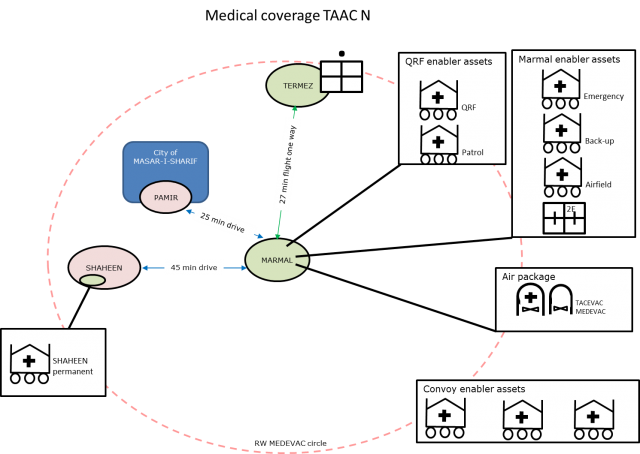

After meeting a deductible if your plan has one your cost may include a percentage of the cost of surgery hospitalization and other fees. During that time Medicaid will review your records and input from your doctor before making the decision.

Weight Loss Pills Other Than Phentermine Phentermine For Weight Loss What Is It And Who Needs It

Weight Loss Pills Other Than Phentermine Phentermine For Weight Loss What Is It And Who Needs It

Medicare Advantage Part C plans also cover weight loss programs when theyre medically necessary.

/medi-weightloss-program-4157710-a-bc198a45b7d340ca81476c48071f9eff.jpg)

Do weight loss clinics take insurance. Suffer from obesity and thousands are having surgeries to get rid of excess weight. A medically supervised out-patient weight loss program providing medical weight loss at the New York Obesity Research Center at St. We are the only weight loss program in New York City associated with an obesity research center.

Insurers usually take a month to approve weight-loss surgeries. Body mass index of 40. New York City weight loss program.

Every new patient schedules an appointment with a licensed medical provider who will discuss your health history personal weight loss goals and lifestyle before prescribing the best program for you. Weight loss centers need business insurance to protect their livelihood from financial disaster due to property loss and lawsuits. Medical Malpractice Insurance For Weight Loss Centers We live in a society where people have become more health conscious which has led them to seek the help of doctors and physicians with their weight loss issues.

Red Mountain Weight Loss Cost How much does the Red Mountain Weight Loss program cost. Millions of people in the US. -metabolic testing including resting metabolic rate -body fat percentage.

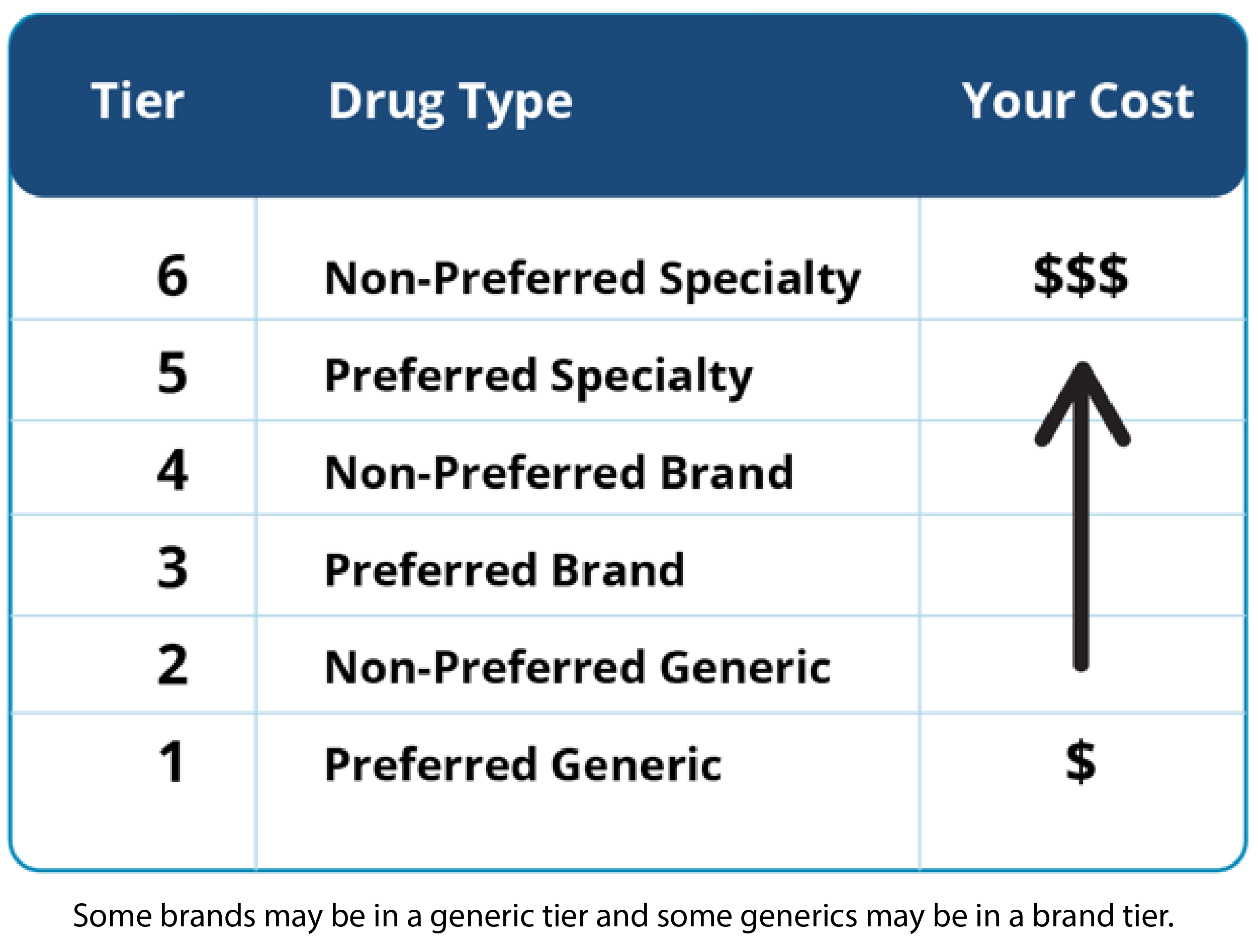

Some insurance companies cover the cost of Optifast counseling sessions labs and other tests. Original Medicare Part A and Part B does cover weight loss programs therapy screenings and surgery if your doctor or health care provider decides that treatment is medically necessary. The best clinics will have trained clinicians doctors and medical staff who will provide evidence-based approaches to help you in your weight loss journey.

This medically supervised weight loss program is a liquid diet and supplement program that treats obesity. Yes but confirm that the weight loss surgery procedure you want is covered by your insurance policy. Calculate your BMI Option 1.

The criteria for surgery are based on your body mass index BMI and your history of attempts at sustaining weight loss through diet exercise or medicines. Lukes Hospital in New York City. The weight clinic does not accept insurance for appointments but we encourage you to contact your health insurance agency to see if you can be reimbursement from them due to legitimate health benefits to losing weight through our program.

If you operate a weight loss center as a sole proprietor or a franchisee talk to your independent insurance agent about your need for the following types of business insurance coverage. Some of these centers called medical weight loss centers focus. A weight loss clinic or weight loss center helps people lose weight and learn strategies and approaches for staying healthy.

Optifast clinics may provide payment plans to make up the difference of the covered portion of treatment. Wrigleyville 0 miles Cicero 9 miles Berwyn 12 miles Oak Park 12 miles Forest Park 14 miles Riverside 14 miles Hometown 15 miles River Forest 15 miles. If your doctor and United Healthcare agree that you are eligible for weight loss surgery to improve your chronic health problems you may be eligible for weight loss surgery.

PLACES NEAR Chicago IL WITH weight loss doctors that accept insurance. Age 18 or older. Insurance Authorization and Out-of-pocket Expenses How long does it take from the time my packet is received until my individual consultation with the surgeon.

What to do if you get declined for bariatric surgery. We do accept insurance for the optional blood work. A history of unsuccessful weight loss attempts through diet exercise or medication therapy.

However wait times for Medicaid approval can take five months or more.

.png)