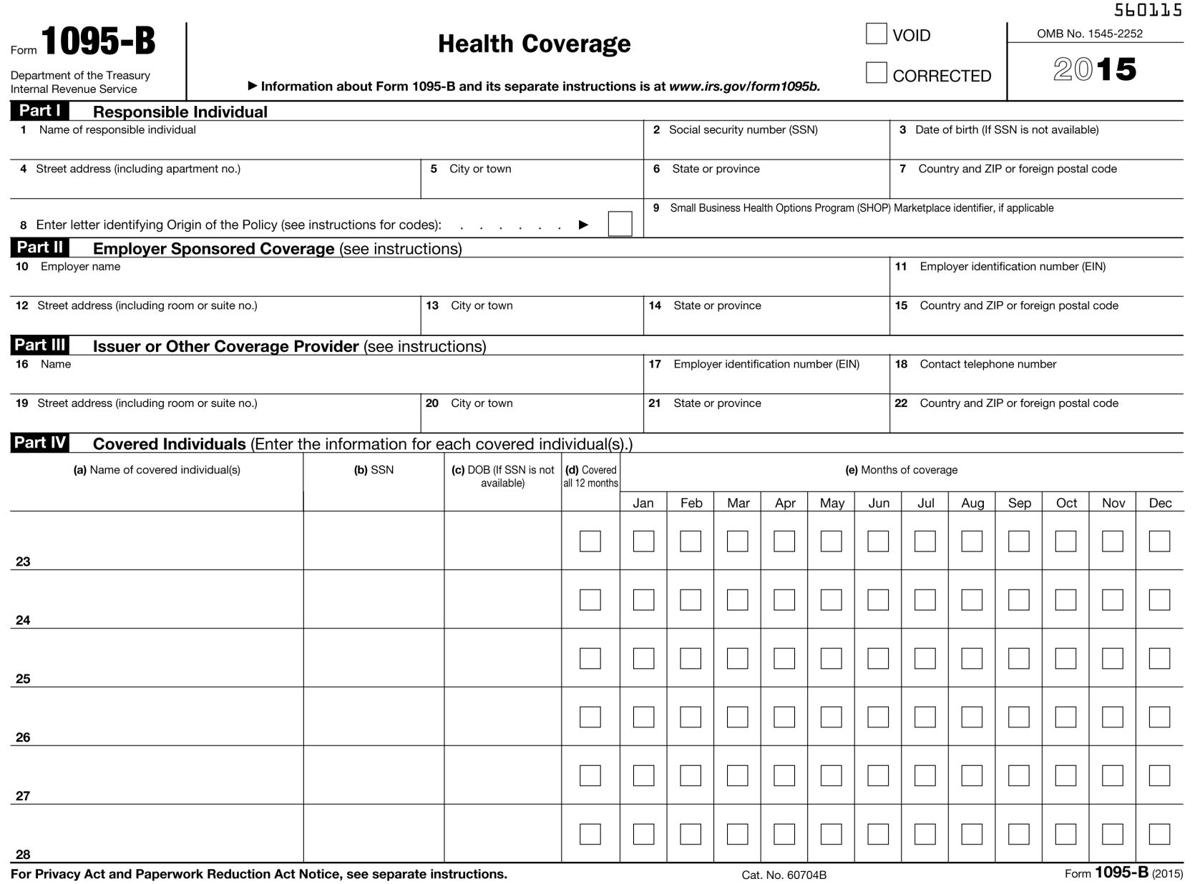

Form 1095-B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year.

Form for health insurance for taxes. Complete your tax return. They are forms 1095-A 1095-B and 1095-C. The IRS requires health insurance companies to report the individuals they covered per tax year.

Expand All Collapse All. For individuals who bought insurance through the health care marketplace this information will help to determine whether. Save it with your other tax documents.

Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers. Form 8962 Premium Tax Credit.

Received a Form 1095-A Health Insurance Marketplace Statement showing you received the benefit of advance payments of the premium tax credit Must file a tax return and reconcile the advance payments with the amount of the premium tax credit allowed on your return. Dont file your taxes until you have an accurate 1095-A. The Patient Protection and Affordable Care Act includes a requirement that many people have health insurance or pay a penalty.

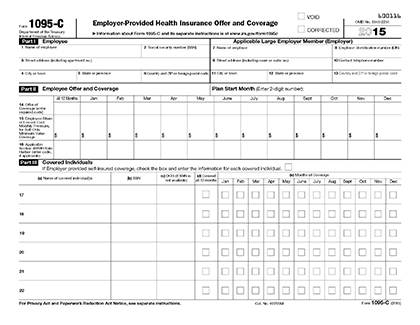

If you received health insurance for all or part of the year from an employer or union your employer or union will send you Form 1095-C. You can find it on Form 1040 PDF 147 KB. However it will not be.

A Health Care Tax Form often called as Form 1095 contains information for specific fees that an individual is required to pay if they did not avail of any health care insurance. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. You must have your 1095-A before you file.

Compliance with this mandate is administered by the Internal Revenue Service IRS. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. If you and your dependents had qualifying health coverage for all of 2020.

You should wait to file your income tax return until you receive that form. If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. The 1095-B Tax Form.

If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. For those who are members of a health insurance company the premium offers of. Check the Full-year coverage box on your federal income tax form.

If your form is accurate youll use it to reconcile your premium tax credit. Form 8965 is used to report an exemption from owing a tax payment for not having health insurance during the year. Questions and Answers about Health Care Information Forms for Individuals Forms 1095-A 1095-B and 1095-C Because of the health care law you might receive some forms early in the year providing information about the health coverage you had or.

The forms are sent to individuals who are insured through marketplaces employers or the government. Form 1095-B is a tax form like a W-2 or 1099-R you may get from your State of Texas-sponsored medical provider as proof that you and your tax dependents had medical coverage. It may be available in your HealthCaregov account as soon as mid-January.

These forms help determine if you the required health insurance under the Act. Individuals who have health insurance should receive one of three tax forms for the 2020 tax year. What is Form 1095-B.

For tax years other than 2020 if advance payments of the premium tax credit APTC were made for your or a member of your tax familys health insurance coverage through the Health Insurance Marketplace you must complete Form 8962 Premium Tax Credit and attach it to your return. This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage. If youre claiming a net Premium Tax Credit for 2020 including if you got an increase in premium tax credits when you reconciled and filed you still need to include Form 8962.

Form 8965 and Your Tax Return. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. The Form 1095-A Form 1095-C or Form 1095-B.

Like Form 1095-B this form has vital information that you will need to file taxes properly. You dont need to file an amended return or do anything else if you already filed your 2020 taxes and reported excess APTC or made an excess APTC repayment. Proving Health Insurance for Your Tax Returns.

You will receive Form 1095-A Health Insurance Marketplace Statement which provides you with information about your health care coverage. You should include this form with your tax return in order to report your health insurance exemption from owing a tax payment. Why do we need one.

Health insurance - Form 1095-B. The reports need to include Social Security Numbers SSN or International Tax. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace.

Health care tax resources. If there are errors contact.

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

1095 C Form Official Irs Version Discount Tax Forms

1095 C Form Official Irs Version Discount Tax Forms

How Does Health Insurance Affect Your Taxes

How Does Health Insurance Affect Your Taxes

Watch Your Mail For Tax Reporting Documents

Watch Your Mail For Tax Reporting Documents

How Can I Get My Health Insurance Tax Form Picshealth

How Can I Get My Health Insurance Tax Form Picshealth

Corrected Tax Form 1095 A Katz Insurance Group

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Action Needed 2015 Income Tax Filing For Health Care Coverage Coast Guard All Hands Archive

2014 Federal Tax Forms Will Ask About Your Health Insurance Coverage Wuwm 89 7 Fm Milwaukee S Npr

2014 Federal Tax Forms Will Ask About Your Health Insurance Coverage Wuwm 89 7 Fm Milwaukee S Npr

Tax Filing With The Affordable Care Act Katz Insurance Group

New Tax Document For Employees Duke Today

New Tax Document For Employees Duke Today

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.