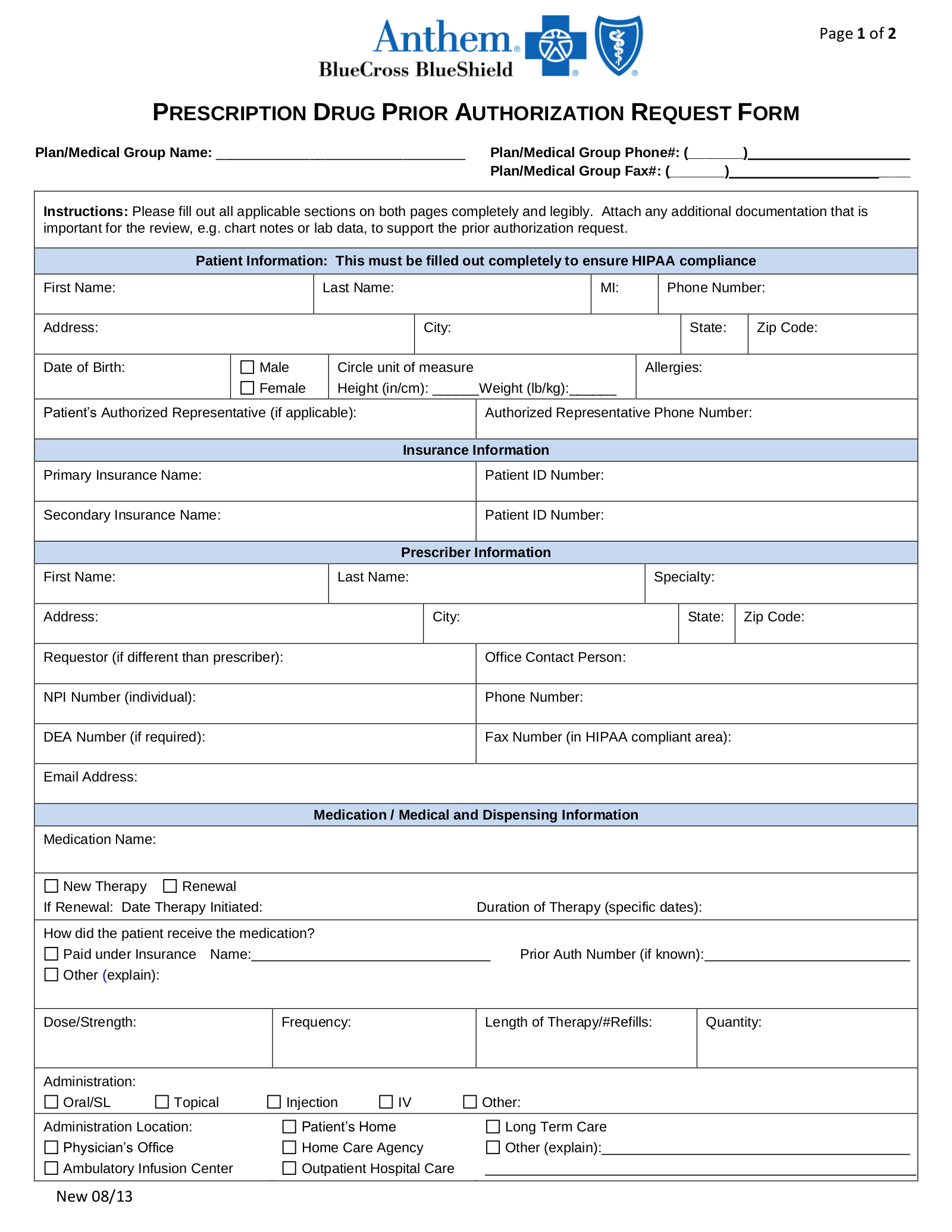

The copay os an out-of-pocket expense for the patient. Get a personalized recommendation made just for you.

How Health Insurance Works Money Matters

How Health Insurance Works Money Matters

How Out-of-Pocket Maximums Work.

How does out of pocket work for health insurance. Once you spend enough money out-of-pocket on healthcare in a given year to reach your plans MOOP your insurance provider will cover the full cost of any medical expenses you incur thereafter for the remainder of your insurance policy period. Your premium the initial cost of buying your insurance paid in one lump sum or in installments throughout the year. Advertentie Germanys best health insurance fund Focus Money business magazine 072021.

Your out-of-pocket maximum works by putting a spending limit on your out-of-pocket expenses. Lets take a look at the following scenario to understand how your out-of-pocket maximum works. These limits help policyholders.

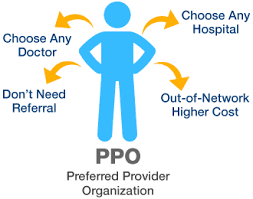

Fill in the easy online application and become a member of TK today. If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket. Your insurance doesnt cover out-of-pocket spending.

What you pay toward your plans deductible coinsurance and copays are all applied to your out-of-pocket max. Simply put your out-of-pocket maximum is the most that youll have to pay for covered medical services in a given year. If the copay is 100 the patient has to pay this amount usually at the time of service and then the insurance plan covers the rest of the allowed cost for the urgent care service.

Advertentie Germanys best health insurance fund Focus Money business magazine 072021. Once your out-of-pocket limit is met your health insurance plan will cover 100 of all your eligible medical expenses. Once the out-of-pocket limit is reached the insurance company pays all future covered costs up to the coverage limit though copays and exclusions remain in effect.

Health insurance is compulsory for all people who live or work in the Netherlands. Use our free digital tool. Use our free digital tool.

The insurance company also sets a maximum amount that youll have for medical expenses on your own called an out-of-pocket maximum. Medical services that are covered by your insurance plan can still have an out-of-pocket. Advertentie See which German Health Insurance is right for you.

In some instances an insurance company might not pay anything toward a covered benefit. Out-of-pocket expenses are the costs of your health care you have to pay yourself. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

It is also called the out-of-pocket limit. Once you reach that limit the plan covers all costs for covered medical expenses for the rest of the year. The reverse of coverage limits this component applies to the insureds maximum exposure for payment while the health insurance contract is in force.

Once you reach your out-of-pocket max your plan pays 100 percent of the allowed amount for covered services. Think of it as an annual cap on your health-care costs. There are different out-of-pocket.

Expats from outside the EU EEA or Switzerland who arrive in the Netherlands must take out Dutch health insurance within four months of receiving their residence permit even if they have an existing foreign policyEU EEA or Swiss nationals who are working in the Netherlands must take out Dutch health insurance. These costs typically include the following four categories of expenses. Get a personalized recommendation made just for you.

Within the context of healthcare out-of-pocket often refers to out-of-pocket costs specifically medical expenses which you pay by yourself instead of expenses where your insurance foots the bill. Advertentie Compare Top Expat Health Insurance In Germany. Advertentie See which German Health Insurance is right for you.

In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan. Out-of-pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses. Get the Best Quote and Save 30 Today.

Fill in the easy online application and become a member of TK today. Obamacare also requires the federal government to set annual limits on out-of-pocket maximums that apply to every health plan sold in America.