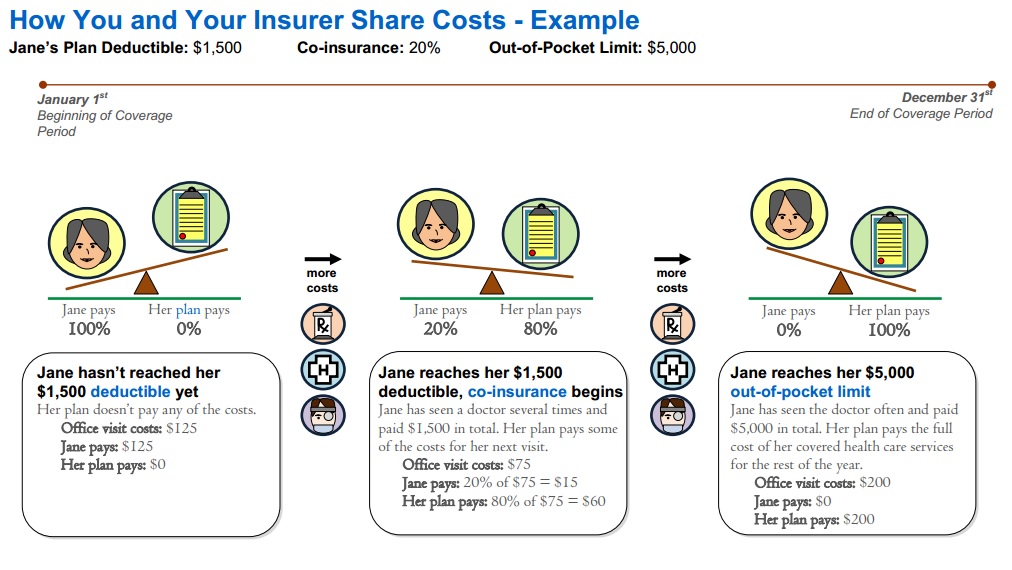

This is a limit on how much you would pay out-of-pocket during a calendar year. These are costs you pay out of your own pocket that go toward your deductible.

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Ad Compare car home van insurance more.

Out of pocket insurance coverage. Buy online or call today. Ad Build the perfect insurance package for your business. Median out-of-pocket cost for women for whom insurance or Medicaid did not pay was 575.

If you have health insurance every month you will pay a premium to keep your plan active. For many plans youll pay 50 of basic service costs in. We Make Comparing Business Insurance As Simple As Possible.

Ad Insurance Cover Comparison at MoneySuperMarket. Median out-of-pocket costs when private insurance or Medicaid paid were 18 and 0. Business and work-related out-of-pocket expenses are usually reimbursed by the employer.

The higher your out of pocket deductible the lower your insurance premium will. Copayments are fixed amounts for a covered medical service. We Make Comparing Business Insurance As Simple As Possible.

An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical costs. What are out-of-pocket expenses. Once that out-of-pocket maximum is reached the plan pays 100 for covered medical services and drugs.

This was closer to two thirds among those receiving later abortions. For more than half out-of-pocket costs were equivalent to more than one-third of monthly personal income. Out of pocket insurance is also known as medical gap insurance designed to help cover the pesky co-pays and deductibles left behind in your group or major medical health insurance plan as well as many times for an additional premium can cover extra expenses that you have to pay like hotel and travel during an emergency and or hospital stay for loved ones many people by out-of-pocket.

Many health insurance plans have an annual out-of-pocket maximum. For those with insurance coverage out-of-pocket fees can range from a few hundred dollars to a few thousand dollars. Sometimes it makes sense to pay these even if your insurance would cover them to avoid an insurance premium increase.

If you have a 500 deductible you will pay 500 and the insurance company will give you 1500. In terms of health insurance out-of-pocket expenses are your share of covered healthcare costs. Your deductible is the amount of money you agree to pay out-of-pocket towards the cost of repairs before the insurance company reimburses you.

All policies cover 100 of preventive services and out-of-pocket costs go down each year for all other procedures. Find Our Best Deals. If your health insurance does not cover ED treatment with a penile implant or if you do not have insurance talk to your doctor.

Ad Compare Business Insurance From 15 Providers Now Find A Policy To Suit Your Needs. Get a quote and see if you could save. Compare Buy With Us Today.

Get a quote and see if you could save. For example say you get into an accident and your car sustains 2000 worth of damage. Ad Compare Business Insurance From 15 Providers Now Find A Policy To Suit Your Needs.

In most plans there is no copayment for covered medical services after you have met your out of pocket maximum. Some physicians offer flat fee or discount packages. All plans are different though so make sure to pay attention to plan details when buying a plan.

Key Takeaways An out-of-pocket expense is a payment you make with your own money even if you are reimbursed later. Ad Compare car home van insurance more. Once you meet your deductible your health plan kicks in to share costs.

Since most plans cover all. The important thing to remember is that this refers to covered medical services and drugs. Ad Insurance Cover Comparison at MoneySuperMarket.

Compare Buy With Us Today. Out of pocket damages are the expenses you are responsible to pay even if you have auto insurance. Find Our Best Deals.

The following are health care expenses that are often applied to an out-of-pocket maximum.