You can start by using your adjusted gross. How Coronavirus Stimulus Payments Affect Your Household Income.

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

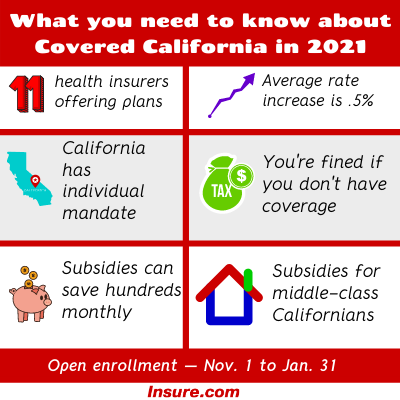

If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance.

How to estimate income for covered california. If you have one or more employee other than a spouse family member or owner use Covered California for Small Business. If your 2020 California adjusted gross income is equal to or greater than. When you enroll on Covered Californias website you need to estimate your income for the coming year.

There are a few different types of stimulus. Covered California will let you know which categories they need documentation from for each person in your. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details.

Make your first payment and you are covered. If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. It is your responsibility to report this change to Covered California.

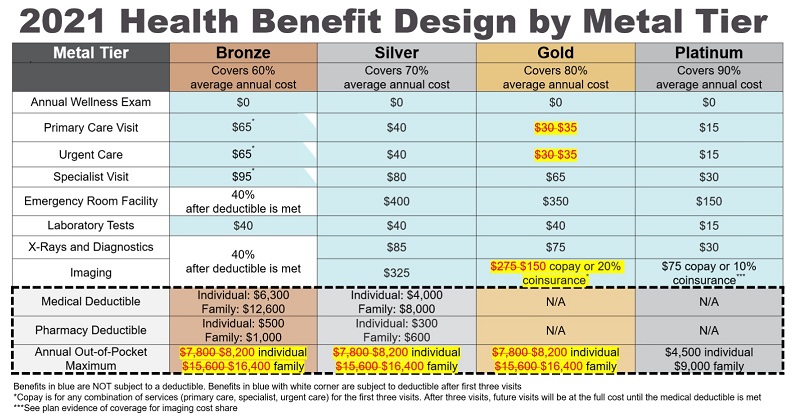

Different eligibility rules may apply for pregnant women -. It can be difficult to know how much youll make in the coming year which is information you need to find out your monthly premiums. The premiums in this calculator reflect the Covered California statewide average for the second most affordable silver plan adjusted for premium inflation and age rating.

The majority of our customers get financial help. However when you do your taxes in April you discover your household income was actually 35000 year. This way you can be switched to the appropriate program.

The price is based on your estimated income for the coverage year your ZIP code your household size and your age. How to Estimate Your Income. Next choose a health plan that is the best fit for you and your family.

In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. After the end of the year you put your actual. 1000000 500000 if marriedRDP filing separately You must pay your estimated tax based on 90 of your tax for 2020.

Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement or a self-employment ledger. The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple. Under the law maximum contributions to premiums will be based on modified adjusted gross income while estimates in this calculator are based on the annual income entered by the user.

In order to be eligible for assistance through Covered California you must meet an income requirement. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage. Dates covered and the net income from profitloss.

This means that you received 250 a month more than you should have. Estimating your income to find out how much financial help youll get can be tricky for self-employed people. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

Covered Californias answer is Generally no. What youll pay depends on your estimated net income for the year youll be covered not the previous year. Go to Shop and Compare and compare coverage options and costs.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Consequently it is important to report the income. In this case you would have to reimburse the overpayment for every month you have received a subsidy.

The persons first and last name and company name. How to make an estimate of your expected income Step 1. The federal governments economic impact payments and the states new stimulus payment may have you wondering how to calculate your household income whether you want to apply for health insurance right now during special enrollment or report a change to your income.

How will Covered California check my income. Start with your households adjusted gross income AGI from your most recent federal income tax return. Begin by estimating your annual household income to see if you can get financial help.

When you applied for Covered California healthcare you estimated that your family income would be 25000 a year. If you make 601 of the FPL you will be ineligible for any subsidies. We are told that the estimator will be live for the public on Oct.